Exam 5: Responsibility Accounting and Transfer Pricing

Transfer Prices and Capacity

Jefferson Company has two divisions:Jefferson Bottles and Jefferson Juice.Jefferson Bottles makes glass containers,which it sells to Jefferson Juice and other companies.Jefferson Bottles has a capacity of 10 million bottles a year.Jefferson Juice currently has a capacity of 3 million bottles of juice per year.Jefferson Bottles has a fixed cost of $100,000 per year and a variable cost of $0.01/bottle.Jefferson Bottles can currently sell all of its output at $0.03/bottle.

Required:

a.What should Jefferson Bottles charge Jefferson Juice for bottles so that both divisions will make appropriate decentralized planning decisions?

b.If Jefferson Bottles can only sell 5 million bottles to outside buyers,what should Jefferson Bottles charge Jefferson Juice for bottles so that both divisions will make appropriate decentralized planning decisions?

Solution to Transfer Prices and Capacity (10 minutes)

a.Jefferson Bottles should charge Jefferson Juice the opportunity cost of providing the bottles.The opportunity cost to Jefferson Bottles of selling to Jefferson Juice is the market price,or $0.03/bottle.

b.Jefferson Bottles can sell 5 million bottles it currently makes,but there is no apparent market for further bottles.If there were further demand,the company would be making more bottles because the bottles provide a positive contribution margin per unit.Therefore,the opportunity cost of making more bottles is the variable cost or $0.01/bottle,which should be used as the transfer price.

Transfer Prices and External Sourcing

Lewis is a large manufacturer of office equipment,including copiers.Its electronics division is a cost center.Currently,electronics sells circuit boards to other divisions exclusively.Lewis has a policy that internal transfers are to be priced at full cost (fixed + variable).Thirty percent of the cost of a board is considered fixed.

The electronics division is operating at 75 percent of capacity.Because there is excess capacity,electronics is seeking opportunities to sell boards to non-Lewis firms.The electronics division policy on non-Lewis sales states that each job must cover full cost and a minimum 10 percent profit.Electronics division management will be measured on its ability to make the minimum profit on any non-Lewis contracts that are accepted.

Copy products is another Lewis division.Copy products has recently reached an agreement with Siviy,a non-Lewis firm,for the assembly of subsystems for a copier.Copy products has selected Siviy because of Siviy's low labor cost.The subsystem Siviy will assemble requires circuit boards.Copy products has stipulated that Siviy must purchase the circuit boards from the electronics division because of electronics' high quality and dependability.

Electronic products is anxious to accept this new work from copy products because it will increase electronic product's workload by 15 percent.

In negotiating a contract price with Siviy,copy products needs to take into account the cost of the circuit boards from electronics.The financial analyst from copy products assumes that electronics will sell the circuit boards to Siviy at full cost (the same as the internal transfer price).Electronics is considering adding the minimum 10 percent profit margin to their full cost and transferring at that price to Siviy.

Copy products is preparing to negotiate its contract with Siviy.Develop and discuss at least three options that may be used in establishing the transfer price between the electronics division and Siviy.Discuss the advantages and disadvantages of each.

Solution to Transfer Prices and External Sourcing (20 minutes)

This problem illustrates some complexities involved in transfer pricing when two internal divisions become involved.

In determining the appropriate selling price,the Electronics Division and the Copy Products Division must consider the following:

• The first question to raise is why the Electronics Division cares about the transfer price.Being a cost center,Electronics should be evaluated on costs,not profits.The first thing to investigate is whether the partitioning of decision rights and the performance evaluation systems are properly aligned.

• Taking the Siviy work raises volume in the Electronics division from 75 percent to 90 percent.Are marginal costs constant as output is increased? If not,then the price being quoted of allocated fixed costs plus variable cost is unlikely an accurate estimate of how costs actually will behave when this contract is added.

• There will be additional transaction costs incurred as a result of dealing with a non-Lewis intermediary,such as billings,accounts receivable,transportation and shipping,etc.

• The stability of the work force within the Electronics Division must be considered.Will the added workload cause additional hiring or overtime or will it allow for better utilization of the existing work force? Without this added work,will Electronics be facing downsizing actions?

• There will be an increased need for management attention and additional overhead to negotiate and monitor such a small portion of the business.Perhaps the profit requirement exists to discourage internal Lewis sales through a third party.

Three alternatives for negotiating a selling price to Siviy are:

• Transfer to Siviy at full cost plus transaction cost.This would ensure that no other Electronics customers would subsidize the sale of boards to Siviy.However,it is contrary to the current Electronics performance measurement system.

