Exam 4: The Accounting Process

Goran Triagin runs a tennis equipment sales and training business.

Following some help from a friend who did accounting at secondary school 15 years ago,Goran has prepared his own Income Statement and Balance Sheet for the last accounting period.He brings them to you for checking.

On inspection and following discussions with Goran,the following points arise:

• His Income Statement shows that only cash receipts and cash payments have been included as revenues and expenses.

• Goran withdrew $100 per week cash from the business during the year.This has been included as a business expense.

• When Goran valued his tennis racquets,nets and other equipment at the end of the year,he estimated their current value according to prices of similar second-hand items being advertised in the NZ Tennis national monthly magazine.

• Goran had several bad customers who left to go to Australia in 1999,who still owe Goran's business money.No adjustments to Goran's accounts have been made for these amounts owing,even though the accounts are now 5 years old;all attempts to contact the customers have failed.

• Goran states 'I want you to check over my financial statements,and to make any adjustments necessary to show the best possible net profit and the highest possible owner's equity.That way,if I want to sell my business,I will get the best price possible,even if I have to pay higher tax on my profits.I don't think it is necessary to show everything in my financial reports;in fact,if there are any items that don't look so good,please hide them somehow.'

State what accounting principle or rule is violated by each of the above scenarios.

• In violation of accrual accounting - must account for transactions as they occur,not just as cash changes hands (or matching principle or similar).

• In violation of accounting entity principle - owner's personal transactions should be kept separate from the business transactions.

• In violation of the historical cost rule - should account for assets at historical cost unless lower of cost or net realisable value rule applies.

• In violation of the prudence (conservatism)rule - should write off bad debts as an expense to show a correct view of assets.

• In violation of neutrality (or reliability or prudence)principle - should not present information to achieve a pre-determined result.

• In violation of representational faithfulness (or disclosure or reliability)- reports should properly represent underlying transactions (transactions should not be hidden).

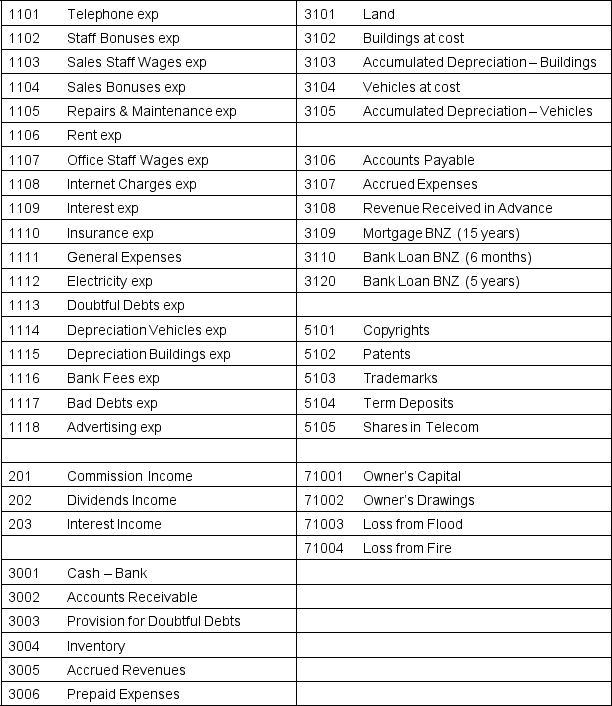

The following is the Chart of Accounts for Blownaparte Bookkeepers:

State corrections or improvements that you could make to the chart to make it more accurate and/or easier to use.

State corrections or improvements that you could make to the chart to make it more accurate and/or easier to use.

Blownaparte Bookkeepers Chart of Accounts:

• Expenses seem to be in reverse alphabetical order;putting them in alphabetical order would speed reference and checking.

• Current and Non-current liabilities should be separated.

• Leave gaps in numbers between accounts to allow for expansion.

• Change numbers to all be consistently 4-digit or 5-digit.

• Change the categories to a more logical order (e.g.Assets,Liabilities,Owner's equity,Revenues,Expenses).

• Separate expenses into selling,general and financial.

• Separate liabilities into current and non-current.

• Separate intangible assets from investments.

• Add titles and subtitles to the chart to make it easier to read (e.g.Current assets,Current liabilities etc. ).

• Move Loss from flood and Loss from fire to the Expenses section,not Equity.

You overhear an owner of a small retail shop saying,'In theory,internal control measures make sense;however,in practice there could be problems with implementing these,especially as they relate to small organisations like mine.'

Discuss some of the problems that the retailer may have had in mind.

The costs of implementing many internal control measures could outweigh the advantages.In many small businesses,segregation of duties and regular rotation of responsibilities is very difficult to achieve.These types of entities do not have the necessary staff numbers,and this coupled with the relatively small amount of work involved with each particular task means that one person may do several tasks.

Define 'monetary convention',and explain the main advantage of (and rationale for)applying the monetary convention to accounting records.

