Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 42

Note: Problems 1 through 37 assume the use of the acquisition method.Problems 38 through 40 assume the use of the purchase method.

Good Corporation acquired 80 percent of the outstanding stock of Morning, Inc., on January 1, 2008, for $1,400,000 in cash, debt, and stock.One of Morning's buildings, with a 10-year remaining life, was undervalued on the company's accounting records by $80,000.Also, Morning's newly developed unpatented technology, with an estimated 10-year life, was assessed to have a fair value of $550,000.

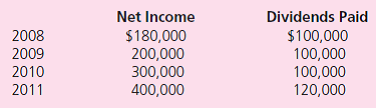

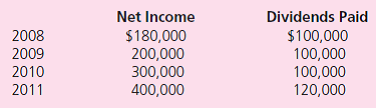

During subsequent years, Morning reports the following:

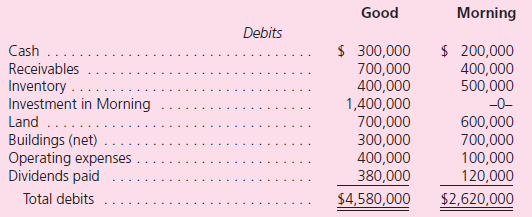

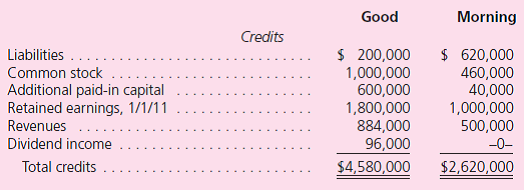

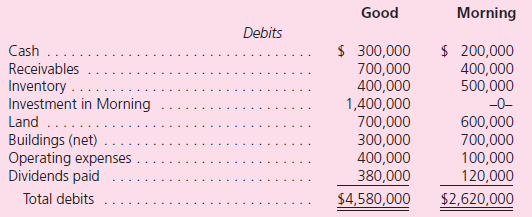

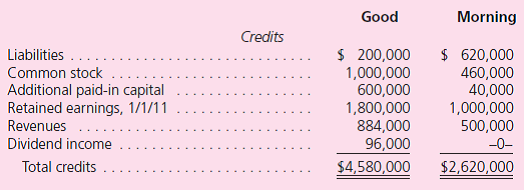

The following trial balances are for these two companies as of December 31, 2011.Morning owes Good $100,000 as of this date.

Using the purchase method, prepare consolidated balances for this business combination for 2011.

Good Corporation acquired 80 percent of the outstanding stock of Morning, Inc., on January 1, 2008, for $1,400,000 in cash, debt, and stock.One of Morning's buildings, with a 10-year remaining life, was undervalued on the company's accounting records by $80,000.Also, Morning's newly developed unpatented technology, with an estimated 10-year life, was assessed to have a fair value of $550,000.

During subsequent years, Morning reports the following:

The following trial balances are for these two companies as of December 31, 2011.Morning owes Good $100,000 as of this date.

Using the purchase method, prepare consolidated balances for this business combination for 2011.

Explanation

Financial Statements:

It is a record of...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255