Exam 18: Fixed Exchange Rates and Foreign Exchange Intervention

Exam 1: Introduction37 Questions

Exam 2: World Trade: an Overview18 Questions

Exam 3: Labor Productivity and Comparative Advantage: the Ricardian Model47 Questions

Exam 4: Specific Factors and Income Distribution62 Questions

Exam 5: Resources and Trade: the Heckscher-Ohlin Model66 Questions

Exam 6: The Standard Trade Model45 Questions

Exam 7: External Economies of Scale and the International Location of Production37 Questions

Exam 8: Firms in the Global Economy: Export Decisions, Outsourcing, and Multinational Enterprises69 Questions

Exam 9: The Instruments of Trade Policy71 Questions

Exam 10: The Political Economy of Trade Policy57 Questions

Exam 11: Trade Policy in Developing Countries33 Questions

Exam 12: Controversies in Trade Policy46 Questions

Exam 13: National Income Accounting and the Balance of Payments72 Questions

Exam 14: Exchange Rates and the Foreign Exchange Market: an Asset Approach74 Questions

Exam 15: Money, Interest Rates, and Exchange Rates65 Questions

Exam 16: Price Levels and the Exchange Rate in the Long Run79 Questions

Exam 17: Output and the Exchange Rate in the Short Run114 Questions

Exam 18: Fixed Exchange Rates and Foreign Exchange Intervention80 Questions

Exam 19: International Monetary Systems: an Historical Overview153 Questions

Exam 20: Financial Globalization: Opportunity and Crisis113 Questions

Exam 21: Optimum Currency Areas and the Euro99 Questions

Exam 22: Developing Countries: Growth, Crisis, and Reform112 Questions

Select questions type

The global financial crisis of 2007-2008 resulted in a(n) ________ of the Swiss franc. In 2011, the Swiss central bank intervened in order to cause a(n) ________ of the franc.

(Multiple Choice)

4.8/5  (46)

(46)

Does the signalling effect of foreign exchange intervention support or refute the claim that assets cannot be perfect substitutes if sterilized intervention is going to have any effect? Please explain.

(Essay)

4.9/5  (40)

(40)

Under the gold standard, if the dollar price of gold is pegged at $35 per ounce and the euro price of gold is pegged at 12 euro per ounce, what is the dollar/euro exchange rate?

(Essay)

4.7/5  (38)

(38)

Use a figure to explain how a balance of payments crisis occurs and its hand in capital flight.

(Essay)

4.9/5  (35)

(35)

Under fixed exchange rates, which one of the following statements is the MOST accurate?

(Multiple Choice)

4.7/5  (36)

(36)

Explain how a country whose currency is the reserve currency can use monetary policy for macroeconomic stabilization. In particular, explain the result if that country doubled its domestic money supply.

(Essay)

4.8/5  (30)

(30)

From the Civil War up to 1914, the United States adhered to a

(Multiple Choice)

4.9/5  (41)

(41)

Use a figure to show the effect of a sterilized central bank purchase of foreign assets under the imperfect asset substitutability assumption.

(Essay)

4.8/5  (34)

(34)

A balance sheet for the central bank of Pecunia is shown below:

Central Bank Balance Sheet

Assets Liabilities

Foreign assets $1,000 Deposits held by private banks $500

Domestic assets $1,500 Currency in circulation $2,000

Please write the new balance sheet if the bank makes a sterilized transaction by selling $100 of foreign assets for domestic currency and then purchasing $100 of domestic assets by writing a check on itself.

(Essay)

4.8/5  (34)

(34)

A balance of payments crises under fixed exchange rates occurs when

(Multiple Choice)

4.8/5  (28)

(28)

A central bank's international reserves consists of its holdings of

(Multiple Choice)

4.7/5  (40)

(40)

In the interest rate parity condition with imperfect substitutes and a risk premium of ρ

(Multiple Choice)

4.9/5  (45)

(45)

Which of the following is an example of a regional currency arrangement?

(Multiple Choice)

4.8/5  (33)

(33)

Which one of the following statements is the MOST accurate?

(Multiple Choice)

4.9/5  (38)

(38)

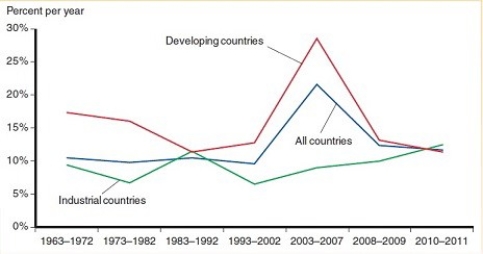

From the figure below, please provide an explanation for the large decline in the growth rate of international reserves held by developing countries in the 2008-2009 period.

(Essay)

4.8/5  (44)

(44)

Assume that initially, the risk premium, ρ = 0 and that the domestic and foreign interest rates are given by R = .06, R* = .05. Suppose that the risk premium depends linearly on the difference between domestic government debt, B, and domestic assets of the central bank, A, i.e.,

ρ =  Find the new domestic interest rate if a sterilized purchase of foreign assets adjusts A s.t.

(a) B - A = -.01/

Find the new domestic interest rate if a sterilized purchase of foreign assets adjusts A s.t.

(a) B - A = -.01/  (b) B - A = .01/

(b) B - A = .01/  (c) B - A = .03/

(c) B - A = .03/

(Essay)

4.9/5  (45)

(45)

This question concerns the mechanism of a reserve currency standard.

Two countries, X and Y, have two currencies, x and y, fixed to the reserve currency, the U.S. dollar. Suppose the exchange rate between x and the U.S. dollar is 3x per dollar. Suppose the exchange rate between y and the U.S. dollar is 5y per dollar. Explain (using numbers) the mechanism if the x-y exchange rate was 0.8 x per y.

(Essay)

4.8/5  (34)

(34)

Use a figure to explain the potential effectiveness of fiscal policy to spur on the economy under a fixed exchange rate.

(Essay)

4.9/5  (23)

(23)

Showing 21 - 40 of 80

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)