Exam 10: Decentralized Performance Evaluation

Exam 1: Introduction to Managerial Accounting142 Questions

Exam 2: Job Order Costing132 Questions

Exam 3: Process Costing132 Questions

Exam 4: Activity-Based Costing and Cost Management132 Questions

Exam 5: Cost Behavior131 Questions

Exam 6: Cost-Volume-Profit Analysis123 Questions

Exam 7: Incremental Analysis for Short-Term Decision Making137 Questions

Exam 8: Budgetary Planning127 Questions

Exam 9: Standard Costing and Variance Analysis127 Questions

Exam 10: Decentralized Performance Evaluation126 Questions

Exam 11: Capital Budgeting126 Questions

Exam 12: Statement of Cash Flows203 Questions

Exam 13: Measuring and Evaluating Financial Performance141 Questions

Select questions type

Holiday Corp.has two divisions,Quail and Marlin.Quail produces a widget that Marlin could use in its production.Quail's variable costs are $4 per widget while the full cost is $7.Widgets sell on the open market for $12 each.If Quail has excess capacity,what would be the cost savings if the transfer were made and Marlin currently is purchasing 100,000 units on the open market?

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

C

Dade Corp.has residual income of $10,000.If operating income equals $30,000 and the minimum required rate of return is 8%,what are average invested assets?

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

C

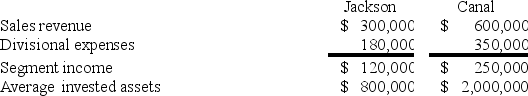

Ontario Company has two divisions with the following results:

Ontario Company has a hurdle rate of 10%.

a.Calculate the return on investment for each division.

b.Break each division's return on investment down into its component parts using the DuPont method.

c.Calculate the residual income for each division.

Ontario Company has a hurdle rate of 10%.

a.Calculate the return on investment for each division.

b.Break each division's return on investment down into its component parts using the DuPont method.

c.Calculate the residual income for each division.

(Essay)

4.8/5  (48)

(48)

Holiday Corp.has two divisions,Quail and Marlin.Quail produces a widget that Marlin could use in its production.Quail's variable costs are $4 per widget while the full cost is $7.Widgets sell on the open market for $12 each.If Quail has excess capacity,what would be the minimum transfer price if Marlin currently is purchasing 100,000 units on the open market?

(Multiple Choice)

4.9/5  (44)

(44)

One of the most important concepts in responsibility accounting is the:

(Multiple Choice)

4.9/5  (40)

(40)

Hubbard Division of the Market Company has an opportunity to invest in a new project.The project will yield an incremental operating income of $36,750 on average invested assets of $460,000.Hubbard currently has operating income of $210,000 on average invested assets of $2,050,000.Market Company requires a 6% rate of return on new projects.

a.What is Hubbard's ROI before making an investment in the project?

b.What is Hubbard's residual income before making an investment in the project?

c.What is Hubbard's ROI after making the investment in the project?

d.What is Hubbard's residual income after making the investment in the project?

(Essay)

4.8/5  (46)

(46)

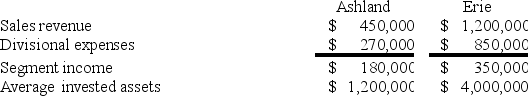

Warren Company has two divisions with the following results:

Warren Company has a hurdle rate of 12%.

a.Calculate the return on investment for each division.

b.Break each division's return on investment down into its component parts using the DuPont method.

c.Calculate the residual income for each division.

Warren Company has a hurdle rate of 12%.

a.Calculate the return on investment for each division.

b.Break each division's return on investment down into its component parts using the DuPont method.

c.Calculate the residual income for each division.

(Essay)

4.8/5  (32)

(32)

Spring Corp.has two divisions,Daffodil and Tulip.Daffodil produces a gadget that Tulip could use in its production.Tulip currently purchases 100,000 gadgets for $12.50 on the open market.Daffodil's variable costs are $6 per widget while the full cost is $9.35.Daffodil sells gadgets for $13 each.If Daffodil is operating at less than full capacity,what would be the maximum transfer price Tulip would pay internally?

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following statements is correct about the functions that fall within various responsibility centers?

(Multiple Choice)

4.9/5  (35)

(35)

A profit center manager often also supervises revenue and cost center managers.

(True/False)

4.8/5  (42)

(42)

Swan Company has two divisions,Hill and Paradise.Hill produces a unit that Paradise could use in its production.Paradise currently is purchasing 5,000 units from an outside supplier for $56.Hill is operating at less than full capacity and has variable costs of $30.80 per unit.The full cost to manufacture the unit is $43.40.Hill currently sells 450,000 units at a selling price of $61.60.How much profit will Hill receive from the transfer if a transfer price of $42 is agreed upon?

(Multiple Choice)

4.9/5  (37)

(37)

Florida Inc.has revenues of $1,500,000 resulting in an operating income of $105,000.Average invested assets total $750,000;the cost of capital is 10%.The profit margin is:

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following balanced scorecard perspectives measures an organization's ability to change?

(Multiple Choice)

4.8/5  (36)

(36)

Spring Corp.has two divisions,Daffodil and Tulip.Daffodil produces a gadget that Tulip could use in its production.Tulip currently purchases 100,000 gadgets for $12.50 on the open market.Daffodil's variable costs are $6 per widget while the full cost is $9.35.Daffodil sells gadgets for $13 each.If Daffodil is operating at capacity,what would be the maximum transfer price Tulip would pay internally?

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following balanced scorecard perspectives measures how an organization satisfies its stakeholders?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following is not something that should be compiled for each dimension of the balanced scorecard?

(Multiple Choice)

4.9/5  (40)

(40)

Killian Corp.has a residual income of $30,000 on invested assets of $450,000.If the hurdle rate is 10%,what is the operating income?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 1 - 20 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)