M&B3 3rd Edition by Dean Croushore

Edition 3ISBN: 978-1285167961

M&B3 3rd Edition by Dean Croushore

Edition 3ISBN: 978-1285167961 Exercise 2

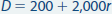

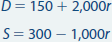

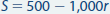

Suppose that the demand for and supply of bonds both change with the state of the business cycle. In economic expansions, the demand for bonds is given by the equation

and the supply of bonds is

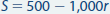

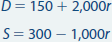

where r is the expected real interest rate. In recessions, however, both the demand for and supply of bonds is lower:

a Given these equations, what is the equilibrium expected real interest rate in economic expansions

b Given these equations, what is the equilibrium expected real interest rate in recessions

c If the expected infl ation rate is 4 percent in economic expansions, what is the equilibrium nominal interest rate in economic expansions

d If the expected infl ation rate is 2 percent in recessions, what is the equilibrium nominal interest rate in recessions

and the supply of bonds is

where r is the expected real interest rate. In recessions, however, both the demand for and supply of bonds is lower:

a Given these equations, what is the equilibrium expected real interest rate in economic expansions

b Given these equations, what is the equilibrium expected real interest rate in recessions

c If the expected infl ation rate is 4 percent in economic expansions, what is the equilibrium nominal interest rate in economic expansions

d If the expected infl ation rate is 2 percent in recessions, what is the equilibrium nominal interest rate in recessions

Explanation

The demand for and supply of bonds in tw...

M&B3 3rd Edition by Dean Croushore

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255