Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 58

T accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet

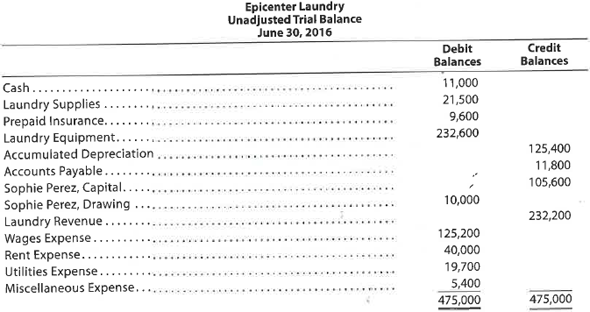

The unadjusted trial balance of Epicenter Laundry at June 30, 2016, the end of the fiscal year, follows:

The data needed to determine year-end adjustments are as follows:

a. Laundry supplies on hand at June 30 are $3,600.

b. Insurance premiums expired during the year are $5,700.

c. Depreciation of laundry equipment during the year is $6,500.

d. Wages accrued but not paid at June 30 are $1,100.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as "June 30 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by "Adj." and the new balances as "Adj. Bal."

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet.

6. Journalize and post the closing entries. Identify the closing entries by "Clos."

7. Prepare a post-closing trial balance.

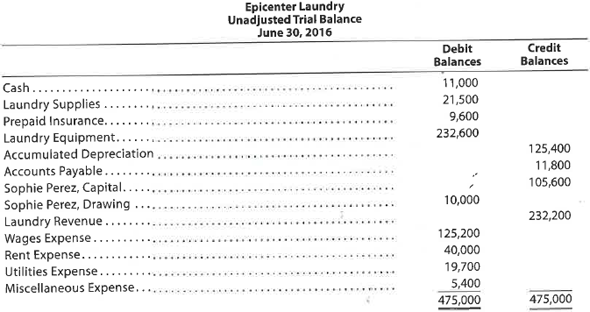

The unadjusted trial balance of Epicenter Laundry at June 30, 2016, the end of the fiscal year, follows:

The data needed to determine year-end adjustments are as follows:

a. Laundry supplies on hand at June 30 are $3,600.

b. Insurance premiums expired during the year are $5,700.

c. Depreciation of laundry equipment during the year is $6,500.

d. Wages accrued but not paid at June 30 are $1,100.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as "June 30 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by "Adj." and the new balances as "Adj. Bal."

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet.

6. Journalize and post the closing entries. Identify the closing entries by "Clos."

7. Prepare a post-closing trial balance.

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255