Exam 7: Incremental Analysis for Short-Term Decision Making

Exam 1: Introduction to Managerial Accounting131 Questions

Exam 2: Job-Order Costing132 Questions

Exam 3: Process Costing128 Questions

Exam 4: Activity-Based Cost Management125 Questions

Exam 5: Cost Behavior and Estimation127 Questions

Exam 6: Cost-Volume-Profit Analysis117 Questions

Exam 7: Incremental Analysis for Short-Term Decision Making125 Questions

Exam 8: Budgeting and Planning125 Questions

Exam 9: Standard Costing and Variances127 Questions

Exam 10: Decentralized Performance Evaluation120 Questions

Exam 11: Capital Budgeting111 Questions

Exam 12: Statement of Cash Flows208 Questions

Exam 13: Financial Statement Analysis145 Questions

Select questions type

The decision-making approach that focuses on factors that will change between alternatives is sometimes called all of the following except:

(Multiple Choice)

4.7/5  (40)

(40)

Managerial decision makers must often consider non-economic factors as well. For example, when considering whether to eliminate a product line, managerial accountants with an emphasis on sustainability should consider the employee job loss implications as well. This represents sustainability within a:

(Multiple Choice)

4.7/5  (37)

(37)

The law firm of Regal and Porter is examining its client base to determine how profitable its regular clients are. Its analysis indicates that Hawthorne, Inc. paid $179,200 in fees last year, but cost the firm $208,600 ($168,000 in billable labor, supplies, and copying, and $40,600 in allocated common fixed costs). If Regal and Porter dropped Hawthorne, Inc. as a client, and all fixed costs are unavoidable, how would profit be affected?

(Multiple Choice)

4.9/5  (41)

(41)

A product should be processed further if no additional fixed costs are incurred in its processing

(True/False)

4.9/5  (44)

(44)

A relevant cost is one that will not change depending upon which alternative is selected

(True/False)

4.8/5  (40)

(40)

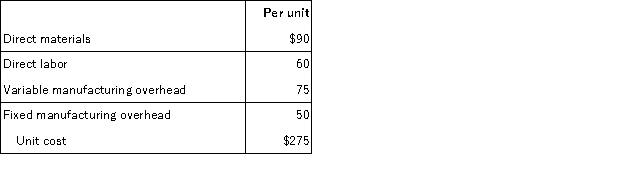

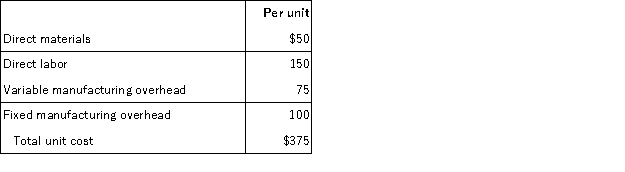

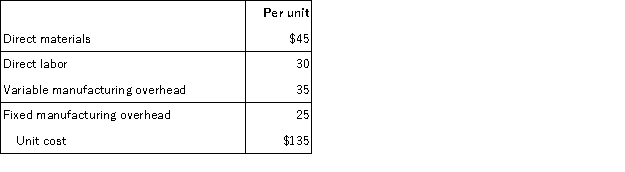

Mason has received a special order for 1,000 units of its product at a special price of $250. The product currently sells 18,000 units for $300 and has the following manufacturing costs:  Assume that Mason has sufficient capacity to fill the order without harming normal production and sales and all fixed overhead is unavoidable.

a. If Mason accepts the order, what effect will the order have on the company's short-term profit?

For the next two questions, now assume that Mason has sufficient capacity to fill 500 units of the order without harming normal sales.

b. If Mason accepts the order and fills it completely, what effect will the order have on the company's short-term profit?

c. If Mason accepts the special order, what average price should Mason charge to make a $20,000 incremental profit?

Assume that Mason has sufficient capacity to fill the order without harming normal production and sales and all fixed overhead is unavoidable.

a. If Mason accepts the order, what effect will the order have on the company's short-term profit?

For the next two questions, now assume that Mason has sufficient capacity to fill 500 units of the order without harming normal sales.

b. If Mason accepts the order and fills it completely, what effect will the order have on the company's short-term profit?

c. If Mason accepts the special order, what average price should Mason charge to make a $20,000 incremental profit?

(Essay)

4.8/5  (33)

(33)

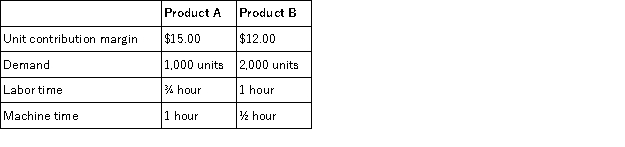

Spring, Inc. manufactures two products. It currently has 1,000 hours of direct labor and 2,000 hours of machine time available per month. The table below lists the contribution margin, labor and machine time requirements, and demand for each product.  How much of each product should Spring manufacture per month?

How much of each product should Spring manufacture per month?

