College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Edition 2ISBN: 978-0073396958

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Edition 2ISBN: 978-0073396958 Exercise 16

Preparing a bank reconciliation statement and journalizing entries to adjust the cash balance.

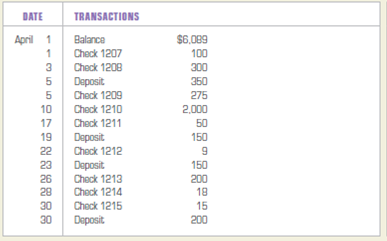

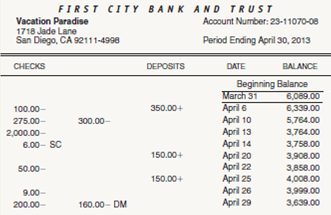

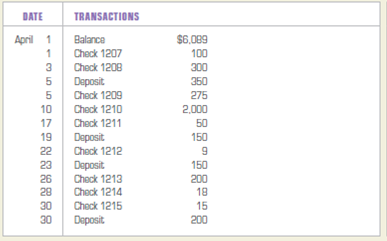

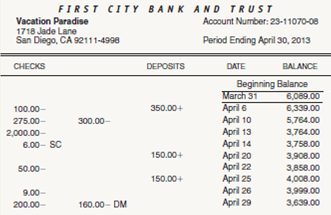

On May 2, 2013, Vacation Paradise received its April bank statement from First City Bank and Trust. Enclosed with the bank statement, which appears below, was a debit memorandum for $160 that covered an NSF check issued by Doris Fisher, a credit customer. The firm's checkbook contained the following information about deposits made and checks issued during April. The balance of the Cash account and the checkbook on April 30, 2013, was $3,972:

INSTRUCTIONS

1. Prepare a bank reconciliation statement for the firm as of April 30, 2013.

2. Record general journal entries for any items on the bank reconciliation statement that must be journalized. Date the entries April 30, 2013.

Analyze: What checks remain outstanding after the bank statement has been reconciled?

On May 2, 2013, Vacation Paradise received its April bank statement from First City Bank and Trust. Enclosed with the bank statement, which appears below, was a debit memorandum for $160 that covered an NSF check issued by Doris Fisher, a credit customer. The firm's checkbook contained the following information about deposits made and checks issued during April. The balance of the Cash account and the checkbook on April 30, 2013, was $3,972:

INSTRUCTIONS

1. Prepare a bank reconciliation statement for the firm as of April 30, 2013.

2. Record general journal entries for any items on the bank reconciliation statement that must be journalized. Date the entries April 30, 2013.

Analyze: What checks remain outstanding after the bank statement has been reconciled?

Explanation

College Accounting 2nd Edition by David Haddock, John Price,Michael Farina

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255