Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 3

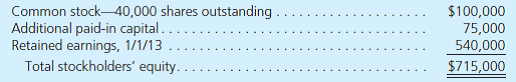

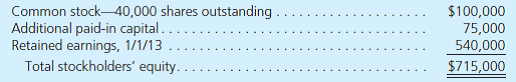

Neill Company purchases 80 percent of the common stock of Stamford Company on January 1, 2013, when Stamford has the following stockholders' equity accounts:

To acquire this interest in Stamford, Neill pays a total of $592,000. The acquisition-date fair value of the 20 percent noncontrolling interest was $148,000. Any excess fair value was allocated to goodwill, which has not experienced any impairment.

On January 1, 2014, Stamford reports retained earnings of $620,000. Neill has accrued the increase in Stamford's retained earnings through application of the equity method. View the following problems as independent situations:

On January 1, 2014, Stamford issues 10,000 additional shares of common stock for $25 per share. Neill acquires 8,000 of these shares. How will this transaction affect the parent company's Additional Paid-In Capital account

A) Has no effect on it.

B) Increases it by $20,500.

C) Increases it by $36,400.

D) Increases it by $82,300.

To acquire this interest in Stamford, Neill pays a total of $592,000. The acquisition-date fair value of the 20 percent noncontrolling interest was $148,000. Any excess fair value was allocated to goodwill, which has not experienced any impairment.

On January 1, 2014, Stamford reports retained earnings of $620,000. Neill has accrued the increase in Stamford's retained earnings through application of the equity method. View the following problems as independent situations:

On January 1, 2014, Stamford issues 10,000 additional shares of common stock for $25 per share. Neill acquires 8,000 of these shares. How will this transaction affect the parent company's Additional Paid-In Capital account

A) Has no effect on it.

B) Increases it by $20,500.

C) Increases it by $36,400.

D) Increases it by $82,300.

Explanation

Compute the ownership ratio after acqu...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255