• Transfer as an internal sale to Copy Products at full cost.Copy Products may then consign the boards to Siviy for use in the sub-system.This allows Electronics to acquire the added workload without incurring the additional transaction cost.However,Copy Products would bear the transaction costs in managing the consigned material.Copy Products would also bear the responsibility for the added inventory dollars for the boards while at Siviy.

• Transfer at full cost plus profit.While this option would allow the Electronics Division to act in accordance with the standard transfer pricing policy,it may jeopardize the relationship between the two Lewis divisions.It inflates the true cost of the board,which results in an inflated sub-system price from Siviy to Copy Products.

Transfer Prices

The Alpha Division of the Carlson Company manufactures product X at a variable cost of $40 per unit.Alpha Division's fixed costs,which are sunk,are $20 per unit.The market price of X is $70 per unit.Beta Division of Carlson Company uses product X to make Y.The variable costs to convert X to Y are $20 per unit and the fixed costs,which are sunk,are $10 per unit.The product Y sells for $80 per unit.

Required:

a.What transfer price of X causes divisional managers to make decentralized decisions that maximize Carlson Company's profit if each division is treated as a profit center?

b.Given the transfer price from part (a),what should the manager of the Beta Division do?

c.Suppose there is no market price for product X.What transfer price should be used for decentralized decision-making?

d.If there is no market for product X,is the operations of the Beta Division profitable?

Solution to Transfer Prices (15 minutes)

a.The transfer price should be equal to the opportunity cost of Alpha Division supplying X to the Beta Division,which is the market price of $70 per unit.

b.If the manager of the Beta Division must pay $70 per unit of X,the manager of Beta Division will not be able to generate a profit and should look for other opportunities rather than processing X.

c.If there is no market for X,the opportunity cost of supplying X is the variable cost of X or $40 per unit.

d.If the Beta Division only has to pay $40 per unit of X,then Beta can operate profitably by adding $20 in variable cost and selling product Y for $80 per unit.

Responsibility Centers

The Maple Way Golf Course is a private club that is owned by the members.It has the following managers and organizational structure:

Eric Olson:General manager responsible for all the operations of the golf course and other facilities (swimming pool,restaurant,golf shop).

Jennifer Jones:Manager of the golf course and responsible for its maintenance.

Edwin Moses:Manager of the restaurant.

Mabel Smith:Head golf professional and responsible for golf lessons,the golf shop,and reserving times for starting golfers on the course.

Wanda Itami:Manager of the swimming pool and family recreational activities.

Jake Reece:Manager of golf carts rented to golfers.

Describe each of the managers in terms of being responsible for a cost,profit,or investment center and possible performance measures for each manager.

Performance Measures for Cost Centers

A soft drink company has three bottling plants throughout the country.Bottling occurs at the regional level because of the high cost of transporting bottled soft drinks.The parent company supplies each plant with the syrup.The bottling plants combine the syrup with carbonated soda to make and bottle the soft drinks.The bottled soft drinks are then sent to regional grocery stores.

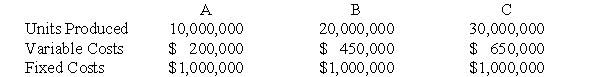

The bottling plants are treated as costs centers.The managers of the bottling plants are evaluated based on minimizing the cost per soft drink bottled and delivered.Each bottling plant uses the same equipment,but some produce more bottles of soft drinks because of different demand.The costs and output for each bottling plant are:  Required:

a.Estimate the average cost per unit for each plant.

b.Why would the manager of plant A be unhappy with using the average cost as the performance measure?

c.What is an alternative performance measure that would make the manager of plant A happier?

d.Under what circumstances might the average cost be a better performance measure?

Required:

a.Estimate the average cost per unit for each plant.

b.Why would the manager of plant A be unhappy with using the average cost as the performance measure?

c.What is an alternative performance measure that would make the manager of plant A happier?

d.Under what circumstances might the average cost be a better performance measure?

Transfer Pricing in the Presence of Divisional Interdependencies

Prior to 1997,PepsiCo,a major soft drink company,had a restaurant division consisting of Kentucky Fried Chicken,Taco Bell,and Pizza Hut.The only cola beverage these restaurants served was Pepsi.Assume that the major reason PepsiCo owned fast food restaurants is an attempt to increase its share of the cola market.Under this assumption,some Pizza Hut patrons who order a cola at the restaurant and are told they are drinking a Pepsi will switch and become Pepsi drinkers instead of Coke drinkers on other purchase occasions.However,studies have shown that some customers refuse to eat at restaurants unless they can get a Coke.

