Exam 10: Decentralized Performance Evaluation

Exam 1: Introduction to Managerial Accounting131 Questions

Exam 2: Job-Order Costing132 Questions

Exam 3: Process Costing128 Questions

Exam 4: Activity-Based Cost Management125 Questions

Exam 5: Cost Behavior and Estimation127 Questions

Exam 6: Cost-Volume-Profit Analysis117 Questions

Exam 7: Incremental Analysis for Short-Term Decision Making125 Questions

Exam 8: Budgeting and Planning125 Questions

Exam 9: Standard Costing and Variances127 Questions

Exam 10: Decentralized Performance Evaluation120 Questions

Exam 11: Capital Budgeting111 Questions

Exam 12: Statement of Cash Flows208 Questions

Exam 13: Financial Statement Analysis145 Questions

Select questions type

Which of the following statements is not correct about using the balanced scorecard for sustainability accounting?

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following is not a method used to determine transfer prices?

(Multiple Choice)

4.9/5  (41)

(41)

The part of the organization for which managers are responsible is called a:

(Multiple Choice)

4.8/5  (43)

(43)

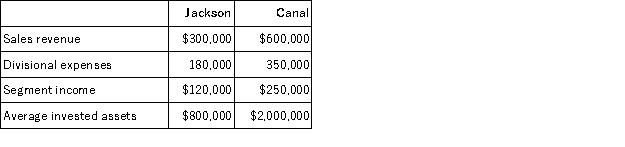

Ontario Company has two divisions with the following results:  Ontario Company has a hurdle rate of 10%.

a. Calculate the return on investment for each division.

b. Break each division's return on investment down into its component parts using the DuPont method.

c. Calculate the residual income for each division.

Ontario Company has a hurdle rate of 10%.

a. Calculate the return on investment for each division.

b. Break each division's return on investment down into its component parts using the DuPont method.

c. Calculate the residual income for each division.

(Essay)

4.8/5  (35)

(35)

Spice Company has two divisions, Parsley and Sage. Parsley produces a unit that Sage could use in its production. Sage currently is purchasing 50,000 units from an outside supplier for $50. Parsley is operating at less than its full capacity of 550,000 and has variable costs of $27 per unit. The full cost to manufacture the unit is $38. Parsley currently sells 450,000 units at a selling price of $54. If an internal transfer is made, variable shipping and administrative costs of $2 per unit could be avoided. What would be the impact on Spice Company's overall profits if the internal transfer were made?

(Multiple Choice)

4.9/5  (38)

(38)

Evergreen Corp. has two divisions, Fern and Bark. Fern produces a widget that Bark could use in the production of units that cost $175 in variable costs, plus the cost of the widget, to manufacture. Fern's variable costs are $60 per widget, and fixed manufacturing costs are applied at a rate of $36 per widget. Widgets sell on the open market for $105 each. Evergreen's policy is that internal transfers will be made at variable cost. If Bark purchases the widgets from Fern, what will be the transfer price?

(Multiple Choice)

4.7/5  (30)

(30)

Devon Inc. has a profit margin of 12% and an investment turnover of 2.5. Sales revenue is $600,000. What is the amount of average invested assets?

(Multiple Choice)

4.9/5  (46)

(46)

Avocado Company has an operating income of $80,000 on revenues of $1,000,000. Average invested assets are $500,000 and Avocado Company has an 8% cost of capital. What is the profit margin?

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following statement is correct about the functions that fall within various responsibility centers?

(Multiple Choice)

4.9/5  (44)

(44)

The responsibility center in which the manager does not have responsibility and authority over revenues is:

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is not an advantage of decentralization?

(Multiple Choice)

4.7/5  (36)

(36)

Almond, Inc. uses a balanced scorecard. One of the measures on the scorecard is the change in stock price. Which balanced scorecard perspective would this measure most likely fit into?

(Multiple Choice)

4.7/5  (38)

(38)

The Walnut Division of Benton Corp. has average invested assets of $22,500,000. Sales revenue of $27,000,000 results in an operating income of $2,379,500. The hurdle rate is 8%.

a. Calculate the return on investment.

b. Calculate the profit margin.

c. Calculate the investment turnover.

d. Calculate the residual income.

(Essay)

4.9/5  (40)

(40)

Superior Division of the Monroe Company has an opportunity to invest in a new project. The project will yield an incremental operating income of $73,350 on average invested assets of $900,000. Superior Division currently has operating income of $425,000 on average invested assets of $4,325,000. Monroe Company has a 7% hurdle rate for new projects.

a. What is Superior Division's ROI before making an investment in the project?

b. What is Superior Division's residual income before making an investment in the project?

c. What is Superior Division's ROI after making the investment in the project?

d. What is Superior Division's residual income after making the investment in the project?

(Essay)

4.8/5  (35)

(35)

The balanced scorecard includes both leading and lagging indicators. Which of the following correctly places each indicator on the spectrum of most leading to most lagging?

(Multiple Choice)

4.8/5  (32)

(32)

Return on investment is calculated as the return on the segment's assets divided by the value of those assets

(True/False)

4.8/5  (32)

(32)

Spring Corp. has two divisions, Daffodil and Tulip. Daffodil produces a gadget that Tulip could use in its production. Tulip currently purchases 100,000 gadgets for $12.50 on the open market. Daffodil's variable costs are $6 per widget while the full cost is $9.35. Daffodil sells gadgets for $13 each. If Daffodil is operating at capacity, what would be the minimum transfer price Daffodil would accept for an internal transfer?

(Multiple Choice)

4.8/5  (41)

(41)

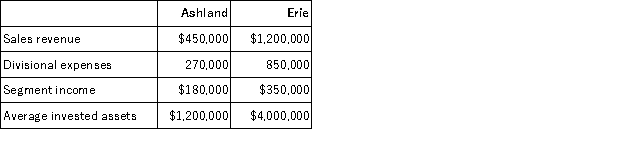

Warren Company has two divisions with the following results:  Warren Company has a hurdle rate of 12%.

a. Calculate the return on investment for each division.

b. Break each division's return on investment down into its component parts using the DuPont method.

c. Calculate the residual income for each division.

Warren Company has a hurdle rate of 12%.

a. Calculate the return on investment for each division.

b. Break each division's return on investment down into its component parts using the DuPont method.

c. Calculate the residual income for each division.

(Essay)

4.8/5  (44)

(44)

Showing 101 - 120 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)