Exam 4: Time Value of Money

Exam 1: An Overview of Financial Management and the Financial Environment40 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes47 Questions

Exam 3: Analysis of Financial Statements53 Questions

Exam 4: Time Value of Money161 Questions

Exam 5: Bonds, Bond Valuation, and Interest Rates77 Questions

Exam 6: Risk and Return53 Questions

Exam 7: Corporate Valuation and Stock Valuation44 Questions

Exam 8: Financial Options and Applications in Corporate Finance25 Questions

Exam 9: The Cost of Capital87 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows52 Questions

Exam 11: Cash Flow Estimation and Risk Analysis56 Questions

Exam 12: Corporate Valuation and Financial Planning41 Questions

Exam 13: Corporate Governance51 Questions

Exam 15: Capital Structure Decisions66 Questions

Exam 16: Bond Refunding14 Questions

Exam 17: Supply Chains and Working Capital Management118 Questions

Exam 18: Multinational Financial Management49 Questions

Select questions type

At the end of 10 years, which of the following investments would have the highest future value? Assume that the effective annual rate for all investments is the same and is greater than zero.

(Multiple Choice)

4.8/5  (43)

(43)

How much would $1, growing at 3.5% per year, be worth after 75 years?

(Multiple Choice)

4.8/5  (41)

(41)

A "growing annuity" is a cash flow stream that grows at a constant rate for a specified number of periods.

(True/False)

4.9/5  (47)

(47)

What's the present value of $1,525 discounted back 5 years if the appropriate interest rate is 6%, compounded monthly?

(Multiple Choice)

4.7/5  (30)

(30)

If a bank compounds savings accounts quarterly, the effective annual rate will exceed the nominal rate.

(True/False)

4.9/5  (49)

(49)

Your aunt wants to retire and has $375,000.She expects to live for another 25 years and to earn 7.5% on her invested funds.How much could she withdraw at the end of each of the next 25 years and end up with zero in the account?

(Multiple Choice)

4.8/5  (35)

(35)

Your older brother turned 35 today, and he is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today.He will invest in a mutual fund that's expected to provide a return of 7.5% per year.He plans to retire 30 years from today, when he turns 65, and he expects to live for 25 years after retirement, to age 90.Under these assumptions, how much can he spend each year after he retires? His first withdrawal will be made at the end of his first retirement year.

(Multiple Choice)

4.7/5  (34)

(34)

Your bank account pays an 8% nominal rate of interest.The interest is compounded quarterly.Which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (39)

(39)

An uncle of yours who is about to retire wants to sell some of his stock and buy an annuity that will provide him with income of $50,000 per year for 30 years, beginning a year from today.The going rate on such annuities is 7.25%.How much would it cost him to buy such an annuity today?

(Multiple Choice)

4.9/5  (30)

(30)

You plan to borrow $35,000 at a 7.5% annual interest rate.The terms require you to amortize the loan with 7 equal end-of-year payments.How much interest would you be paying in Year 2?

(Multiple Choice)

4.9/5  (40)

(40)

The store where you bought new home furnishings offers you two alternative payment plans.The first plan requires a $4,000 immediate up-front payment.The second plan requires you to make monthly payments of $137.41, payable at the end of each month for 3 years.What nominal annual interest rate is built into the monthly payment plan?

(Multiple Choice)

4.7/5  (40)

(40)

Your cousin will sell you his coffee shop for $250,000, with "seller financing," at a 6.0% nominal annual rate.The terms of the loan would require you to make 12 equal end-of-month payments per year for 4 years, and then make an additional final (balloon) payment of $50,000 at the end of the last month.What would your equal monthly payments be?

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following statements regarding a 20-year (240-month) $225,000, fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs.)

(Multiple Choice)

4.8/5  (42)

(42)

Your bank offers to lend you $100,000 at an 8.5% annual interest rate to start your new business.The terms require you to amortize the loan with 10 equal end-of-year payments.How much interest would you be paying in Year 2?

(Multiple Choice)

4.9/5  (28)

(28)

As a result of compounding, the effective annual rate on a bank deposit (or a loan) is always equal to or greater than the nominal rate on the deposit (or loan).

(True/False)

4.8/5  (38)

(38)

Your Green Investment Tips subscription is about to expire.You plan to subscribe to the magazine for the rest of your life, and you can renew it by paying $85 annually, beginning immediately, or you can get a lifetime subscription for $850, also payable immediately.Assuming that you can earn 6.0% on your funds and that the annual renewal rate will remain constant, how many years must you live to make the lifetime subscription the better buy?

(Multiple Choice)

4.9/5  (40)

(40)

Midway through the life of an amortized loan, the percentage of the payment that represents interest must be equal to the percentage that represents repayment of principal.This is true regardless of the original life of the loan or the interest rate on the loan.

(True/False)

4.8/5  (33)

(33)

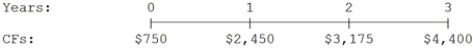

What is the present value of the following cash flow stream at a rate of 8.0%?

(Multiple Choice)

4.8/5  (28)

(28)

Your business has just taken out a 1-year installment loan for $72,500 at a nominal rate of 11.0% but with equal end-of-month payments.What percentage of the 2nd monthly payment will go toward the repayment of principal?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following statements regarding a 30-year monthly payment amortized mortgage with a nominal interest rate of 8% is CORRECT?

(Multiple Choice)

4.9/5  (47)

(47)

Showing 141 - 160 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)