Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 35

Preparing and Interpreting IFRS Financial Statements

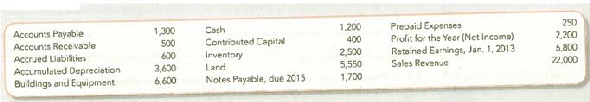

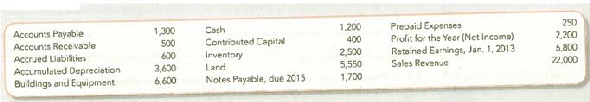

Latteria Limited (LL) is a dairy company headquartered in Italy. The company began its 2013 fiscal year with assets totaling 9 million pure but ended the year (on December 31, 2013) with 13 million euro of total assets. Account balances on December 31, 2013, appear below (in thousands of euro).

Required:

1. Prepare a statement of financial positional December 31, 2013, using Exhibit 5.12 as a guide.

2. Use an appropriate ratio to compute LL's financing risk. Compare LL's ratio to the 0.42 reported in a recent year for Saputo, Inc. (a dairy company based in Montreal, Canada). Which company appears more likely to pay its liabilities

3. Use an appropriate ratio to compute the amount of profit LL earns from each euro of sales. Compare LL's ratio to Saputo, which had a ratio of 0.07. Which company is better able to control its expenses

4. Use an appropriate ratio to compute LL's efficiency at using assets to generate sales. Compare LL's ratio to the 1.74 reported for Saputo. Which company is more efficient at using its assets to generate sales

Latteria Limited (LL) is a dairy company headquartered in Italy. The company began its 2013 fiscal year with assets totaling 9 million pure but ended the year (on December 31, 2013) with 13 million euro of total assets. Account balances on December 31, 2013, appear below (in thousands of euro).

Required:

1. Prepare a statement of financial positional December 31, 2013, using Exhibit 5.12 as a guide.

2. Use an appropriate ratio to compute LL's financing risk. Compare LL's ratio to the 0.42 reported in a recent year for Saputo, Inc. (a dairy company based in Montreal, Canada). Which company appears more likely to pay its liabilities

3. Use an appropriate ratio to compute the amount of profit LL earns from each euro of sales. Compare LL's ratio to Saputo, which had a ratio of 0.07. Which company is better able to control its expenses

4. Use an appropriate ratio to compute LL's efficiency at using assets to generate sales. Compare LL's ratio to the 1.74 reported for Saputo. Which company is more efficient at using its assets to generate sales

Explanation

Financial statements using IFRS

With th...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255