Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 23

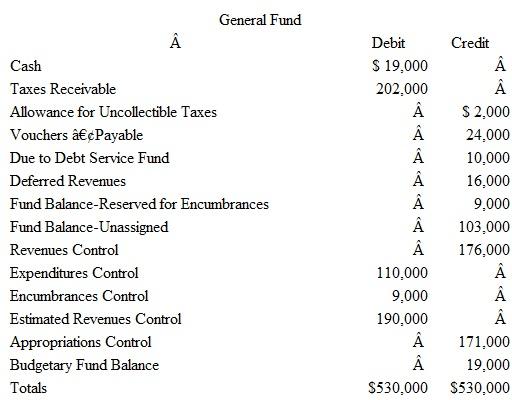

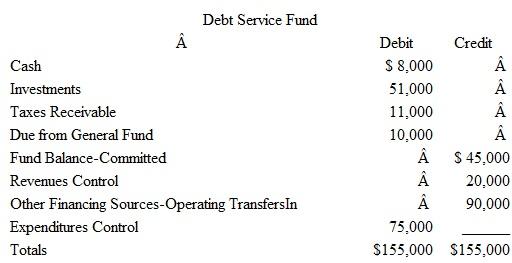

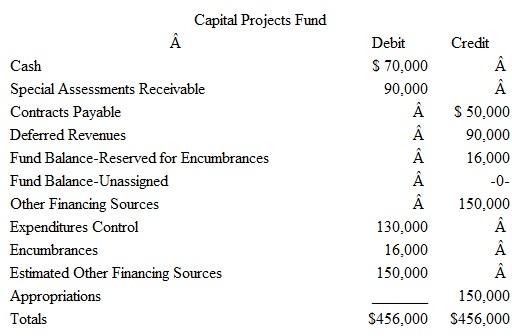

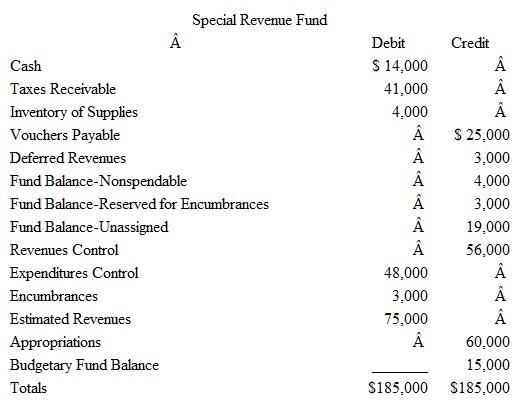

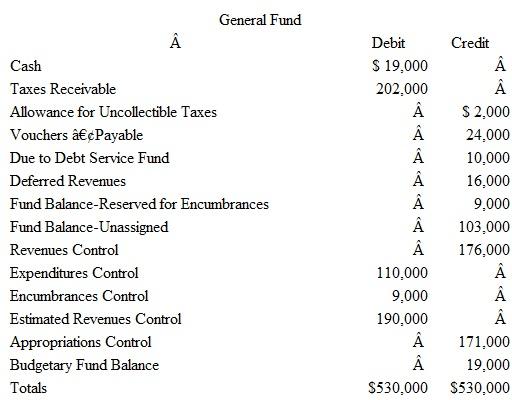

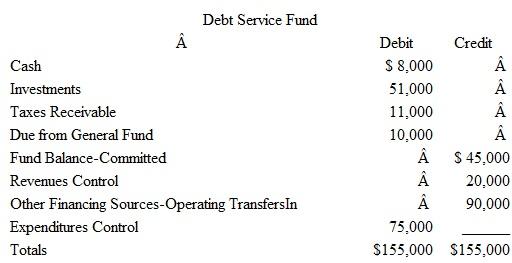

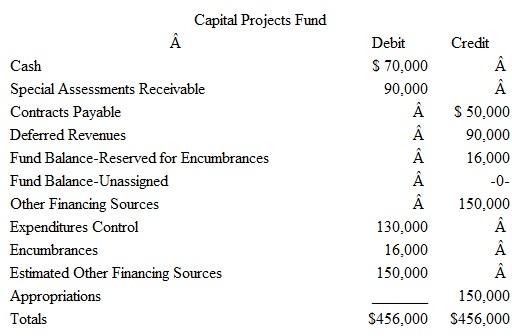

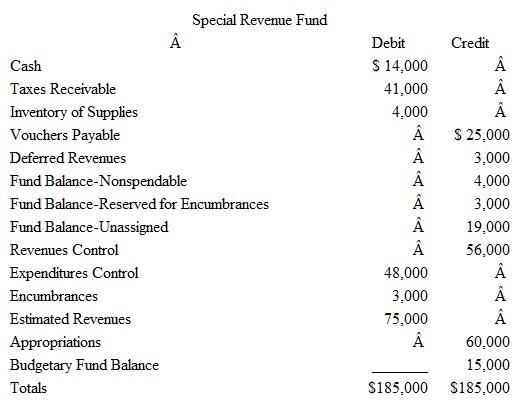

The following unadjusted trial balances are for the governmental funds of the City of Cope- land prepared from the current accounting records:

Based on the information presented for each of these governmental funds, answer the following questions:

A) How much more money can city officials expend or commit from the General Fund during the remainder of the current year without amending the budget

B) Why does the Capital Projects Fund have no construction or capital asset accounts

C) What does the $150,000 Appropriations balance found in the Capital Projects Fund represent

D) Several funds have balances for Encumbrances and Fund Balance-Reserved for Encumbrances. How will these amounts be accounted for at the end of the fiscal year

E) Why does the Fund Balance-Unassigned account in the Capital Projects Fund have a zero balance

F) What are possible explanations for the $ 150,000 Other Financing Sources balance found in the Capital Projects Fund

G) What does the $75,000 balance in the Expenditures Control account of the Debt Service Fund represent

H) What is the purpose of the Special Assessments Receivable found in the Capital Projects Fund

I) In the Special Revenue Fund, what is the purpose of the Fund Balance-Nonspendable account

J) Why does the Debt Service Fund not have budgetary account balances

Based on the information presented for each of these governmental funds, answer the following questions:

A) How much more money can city officials expend or commit from the General Fund during the remainder of the current year without amending the budget

B) Why does the Capital Projects Fund have no construction or capital asset accounts

C) What does the $150,000 Appropriations balance found in the Capital Projects Fund represent

D) Several funds have balances for Encumbrances and Fund Balance-Reserved for Encumbrances. How will these amounts be accounted for at the end of the fiscal year

E) Why does the Fund Balance-Unassigned account in the Capital Projects Fund have a zero balance

F) What are possible explanations for the $ 150,000 Other Financing Sources balance found in the Capital Projects Fund

G) What does the $75,000 balance in the Expenditures Control account of the Debt Service Fund represent

H) What is the purpose of the Special Assessments Receivable found in the Capital Projects Fund

I) In the Special Revenue Fund, what is the purpose of the Fund Balance-Nonspendable account

J) Why does the Debt Service Fund not have budgetary account balances

Explanation

(a) Currently the total amount of money ...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255