Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 53

Recording and Posting Accrual Basis Journal Entries

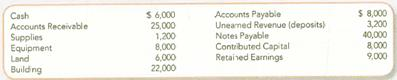

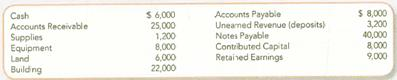

Ricky's Piano Rebuilding Company has been operating for one year (2012). At the start of 2013, its income statement accounts had zero balances and its balance sheet account balances were as follows:

Required:

1. Create T-accounts for the balance sheet accounts and for these additional accounts: Service Revenue, Rent Revenue, Wages Expense, and Utilities Expense. Enter the beginning balances.

2. Prepare journal entries for the following January 2013 transactions, using the letter of each transaction as a reference:

a. Received a $500 deposit from a customer who wanted her piano rebuilt in February.

b. Rented a part of the building to a bicycle repair shop; $300 rent received for January.

c. Delivered five rebuilt pianos to customers who paid $14,500 in cash.

d. Delivered two rebuilt pianos to customers for $7,000 charged on account.

e. Received $6,000 from customers as payment on their accounts.

f. Received an electric and gas utility bill for $350 for January services to be paid in February.

g. Ordered $800 in supplies.

h. Paid $1,700 on account in January.

i. Paid $10,000 in wages to employees in January for work done this month.

j. Received and paid cash for the supplies in (g).

Post the journal entries to the T-accounts. Show the unadjusted ending balances in the T-accounts.

Ricky's Piano Rebuilding Company has been operating for one year (2012). At the start of 2013, its income statement accounts had zero balances and its balance sheet account balances were as follows:

Required:

1. Create T-accounts for the balance sheet accounts and for these additional accounts: Service Revenue, Rent Revenue, Wages Expense, and Utilities Expense. Enter the beginning balances.

2. Prepare journal entries for the following January 2013 transactions, using the letter of each transaction as a reference:

a. Received a $500 deposit from a customer who wanted her piano rebuilt in February.

b. Rented a part of the building to a bicycle repair shop; $300 rent received for January.

c. Delivered five rebuilt pianos to customers who paid $14,500 in cash.

d. Delivered two rebuilt pianos to customers for $7,000 charged on account.

e. Received $6,000 from customers as payment on their accounts.

f. Received an electric and gas utility bill for $350 for January services to be paid in February.

g. Ordered $800 in supplies.

h. Paid $1,700 on account in January.

i. Paid $10,000 in wages to employees in January for work done this month.

j. Received and paid cash for the supplies in (g).

Post the journal entries to the T-accounts. Show the unadjusted ending balances in the T-accounts.

Explanation

1.

T-account: T Account or ledger is sep...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255