(Multiple Choice)

4.9/5  (33)

(33)

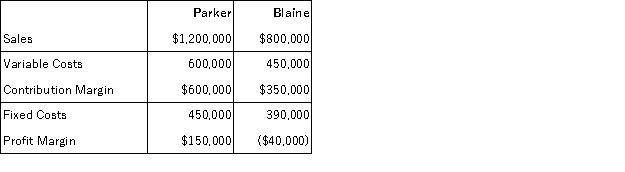

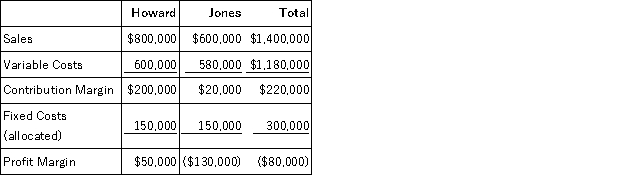

Hamilton, Inc. has two divisions, Parker and Blaine. Following is the income statement for the previous year:  Of the total fixed costs, $600,000 are common fixed costs that are allocated equally between the divisions. What would Hamilton's profit margin be if Blaine were dropped?

Of the total fixed costs, $600,000 are common fixed costs that are allocated equally between the divisions. What would Hamilton's profit margin be if Blaine were dropped?

(Multiple Choice)

4.8/5  (34)

(34)

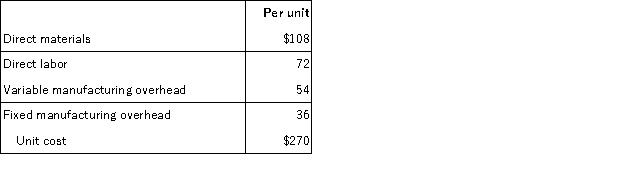

Walnut has received a special order for 2,000 units of its product at a special price of $270. The product normally sells for $360 and has the following manufacturing costs:  Walnut is currently operating at full capacity and cannot fill the order without harming normal production and sales. If Walnut accepts the order, what effect will the order have on the company's short-term profit?

Walnut is currently operating at full capacity and cannot fill the order without harming normal production and sales. If Walnut accepts the order, what effect will the order have on the company's short-term profit?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is not a true statement about capacity?

(Multiple Choice)

4.8/5  (29)

(29)

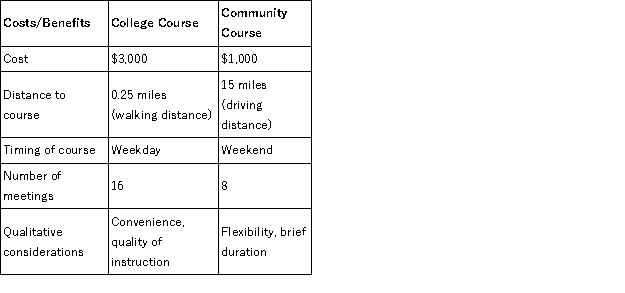

You wish to take an Excel course. You may enroll at one within your school or you may take a community class at the local library. You've gathered the following information to aid in your decision-making process.  Pretend transportation (gas, mileage, and parking) cost $200 per class session at the library. If you consider solely the cost - including transportation - of each alternative, which would you choose?

Pretend transportation (gas, mileage, and parking) cost $200 per class session at the library. If you consider solely the cost - including transportation - of each alternative, which would you choose?

(Multiple Choice)

5.0/5  (29)

(29)

Manor, Inc. currently manufactures 1,000 subcomponents per month in one of its factories. The unit costs to produce the subcomponents are:  Manor is considering purchasing the subcomponents from an outside supplier, who normally charges $300 per unit. The supplier also has an "Exclusive Buyer's Club" which costs $30,000 per month to join, but whose members can purchase the subcomponents for $250 per unit. Fixed overhead is not avoidable. If Manor chose to purchase the subcomponents using the cheaper of the two buying options, what would be the effect on profit?

Manor is considering purchasing the subcomponents from an outside supplier, who normally charges $300 per unit. The supplier also has an "Exclusive Buyer's Club" which costs $30,000 per month to join, but whose members can purchase the subcomponents for $250 per unit. Fixed overhead is not avoidable. If Manor chose to purchase the subcomponents using the cheaper of the two buying options, what would be the effect on profit?

