Exam 5: Risk Analysis

Exam 1: Overview of Financial Reporting, Financial Statement Analysis, and Valuation99 Questions

Exam 2: Asset and Liability Valuation and Income Measurement78 Questions

Exam 3: Income Flows Versus Cash Flows: Understanding the Statement of Cash Flows86 Questions

Exam 4: Profitability Analysis95 Questions

Exam 5: Risk Analysis81 Questions

Exam 6: Financing Activities64 Questions

Exam 7: Investing Activities99 Questions

Exam 8: Operating Activities88 Questions

Exam 9: Accounting Quality63 Questions

Exam 10: Forecasting Financial Statements62 Questions

Exam 11: Risk-Adjusted Expected Rates of Return and the Dividends Valuation Approach52 Questions

Exam 12: Valuation: Cash-Flow-Based Approaches64 Questions

Exam 13: Valuation: Earnings-Based Approaches67 Questions

Exam 14: Valuation: Market-Based Approaches64 Questions

Select questions type

By adding the number of days that inventory is held to the number of days that accounts receivable is outstanding an analyst can calculate the number of days of _____________________________________________ the firm requires.

(Short Answer)

4.8/5  (31)

(31)

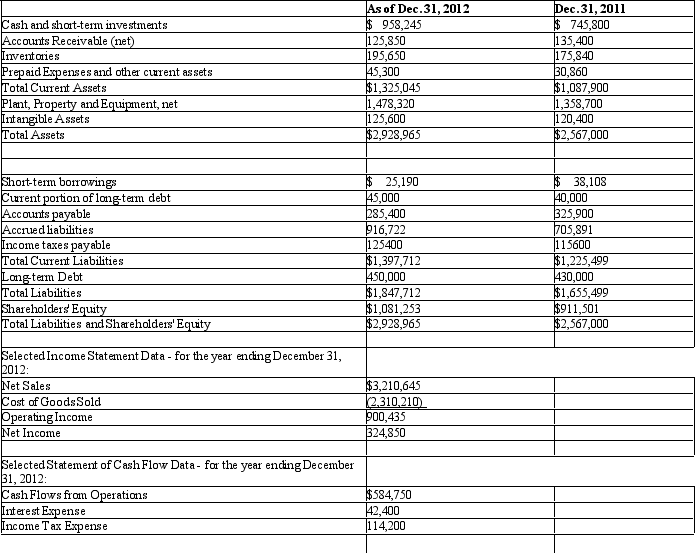

Company manufactures computer technology devices. Selected financial data for Mobile is presented below, use the information to answer the following questions:

As of Dec. 31, 2010 Dec. 31, 2009 Cash and short-term investments \ 1,267,038 \ 616,604 Accounts Receivable (net) 490,816 665,828 Inventories 338,599 487,505 Prepaid Expenses and other current assets Total Current Assets \ 2,388,964 \ 2,061,852 \ 38,108 Short-term borrowings \ 25,190 210,090 Current portion of long-term debt 182,295 334,247 Accounts payable 296,307 743,999 Accrued liabilities 941,912 239.793 Income taxes payable Total Current Liabilities 1,648,753 1,566,237

Net Sales \4 ,885,340 Cost of Goods Sold 2,542,353 Operating Income 733,541 Net Income 230,101

Cash Flows from Operations \ 1,156,084

-

Refer to the information for Mobile Company. Mobile's 2010 Inventory Turnover ratio is

(Multiple Choice)

4.8/5  (33)

(33)

In general, the shorter the number of days of needed financing, the ____________________ is the cash flow from operations to average current liabilities.

(Short Answer)

4.9/5  (41)

(41)

Below is information from Darren Company's 2012 financial statements.

(Essay)

4.7/5  (31)

(31)

When management takes deliberate steps at a balance sheet date to produce a better current ratio than is normal it is called ______________________________.

(Short Answer)

4.8/5  (39)

(39)

Which of the following properly links the factors affecting a firm's ability to generate cash with its need to use cash in financing?

A. Profitability of goods and services sold Working capital requirements

B. Sales of existing plant assets Plant capacity requirements

C. Borrowing capacity Debt service requirements

D. Profitability of goods and services sold Debt service requirements

(Short Answer)

4.9/5  (29)

(29)

All of the following typically drive firm-specific risks except:

(Multiple Choice)

4.9/5  (38)

(38)

One problem with debt ratios is that they provide no information about the ability of the firm to generate ________________________________________ to service debt.