Randolph Nearenough,a dance instructor,runs his own dance instruction business employing 12 dancers and 4 administration staff.He has asked you for some advice on his accounting system and controls,and after visiting and viewing operations,you make the following notes:

• His cousin Datz handles all the incoming mail,customer account records and cash receipts and banking.She checks the monthly bank statement with the firm's records of cash receipts and payments.She is also responsible for all aspects of preparing,recording and administering the payroll.

• The business cheque book is used by whoever is handy,to pay whatever invoices need to be paid.The cheque book is kept in the main office drawer in Datz's office;this drawer always kept locked.

• The key to the drawer is hidden behind Datz's filing cabinet out of the sight of customers;however,all staff are aware of the key's existence and where it is kept,so any staff member can easily get to it.

• Lucy Liu,another one of Randolph's cousins,with a degree in accounting,recently joined the administration staff.As the business is quite successful financially,Randolph has been training her to teach dance,which she enjoys,as there is no accounting task requiring her,and she is often having to read books to fill in her time.

• The firm closes down each December-January for 4 weeks.This enables all staff to take their holidays,without having to train up other staff to do their job while they are away.

a Identify any 4 internal control practices or principles which are not being followed in this business.

b Advise Randolph on what should be done for each one.

Define the (accounting)entity concept,and explain two implications that follow from adopting it.

Explain,with examples,the different accounting information needs of the following users: investors,department managers and trade creditors.

Define 'Chart of Accounts',explain why it is important,and give an example of a coding system for identifying different categories of accounts.

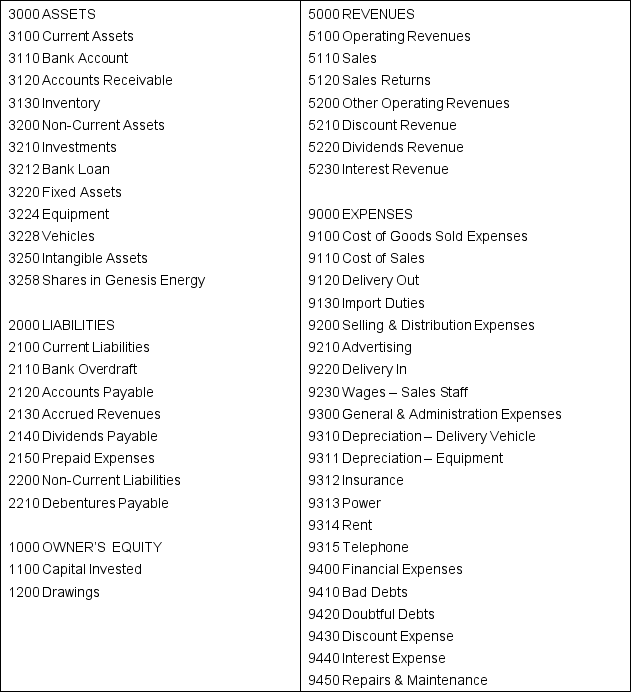

Rolando has just completed a course in accounting principles and has designed a Chart of Accounts for a small sole trader business,Barry's Bike Sales,which Barry has handed to you for comment.Barry also informs you that:

• he expects the business to expand,but still wants expense accounts listed in alphabetical order within each sub-category wherever possible

• he also intends to buy shares in Genesis Energy in the near future,but has no intention of Barry's Bike Sales becoming a limited company.

Barry has begun repairing and servicing bikes,as well as selling them.

a Look over the chart (below)and point out any errors or omissions.

b State 3 improvements that can be made to this chart.

c Explain 3 ways in which a Chart of Accounts may act as an internal control mechanism for a business.

Explain each of the following internal control measures,with an illustration and implication for each:

• establishment of responsibility

• segregation of duties

• documentation procedures

• physical,mechanical and electronic controls

• independent internal verification

• rotation of duties.

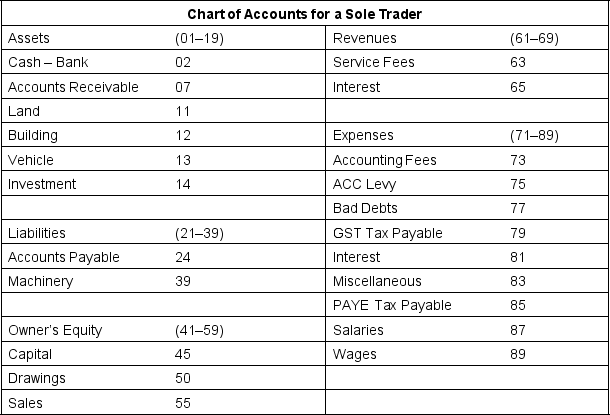

View the Chart of Accounts below and evaluate it in terms of:

a general design and usefulness if the business expands its number of accounts

b number of digits used in the coding system

c errors.

'Every accounting transaction has at least two effects on the accounting equation.'

In light of this statement,answer the following questions:

a Explain what is meant by the term 'accounting equation'.

b Explain why the statement is valid.Illustrate your explanation with at least 2 examples.

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)