(Multiple Choice)

4.9/5  (30)

(30)

If a company has idle capacity, it means it has reached the limit on its resources

(True/False)

4.7/5  (41)

(41)

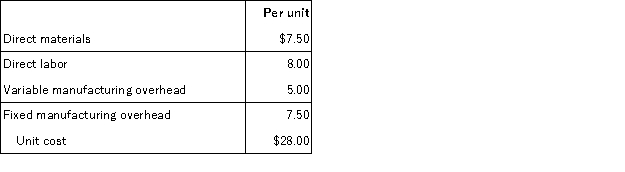

Edward currently manufactures a subcomponent that is used in its main product. A supplier has offered to supply all the subcomponents needed at a price of $22. Edward currently produces 100,000 subcomponents at the following manufacturing costs:  a. If Edward has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

b. If Edward has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier?

c. Now assume Edward would avoid $300,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

a. If Edward has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

b. If Edward has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier?

c. Now assume Edward would avoid $300,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

(Essay)

4.8/5  (38)

(38)

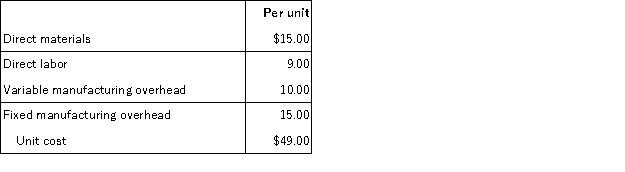

Archer currently manufactures a subcomponent that is used in its main product. A supplier has offered to supply all the subcomponents needed at a price of $42. Archer currently produces 100,000 subcomponents at the following manufacturing costs:  a. If Archer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

b. If Archer has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier?

c. Now assume Archer would avoid $150,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

a. If Archer has no alternative uses for the manufacturing capacity, what would be the profit impact of buying the subcomponents from the supplier?

b. If Archer has no alternative uses for the manufacturing capacity, what would be the maximum price per unit they would be willing to pay the supplier?

c. Now assume Archer would avoid $150,000 in equipment leases and salaries if the subcomponent were purchased from the supplier. Now what would be the profit impact of buying from the supplier?

(Essay)

4.8/5  (36)

(36)

Elmwood, Inc. currently sells 12,000 units of its product per year for $100 each. Variable costs total $75 per unit. Elmwood's manager believes that if a new machine is leased for $147,000 per year, modifications can be made to the product that will increase its retail value. These modifications will increase variable costs by $20 per unit, but Elmwood is hoping to sell the modified units for $130 each.

a. Should Elmwood modify the units or sell them as is? How much will the decision affect profit?

b. What is the least Elmwood could charge for the modified units to make it worthwhile to modify them?

c. The leasing company is willing to negotiate the price of the machine lease. What is the most Elmwood would be willing to pay to lease the machine if they plan to charge $130 for the modified units?

(Essay)

4.9/5  (40)

(40)

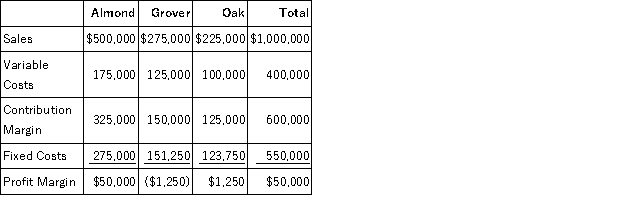

Valley Inc. has three divisions, Almond, Grover and Oak. Following is the income statement for the previous year:  Of the fixed costs, $300,000 is for corporate costs and is allocated equally to the three divisions.

a. How much does Grover Division have in direct fixed costs?

b. What is Grover Division's segment margin?

c. What would Valley's profit margin be if Grover Division were dropped?

Of the fixed costs, $300,000 is for corporate costs and is allocated equally to the three divisions.

a. How much does Grover Division have in direct fixed costs?

b. What is Grover Division's segment margin?

c. What would Valley's profit margin be if Grover Division were dropped?

(Essay)

4.8/5  (36)

(36)

Poppy has received a special order for 1,000 units of its product at a special price of $125. The product currently sells 18,000 units for $150 and has the following manufacturing costs:  Assume that Poppy has sufficient capacity to fill the order without harming normal production and sales and all fixed overhead is unavoidable.

a. If Poppy accepts the order, what effect will the order have on the company's short-term profit?

For the next two questions, now assume that Poppy has sufficient capacity to fill 500 units of the order without harming normal sales.

b. If Poppy accepts the order and fills it completely, what effect will the order have on the company's short-term profit?

c. If Poppy accepts the special order, what average price should Poppy charge to make a $10,000 incremental profit?

Assume that Poppy has sufficient capacity to fill the order without harming normal production and sales and all fixed overhead is unavoidable.

a. If Poppy accepts the order, what effect will the order have on the company's short-term profit?

For the next two questions, now assume that Poppy has sufficient capacity to fill 500 units of the order without harming normal sales.

b. If Poppy accepts the order and fills it completely, what effect will the order have on the company's short-term profit?

c. If Poppy accepts the special order, what average price should Poppy charge to make a $10,000 incremental profit?

(Essay)

4.9/5  (30)

(30)

Davenport Inc. has two divisions, Howard and Jones. Following is the income statement for the past month:  What would Davenport's profit margin be if the Jones division was dropped?

What would Davenport's profit margin be if the Jones division was dropped?

(Multiple Choice)

4.7/5  (33)

(33)

In deciding whether to eliminate a business segment, managers should consider which costs and benefits will change as a result of the decision

(True/False)

4.8/5  (41)

(41)

Showing 61 - 80 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)