Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Edition 10ISBN: 978-1260575910 Exercise 40

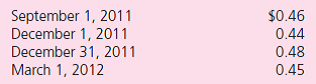

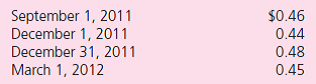

Benjamin, Inc., operates an export/import business.The company has considerable dealings with companies in the country of Camerrand.The denomination of all transactions with these companies is alaries (AL), the Camerrand currency.During 2011, Benjamin acquires 20,000 widgets at a price of 8 alaries per widget.It will pay for them when it sells them.Currency exchange rates for 1 AL are as follows:

a.Assume that Benjamin acquired the widgets on December 1, 2011, and made payment on March 1, 2012.What is the effect of the exchange rate fluctuations on reported income in 2011 and in 2012

b.Assume that Benjamin acquired the widgets on September 1, 2011, and made payment on December 1, 2011.What is the effect of the exchange rate fluctuations on reported income in 2011

c.Assume that Benjamin acquired the widgets on September 1, 2011, and made payment on March 1, 2012.What is the effect of the exchange rate fluctuations on reported income in 2011 and in 2012

a.Assume that Benjamin acquired the widgets on December 1, 2011, and made payment on March 1, 2012.What is the effect of the exchange rate fluctuations on reported income in 2011 and in 2012

b.Assume that Benjamin acquired the widgets on September 1, 2011, and made payment on December 1, 2011.What is the effect of the exchange rate fluctuations on reported income in 2011

c.Assume that Benjamin acquired the widgets on September 1, 2011, and made payment on March 1, 2012.What is the effect of the exchange rate fluctuations on reported income in 2011 and in 2012

Explanation

Journal entries

All the financial trans...

Advanced Accounting 10th Edition by Thomas Schaefer, Joe Ben Hoyle, Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255