Exam 12: A Firms Sources of Financing

Exam 1: The Entrepreneurial Life101 Questions

Exam 2: Integrity and Ethics of Entrepreneurship105 Questions

Exam 3: Getting Started103 Questions

Exam 4: Franchises and Buyouts99 Questions

Exam 5: The Family Business90 Questions

Exam 6: Creating Business Plans93 Questions

Exam 7: The Marketing Plan94 Questions

Exam 8: The Organization of the Business109 Questions

Exam 9: The Location Plan103 Questions

Exam 10: Financial Statements78 Questions

Exam 11: Projecting Financial Requirements57 Questions

Exam 12: A Firms Sources of Financing86 Questions

Exam 13: The Harvest Plan82 Questions

Exam 14: Customer Relationships89 Questions

Exam 15: Product and Supply Chain Management102 Questions

Exam 16: Pricing and Credit99 Questions

Exam 17: Promotional Planning109 Questions

Exam 18: Global Marketing102 Questions

Exam 19: Professional Management and Leadership100 Questions

Exam 20: Human Resource Management103 Questions

Exam 21: Operations Management93 Questions

Exam 22: Managing the Firms Assets103 Questions

Exam 23: Risk Management85 Questions

Select questions type

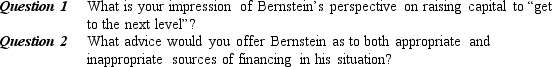

You Make the Call-Situation 1

David Bernstein needs help financing his Lodi, New Jersey-based Access Direct Inc., a six-year-old $3.5 million company. "We're ready to get to the next level," says Bernstein. "But we're not sure which way to go." Access Direct spruces up and then sells used computer equipment for corporations; it is looking for up to $2 million in order to expand. "Venture capitalists, individual investors, or banks," says Bernstein, who owns the company with four partners, "we've thought about them all."

(Essay)

4.7/5  (42)

(42)

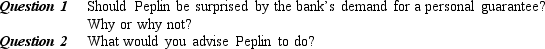

You Make the Call-Situation 3

Steve Peplin is the president of Talan Products, a metal stamper based in Cleveland. Peplin has a long-term relationship with his banker. But recently his firm ran into financial difficulty, and the bank is demanding that Peplin personally guarantee 100 percent of the company's loans. Peplin would prefer not to do so, but isn't sure that he has a choice.

(Source: "Hands On," Inc., Vol. 25, No. 8 (August 2003), p. 50.)

(Essay)

4.8/5  (38)

(38)

If an owner is looking to take out a loan for equipment that will last approximately 8 years the ideal loan would be

(Multiple Choice)

4.7/5  (36)

(36)

Venture capitalists restrict their investment in startup companies.

(True/False)

4.7/5  (34)

(34)

If Bill Bailey, owner of Cherokee Communications, had violated the covenants of his loan agreement,

(Multiple Choice)

4.8/5  (42)

(42)

Research for developing a new method of manufacturing would be a(n) _____ asset.

(Multiple Choice)

4.9/5  (37)

(37)

Private placement is the selling of stock only to selected individuals.

(True/False)

4.8/5  (40)

(40)

Use of debt financing increases potential returns when a company is performing well, but it also increases the possibility of lower-even negative-returns if the company does not attain its goals in a given year.

(True/False)

4.9/5  (28)

(28)

Most of those who invest in startups limit their investing to firms with potentially high returns in a _____ period.

(Multiple Choice)

4.9/5  (40)

(40)

The five Cs of credit are character, capacity, capital, conditions, and collateral.

(True/False)

4.8/5  (35)

(35)

When bankers look for evidence of whether a business will be able to repay a loan, they usually base their assessment of this on

(Multiple Choice)

4.9/5  (41)

(41)

The main advantage of using credit cards for financing is the relatively low interest rate compared to bank loans.

(True/False)

4.9/5  (37)

(37)

Qualified small businesses that cannot obtain business loans through normal lending channels can get loans directly from the SBA through its 7(a) Loan Guaranty Program.

(True/False)

4.9/5  (41)

(41)

Based on an operating income of $30,000 and total assets of $200,000 what would be the percent return on assets?

(Multiple Choice)

4.8/5  (40)

(40)

The following are key terms included in all bank loan agreements except

(Multiple Choice)

4.9/5  (34)

(34)

How likely is the typical startup to succeed in getting funded by a venture capitalist?

(Multiple Choice)

4.8/5  (35)

(35)

When it comes to financing a company, a banker looks at two kinds of assets:

(Multiple Choice)

4.9/5  (45)

(45)

Showing 21 - 40 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)