Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 46

Problems 17 through 19 should be viewed as independent situations.They are based on the following data:

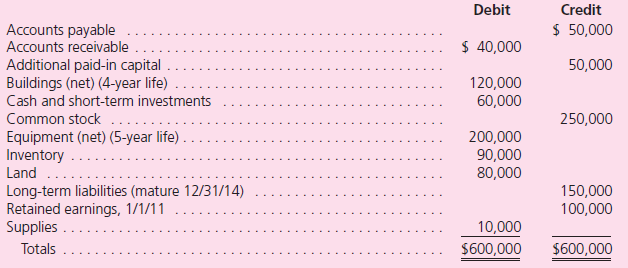

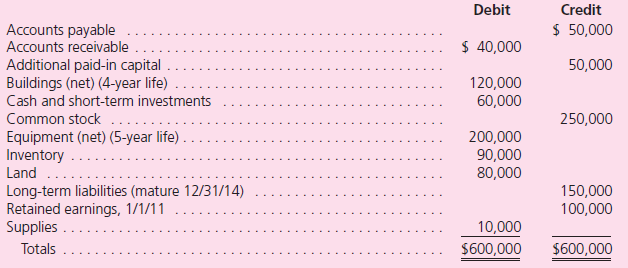

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2011.As of that date, Abernethy has the following trial balance:

During 2011, Abernethy reported income of $80,000 while paying dividends of $10,000.During 2012, Abernethy reported income of $110,000 while paying dividends of $30,000.

Assume that Chapman Company acquired Abernethy's common stock for $500,000 in cash.Assume that the equipment and long-term liabilities had fair values of $220,000 and $120,000, respectively, on the acquisition date.Chapman uses the initial value method to account for its investment.Prepare consolidation worksheet entries for December 31, 2011, and December 31, 2012.

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2011.As of that date, Abernethy has the following trial balance:

During 2011, Abernethy reported income of $80,000 while paying dividends of $10,000.During 2012, Abernethy reported income of $110,000 while paying dividends of $30,000.

Assume that Chapman Company acquired Abernethy's common stock for $500,000 in cash.Assume that the equipment and long-term liabilities had fair values of $220,000 and $120,000, respectively, on the acquisition date.Chapman uses the initial value method to account for its investment.Prepare consolidation worksheet entries for December 31, 2011, and December 31, 2012.

Explanation

Calculation of the fair value of net ide...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255