Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 36

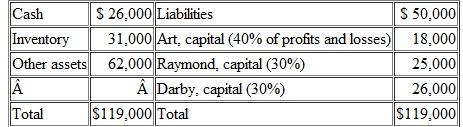

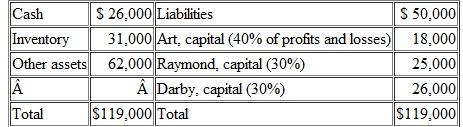

A partnership has the following balance sheet just before final liquidation is to begin:

Liquidation expenses are estimated to be $12,000. The other assets are sold for $40,000. What distribution can be made to the partners

A) -0-to Art, $1,500 to Raymond, $2,500 to Darby.

B) $1,333 to Art, $1,333 to Raymond, $1,334 to Darby.

C) -0- to Art, $ 1,200 to Raymond, $2,800 to Darby.

D) $600 to Art, $1,200 to Raymond, $2,200 to Darby.

Liquidation expenses are estimated to be $12,000. The other assets are sold for $40,000. What distribution can be made to the partners

A) -0-to Art, $1,500 to Raymond, $2,500 to Darby.

B) $1,333 to Art, $1,333 to Raymond, $1,334 to Darby.

C) -0- to Art, $ 1,200 to Raymond, $2,800 to Darby.

D) $600 to Art, $1,200 to Raymond, $2,200 to Darby.

Explanation

Thus, the amounts that would be distribu...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255