Exam 15: Modern Macroeconomics: From the Short Run to the Long Run

Exam 1: Introduction: What Is Economics144 Questions

Exam 2: The Key Principles of Economics195 Questions

Exam 3: Exchange and Markets135 Questions

Exam 4: Demand, Supply, and Market Equilibrium279 Questions

Exam 5: Measuring a Nations Production and Income161 Questions

Exam 6: Unemployment and Inflation206 Questions

Exam 7: The Economy at Full Employment165 Questions

Exam 8: Why Do Economies Grow203 Questions

Exam 9: Aggregate Demand and Aggregate Supply189 Questions

Exam 10: Fiscal Policy166 Questions

Exam 11: The Income-Expenditure Model265 Questions

Exam 12: Investment and Financial Markets179 Questions

Exam 13: Money and the Banking System184 Questions

Exam 14: The Federal Reserve and Monetary Policy203 Questions

Exam 15: Modern Macroeconomics: From the Short Run to the Long Run176 Questions

Exam 16: The Dynamics of Inflation and Unemployment186 Questions

Exam 17: Macroeconomic Policy Debates143 Questions

Exam 18: International Trade and Public Policy226 Questions

Exam 19: The World of International Finance189 Questions

Select questions type

According to Keynes, which of the following determines the level of employment in the economy?

(Multiple Choice)

4.8/5  (28)

(28)

In order to shorten a recession when the economy is producing below full employment, the monetary authority could:

(Multiple Choice)

4.9/5  (38)

(38)

The adjustment- process model used in this chapter, which highlights the speed at which the economy goes back to potential GDP, was first developed by:

(Multiple Choice)

4.7/5  (49)

(49)

Because the long- run aggregate supply curve is drawn as a vertical line, then we effectively assume that the level of production in the economy is determined solely by:

(Multiple Choice)

5.0/5  (37)

(37)

Recall Application 3, "Increasing Health-Care Expenditures and Crowding Out," to answer the following questions:

-According to the application, health- care expenditures as a proportion of GDP has risen from 1950- 2000 from:

(Multiple Choice)

4.9/5  (39)

(39)

Why do classical economists believe that the labor market always clears?

(Essay)

4.9/5  (33)

(33)

What type of fiscal policy will lead to crowding out in the long run?

(Essay)

4.8/5  (43)

(43)

Which of the following curves is drawn as a vertical line?

(Multiple Choice)

4.8/5  (42)

(42)

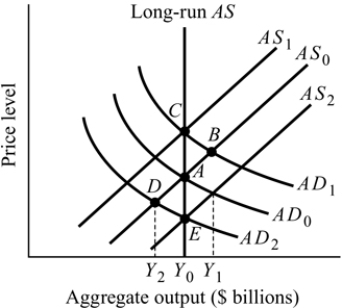

Figure 15.2

-Refer to Figure 15.2. For this economy to produce Y1 and sustain that level of output without inflation:

Figure 15.2

-Refer to Figure 15.2. For this economy to produce Y1 and sustain that level of output without inflation:

(Multiple Choice)

4.8/5  (38)

(38)

What causes investments to increase when the production in the economy is below full employment?

(Multiple Choice)

4.9/5  (37)

(37)

Assuming that the economy is in the long run equilibrium at full employment, changes in the money supply affect:

(Multiple Choice)

4.9/5  (38)

(38)

If crowding out occurs in the long run and the government increases spending for infrastructure projects such as roads and bridges, then the additional government spending:

(Multiple Choice)

4.8/5  (39)

(39)

If Say's Law holds true, then if households save more of their incomes,

(Multiple Choice)

4.8/5  (38)

(38)

Keynes believed that, without government intervention, the liquidity trap could prevent economies from recovering from a recession.

(True/False)

4.8/5  (33)

(33)

Suppose an economy is currently producing at a level above full employment. Explain what will likely happen to wages and prices.

(Essay)

4.8/5  (38)

(38)

AN UNFORTUNATE GAMBLE

What explained the decision by the Japanese government to increase taxes in the 1990s when the economy

was still suffering from a recession?

The Japanese government sharply increased taxes on consumption in 1997—just as Japan was in the midst of its prolonged

recession. Why did the government do this?

The reasons were clear. As the economy slumped, fiscal deficits were increasing, as taxes fell and government spending rose.

Policy makers understood that their society was aging rapidly and that this would mean even more demands on the public

sector in the near future. They became convinced that the current fiscal deficits plus the inevitable future demands on the

government would lead to long-run increases in government spending. To avoid crowding out of investment in the future,

they decided to tax consumption in order to reduce it. Their goal was to match the increases in government spending with

decreases in consumption spending and therefore not experience crowding out of investment.

Although policy makers were right to consider the long-run consequences of increases in government spending, they made

the unfortunate gamble that the short-run effects of the tax increase would not hinder the economy’s recovery. They were

wrong, because the tax increase prolonged the recession. Although it is important to consider the long-run consequences of

policy, it is important to understand the short-run consequences as well.

-According to the application, what was the reason why the Japanese government increased consumption taxes in the 1990s?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 141 - 160 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)