Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 2

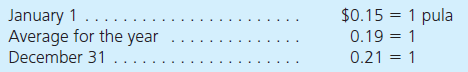

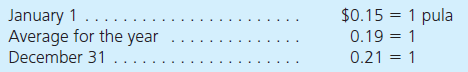

Ace Corporation starts a foreign subsidiary on January 1 by investing 20,000 pulas. Ace owns all of the shares of the subsidiary's common stock. The foreign subsidiary generates 10,000 pulas of net income throughout the year and pays no dividends. The pula is the foreign company's functional currency. Currency exchange rates for 1 pula are as follows:

In preparing consolidated financial statements, what translation adjustment will Ace report at the end of the current year

A) $400 positive (credit).

B) $600 positive (credit).

C) $1,400 positive (credit).

D) $1,800 positive (credit).

In preparing consolidated financial statements, what translation adjustment will Ace report at the end of the current year

A) $400 positive (credit).

B) $600 positive (credit).

C) $1,400 positive (credit).

D) $1,800 positive (credit).

Explanation

The translation adjustment is the differ...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255