Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory

Exam 1: Financial Statements and Business Decisions130 Questions

Exam 2: Investing and Financing Decisions and the Accounting System140 Questions

Exam 3: Operating Decisions and the Accounting System128 Questions

Exam 4: Adjustments,financial Statements,and the Quality of Earnings138 Questions

Exam 5: Communicating and Interpreting Accounting Information119 Questions

Exam 6: Reporting and Interpreting Sales Revenue,receivables,and Cash133 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory137 Questions

Exam 8: Reporting and Interpreting Property,plant,and Equipment;intangibles;and Natural Resources132 Questions

Exam 9: Reporting and Interpreting Liabilities129 Questions

Exam 10: Reporting and Interpreting Bond Securities128 Questions

Exam 11: Reporting and Interpreting Stockholders Equity137 Questions

Exam 12: Statement of Cash Flows121 Questions

Exam 13: Analyzing Financial Statements124 Questions

Exam 14: Reporting and Interpreting Investments in Other Corporations113 Questions

Select questions type

Sideline Company reported net income for 2018 of $70,000 and in 2019 of $84,000 (both after income taxes at a 30% rate).It was discovered in 2019 that the ending inventory for 2018 was understated by $2,000 (before any income tax effect).

Calculate the correct net income (after income tax of 30%)for 2018 and 2019.

(Essay)

4.9/5  (41)

(41)

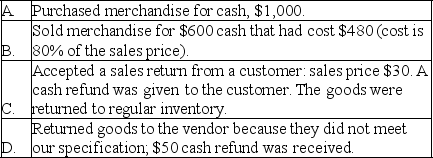

Prepare the journal entries for the transactions listed below under both the periodic inventory system and the perpetual inventory system.

(Essay)

4.9/5  (39)

(39)

The lower of cost or net realizable value rule is used due to the conservatism constraint,and therefore an inventory calculation may result in a departure from the historical cost principle.

(True/False)

4.7/5  (33)

(33)

The journal entry to write down inventory under the lower of cost or net realizable value rule results in a credit to cost of goods sold and a debit to inventory.

(True/False)

4.9/5  (35)

(35)

Iris Company has provided the following information regarding two of its items of inventory at year-end: • There are 100 units of Item A,having a cost of $20 per unit,a selling price of $24 and a cost to sell of $6 per unit.

• There are 50 units of Item B,having a cost of $50 per unit,a selling price of $56 and a cost to sell of $4 per unit.

How much is the ending inventory using lower of cost or net realizable value?

(Multiple Choice)

4.8/5  (41)

(41)

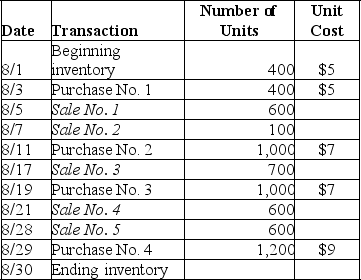

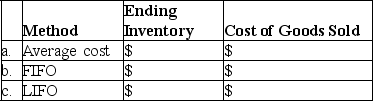

The inventory records of Martin Corporation reflected the following information for the month of August:

A.Determine the amount of the ending inventory and cost of goods sold under each of the following methods assuming the periodic inventory system.

A.Determine the amount of the ending inventory and cost of goods sold under each of the following methods assuming the periodic inventory system.

B.Why would cash flow considerations relate to the choice of an inventory method?

B.Why would cash flow considerations relate to the choice of an inventory method?

(Essay)

4.7/5  (39)

(39)

A $25,000 overstatement of the 2018 ending inventory was discovered after the financial statements for 2018 were prepared.Which of the following describes the effect of the inventory error on the 2019 financial statements?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following statements is correct regarding either the perpetual or periodic inventory systems?

(Multiple Choice)

4.9/5  (38)

(38)

A grocery store would likely use the specific identification inventory costing method for most of the items in its inventory.

(True/False)

4.8/5  (34)

(34)

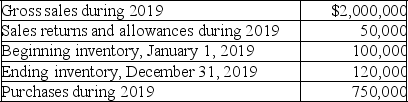

McMillan Company uses the periodic inventory system.It has compiled the following information in order to prepare the financial statements at December 31,2019:

Calculate each of the following:

A.Cost of goods available for sale

B.Cost of goods sold

C.Gross profit

Calculate each of the following:

A.Cost of goods available for sale

B.Cost of goods sold

C.Gross profit

(Essay)

4.9/5  (40)

(40)

A decrease in the merchandise inventory account occurs when units of inventory purchased are greater than units of goods sold.

(True/False)

4.8/5  (40)

(40)

An increase in accounts payable is added to net income when determining cash flows from operating activities.

(True/False)

4.8/5  (35)

(35)

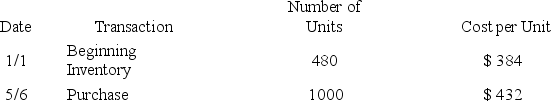

JJ Enterprises began the year with 480 units of one of its most popular products.During the year JJ purchased 1,000 units and sold 1,100 units for $500 each.What is the pre-tax effect of JJ's LIFO liquidation?

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following costs will not affect cost of goods sold?

(Multiple Choice)

4.8/5  (49)

(49)

Abel Company must write down its inventory by $30,000 to the net realizable value of $450,000 at December 31,2019.What is the effect of this write-down on the year 2019 financial statements?

(Multiple Choice)

4.9/5  (43)

(43)

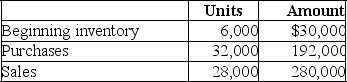

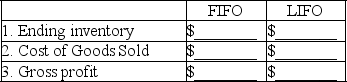

William Company has provided the following data:

A.Calculate the following using both: FIFO and LIFO inventory methods.

A.Calculate the following using both: FIFO and LIFO inventory methods.

B.In times of rising unit costs,how does pretax income using FIFO compare to pretax income using LIFO? Explain your answer.

B.In times of rising unit costs,how does pretax income using FIFO compare to pretax income using LIFO? Explain your answer.

(Essay)

4.9/5  (40)

(40)

Which of the following statements is correct when inventory unit costs are increasing?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 41 - 60 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)