Exam 14: Reporting and Interpreting Investments in Other Corporations

Exam 1: Financial Statements and Business Decisions130 Questions

Exam 2: Investing and Financing Decisions and the Accounting System140 Questions

Exam 3: Operating Decisions and the Accounting System128 Questions

Exam 4: Adjustments,financial Statements,and the Quality of Earnings138 Questions

Exam 5: Communicating and Interpreting Accounting Information119 Questions

Exam 6: Reporting and Interpreting Sales Revenue,receivables,and Cash133 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory137 Questions

Exam 8: Reporting and Interpreting Property,plant,and Equipment;intangibles;and Natural Resources132 Questions

Exam 9: Reporting and Interpreting Liabilities129 Questions

Exam 10: Reporting and Interpreting Bond Securities128 Questions

Exam 11: Reporting and Interpreting Stockholders Equity137 Questions

Exam 12: Statement of Cash Flows121 Questions

Exam 13: Analyzing Financial Statements124 Questions

Exam 14: Reporting and Interpreting Investments in Other Corporations113 Questions

Select questions type

On January 1,2019,Sheldon Company paid $750,000 cash for 100% of the outstanding common stock of Mullen Company;Mullen's book value of assets minus liabilities on the date of acquisition was $550,000.The current fair value of Mullen's net assets was $70,000 in excess of their book value.What was the amount of goodwill acquired by Sheldon Company?

(Multiple Choice)

4.9/5  (45)

(45)

Barnum Company owns an investment and uses the equity method of accounting.Under the equity method of accounting,Barnum would decrease the Investment account for the proportionate share of the affiliate's reported net loss.

(True/False)

4.9/5  (34)

(34)

Goodwill is reported on a consolidated balance sheet only if it was acquired in a merger or acquisition.

(True/False)

4.7/5  (49)

(49)

Chang Corp.purchased $1,000,000 of bonds at par value on April 1,2019.The bonds pay interest at the rate of 10%.Chang intends and has the ability to hold these bonds to maturity.Which of the following statements is false?

(Multiple Choice)

4.7/5  (33)

(33)

On January 1,2019,Palmer,Inc.bought 40% of the outstanding shares of Arnold Corporation at a cost of $137,000.Palmer uses the equity method of accounting for this investment.During 2019,Arnold Corporation reported $30,000 of net income and paid a total of $10,000 in cash dividends.At the end of 2019,the shares had a fair value of $150,000.

-At the end of 2019,the shares had a fair value of $150,000.What is the amount of Equity in investee earnings for 2019?

(Multiple Choice)

4.8/5  (37)

(37)

Investments in bonds intended to be sold before they reach maturity should be reported under the fair value method.

(True/False)

4.9/5  (42)

(42)

Which of the following is the best description of investments in available-for-sale securities?

(Multiple Choice)

4.8/5  (45)

(45)

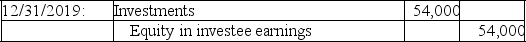

On December 31,2019,Jean World Corporation recorded the following journal entry relating to its investment in 9,000 shares of common stock of Soda Corporation.

At the end of 2019,Soda Corporation reported net income of $120,000.

Earlier in the year,Soda declared and paid dividends of $18,000.

A.What method is being used to account for this investment?

B.What is the total number of shares outstanding of Soda's common stock?

At the end of 2019,Soda Corporation reported net income of $120,000.

Earlier in the year,Soda declared and paid dividends of $18,000.

A.What method is being used to account for this investment?

B.What is the total number of shares outstanding of Soda's common stock?

(Essay)

4.9/5  (38)

(38)

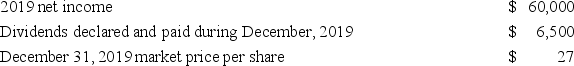

On July 1,2019,as a long-term investment,Wildlife Supply Company purchased 6,000 of the 18,000 outstanding shares of the nonvoting preferred stock of Nature Company for $30 per share.The records of Nature Company reflect the following:  The amount reported on the balance sheet by Wildlife Company for its investment at December 31,2019 would be which of the following?

The amount reported on the balance sheet by Wildlife Company for its investment at December 31,2019 would be which of the following?

(Multiple Choice)

4.9/5  (31)

(31)

On January 1,2019,as a long-term investment,John Company purchased 1,000 of the 10,000 outstanding voting common shares of Wayne Corporation at $9 per share.Wayne reported 2019 net income of $30,000 and declared and paid cash dividends of $20,000.The market price of the Wayne stock at the end of 2019 was $10 per share.Calculate the carrying value of John's investment at the end of 2019.

(Essay)

5.0/5  (41)

(41)

Miller Corp.purchased $1,000,000 of bonds at 95 when the market yield was 10%.The bonds pay interest at the rate of 8%.Miller intends to hold these bonds to maturity and will not need to sell the bonds before that date.Which of the following statements is false?

(Multiple Choice)

4.8/5  (37)

(37)

The equity investment portfolio is adjusted to fair value at the end of each period with the offsetting effect reported on the income statement as a realized gain or loss.

(True/False)

4.9/5  (38)

(38)

In which of the following circumstances is the investor most likely to exert significant influence over the operating and financial policies of the investee company?

(Multiple Choice)

4.8/5  (31)

(31)

When accounting for investments in trading securities,any decline in fair value below the cost of the investments is reported in which of the following ways?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following accounts is only created as the result of acquiring a controlling interest in another company?

(Multiple Choice)

4.8/5  (40)

(40)

McGinn Company purchased 10% of RJ Company's common stock during 2019 for $100,000.The 10% investment in RJ had a $90,000 fair value at the end of 2019 and a $105,000 fair value at the end of 2020. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (38)

(38)

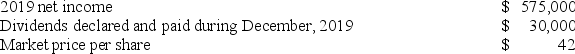

Gilman Company purchased 100,000 of the 250,000 shares of common stock of Burke Corporation on January 1,2019,at $40 per share as a long-term investment.The records of Burke Corporation showed the following on December 31,2019:  - At what amount should Gilman Company report the Burke investment on the December 31,2019 balance sheet?

- At what amount should Gilman Company report the Burke investment on the December 31,2019 balance sheet?

(Multiple Choice)

4.9/5  (39)

(39)

The use of consolidation accounting for a long-term investment in common stock of another company is required when the ownership of its voting stock is:

(Multiple Choice)

4.8/5  (31)

(31)

When is the equity method not used to account for a long-term investment in common stock?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 21 - 40 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)