(Short Answer)

4.8/5  (33)

(33)

On January 1, 2012, Deputron Company's beginning inventory was $600,000. During 2012, the company purchased $2,600,000 of additional inventory, and on December 31, 2012 Creek's ending inventory was $565,000.

Required:

What was Deputron's inventory turnover for 2012?

(Essay)

4.8/5  (37)

(37)

Mobile Company manufactures computer technology devices. Selected financial data for Mobile is presented below, use the information to answer the following questions:

As of Dec. 31, 2010 Dec. 31, 2009 Cash and short-term investments \ 1,267,038 \ 616,604 Accounts Receivable (net) 490,816 665,828 Inventories 338,599 487,505 Prepaid Expenses and other current assets Total Current Assets \ 2,388,964 \ 2,061,852 \ 38,108 Short-term borrowings \ 25,190 210,090 Current portion of long-term debt 182,295 334,247 Accounts payable 296,307 743,999 Accrued liabilities 941,912 239.793 Income taxes payable Total Current Liabilities 1,648,753 1,566,237

Net Sales \4 ,885,340 Cost of Goods Sold 2,542,353 Operating Income 733,541 Net Income 230,101

Cash Flows from Operations \ 1,156,084

-

Refer to the information for Mobile Company. Mobile's days accounts payable outstanding at the end of 2010 is

(Multiple Choice)

4.9/5  (32)

(32)

Given the following information, calculate for Year 2 the number of days of working capital financing the firm will need to obtain from other sources?

Year 1 Year 2 Accounts Receivable, net \5 18 \5 62 Accounts Payable 203 192 Inventory 535 564 Credit Sales 3,205 3,636 Cost of GoodsSold. 2,037 2,294 Selling and Admin Expense 1,081 1,131

(Essay)

4.9/5  (41)

(41)

In the empirical research on earnings manipulation discussed in the chapter a number of firm characteristics are found to be associated with the likelihood of engaging in earnings manipulation. For each of the characteristics listed below, discuss the rationale for their inclusion in the model:

a. Gross Margin Index

b. Asset Quality Index

c. Sales Growth Index

d. Depreciation Index

e. Leverage Index

(Essay)

4.8/5  (31)

(31)

When calculating the quick ratio, an analyst would include in the numerator cash, ________________________________________, and receivables.

(Short Answer)

4.8/5  (36)

(36)

The source of risk related to management competence, strategic direction and lawsuits is _________________________.

(Short Answer)

4.7/5  (38)

(38)

In bankruptcy prediction analysis a type ____________________ error is classifying a firm as bankrupt and it ultimately survives.

(Short Answer)

4.8/5  (36)

(36)

Foxmoor Company's merchandise inventory and other related accounts for 2012 follow:

Sales \ 2,937,500 Cost of GoodsSold 2,303,400 Merchandise Inventory Begiming of Year 650,000 End of Year 825,000

Required:

Calculate Foxmoor's inventory turnover during 2012 assuming that the merchandise inventory buildup was relatively constant during the year.

(Essay)

4.7/5  (32)

(32)

Mobile Company manufactures computer technology devices. Selected financial data for Mobile is presented below, use the information to answer the following questions:

As of Dec. 31, 2010 Dec. 31, 2009 Cash and short-term investments \ 1,267,038 \ 616,604 Accounts Receivable (net) 490,816 665,828 Inventories 338,599 487,505 Prepaid Expenses and other current assets Total Current Assets \ 2,388,964 \ 2,061,852 \ 38,108 Short-term borrowings \ 25,190 210,090 Current portion of long-term debt 182,295 334,247 Accounts payable 296,307 743,999 Accrued liabilities 941,912 239.793 Income taxes payable Total Current Liabilities 1,648,753 1,566,237

Net Sales \4 ,885,340 Cost of Goods Sold 2,542,353 Operating Income 733,541 Net Income 230,101

Cash Flows from Operations \ 1,156,084

-

Refer to the information for Mobile Company. Mobile's Operating Cash Flow to Current Liabilities ratio in 2010 was

(Multiple Choice)

4.8/5  (47)

(47)

Univariate bankruptcy prediction models help identify factors related to bankruptcy, but they do not provide information about

(Multiple Choice)

4.9/5  (31)

(31)

Here are several ratios calculated from Midas Company's financial statements: Days in Receivables = 43

Days in Payables = 38

Days in Inventory = 31

How many days of working capital financing does Midas need to obtain from other sources?

(Multiple Choice)

4.7/5  (40)

(40)

Showing 21 - 40 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)