Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 11

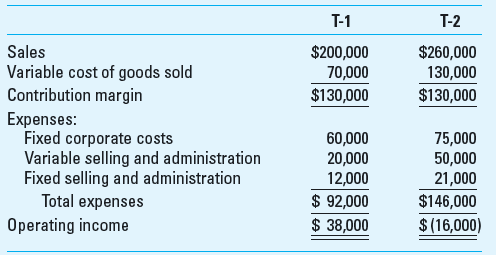

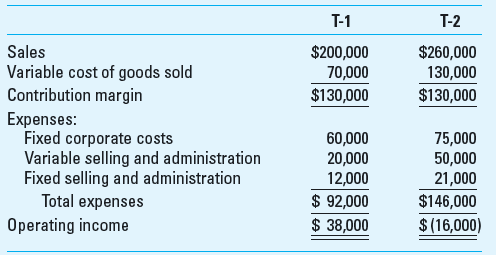

Product-Profitability Analysis Barbour Corporation, located in Buffalo, New York, is a retailer of high-tech products known for its excellent quality and innovation. Recently the firm conducted a relevant cost analysis of one of its product lines that has only two products, T-1 and T-2. The sales for T-2 are decreasing and the purchase costs are increasing. The firm might dropT-2 and sell only T-1.

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statement, he agreed that T-2 should be dropped. If this is done, sales of T-1 are expected to increase by 10% next year; the firm's cost structure will remain the same.

Required

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1.

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2

3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be reduced by $45,000

4. What strategic factors should be considered

Barbour allocates fixed costs to products on the basis of sales revenue. When the president of Barbour saw the income statement, he agreed that T-2 should be dropped. If this is done, sales of T-1 are expected to increase by 10% next year; the firm's cost structure will remain the same.

Required

1. Find the expected change in annual operating income by dropping T-2 and selling only T-1.

2. By what percentage would sales from T-1 have to increase in order to make up the financial loss from dropping T-2

3. What is the required percentage increase in sales from T-1 to compensate for lost margin from T-2, if total fixed costs can be reduced by $45,000

4. What strategic factors should be considered

Explanation

Answer Sub Part (1)

The annual income w...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255