PepsiCo sells Pepsi Cola to non-PepsiCo restaurants at $0.53 per gallon.This is the market price of Pepsi-Cola.Pepsi-Cola's variable manufacturing cost is $0.09 per gallon and its total (fixed and variable)manufacturing cost is $0.22 per gallon.PepsiCo produces Pepsi-Cola in numerous plants located around the world.Plant capacity can be added in small increments (e.g. ,a half-million gallons per year).The cost of additional capacity is approximately equal to the fixed costs per gallon of $0.13.

Required:

What transfer price should be set for Pepsi transferred from the soft drink division of PepsiCo to a PepsiCo restaurant such as Taco Bell? Justify your answer.

Transfer Pricing in Universities

The Eastern University Business School teaches some undergraduate business courses for students in the Eastern University College of Arts and Science (CAS).The 6,000 undergraduates generate 2,000 undergraduate student course enrollments in business courses per year.The B-school and CAS are treated as profit centers in that their budgets contain student tuition revenues as well as costs.The deans have discretion to set tuition and salaries and determine hiring as long as they operate with no deficit (revenues = expenses).Undergraduate tuition is $12,000 per year and each student takes eight courses per year.Average undergraduate financial aid amounts to 20% of gross tuition.The current transfer price rule is gross tuition per course less average financial aid.

This transfer price rule gives net tuition to the B-school as a revenue and deducts an equal amount from the CAS budget.The CAS dean argues that the current system is grossly unfair.CAS must provide costly services for undergraduates to maintain a top-rated undergraduate program.For example,career counseling,academic advising,sports programs,and the admissions office are costs that must be incurred if undergraduates are to enroll at Eastern.Therefore,the CAS dean argues,the average cost of these services per undergraduate student course enrollment should be deducted from the tuition transfer price.These undergraduate student services total $9.6 million per year.

Required:

a.Calculate the current revenue the B-school is receiving from undergraduate business courses.What will it be if the CAS dean's proposal is adopted?

b.Discuss the pros and cons of the CAS dean's proposal.

c.As special assistant to the B-school dean,prepare a response to the proposed tuition transfer pricing scheme.

ROI and Residual Income

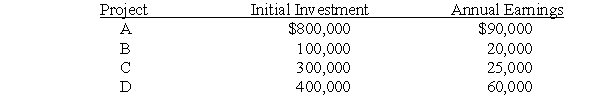

The following investment opportunities are available to an investment center manager:  Required:

a.If the investment manager is currently making a return on investment of 16 percent,which project(s)would the manager want to pursue?

b.If the cost of capital is 10 percent and the annual earnings approximate cash flows excluding finance charges,which project(s)should be chosen?

c.Suppose only one project can be chosen and the annual earnings approximate cash flows excluding finance charges.Which project should be chosen?

Required:

a.If the investment manager is currently making a return on investment of 16 percent,which project(s)would the manager want to pursue?

b.If the cost of capital is 10 percent and the annual earnings approximate cash flows excluding finance charges,which project(s)should be chosen?

c.Suppose only one project can be chosen and the annual earnings approximate cash flows excluding finance charges.Which project should be chosen?

Comparing ROA and EVA

General Motors's CFO,Michael Losh,converted GM's performance measure for compensation from net income to ROA.In explaining the move in CFO (August 1996),he said,"ROA was a logical next step because all those other measures generally have focused on the income statement.Moving to ROA means that we're going to focus not only on the income statement,but on the balance sheet and effective utilization of the assets and liabilities that are on the balance sheet as well.

"ROA is a better measure for us than EVA.… EVA is simpler conceptually,because it automatically builds on growth,whereas with this approach we know that we've got to have growth as an overlying objective.… EVA is more comprehensive.And that has a certain appeal to me.But,given our situation,particularly in our North American operations,it just would not have been the right measure.

"ROA works for us and EVA doesn't because our operations have to deal with those two different kinds of starting points.Within GM,in our North American operations,you've got a classic turnaround situation,and in our international operations,you've got a classic growth situation.You can apply ROA to both;you can't apply EVA to both."

Required:

a.Explain how ROA focuses on both the income statement and the balance sheet.

b.Explain why EVA is more "comprehensive" than ROA.

c.Do you agree with Losh's statement that "you can apply ROA to both;you can't apply EVA to both"? Explain.

Transfer Prices and Divisional Profit

A chair manufacturer has two divisions:framing and upholstering.The framing costs are $100 per chair and the upholstering costs are $200 per chair.The company makes 5,000 chairs each year,which are sold for $500.

Required:

a.What is the profit of each division if the transfer price is $150?

b.What is the profit of each division if the transfer price is $200?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)