Exam 6: Statements of Financial Position and Cash Flows and the Annual Report

Exam 1: The Financial Reporting Environment80 Questions

Exam 2: Financial Reporting Theory186 Questions

Exam 3: Judgment and Applied Financial Accounting Research144 Questions

Exam 4: Review of the Accounting Cycle187 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income145 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report177 Questions

Exam 7: Accounting and the Time Value of Money117 Questions

Exam 8: Revenue Recognition164 Questions

Exam 8: Extenssion: Ol Revenue Recognition Previous Standard110 Questions

Exam 9: Short-Term Operating Assets: Cash and Receivables134 Questions

Exam 10: Short-Term Operating Assets: Inventory135 Questions

Exam 11: Long-Term Operating Assets: Acquisition, Cost Allocation168 Questions

Exam 12: Long-Term Operating Assets: Departures From Historical Cost141 Questions

Exam 13: Operating Liabilities and Contingencies108 Questions

Exam 14: Financing Liabilities181 Questions

Exam 15: Accounting for Stockholders Equity125 Questions

Exam 16: Investing Assets179 Questions

Exam 17: Accounting for Income Taxes146 Questions

Exam 18: Accounting for Leases148 Questions

Exam 18: Extension: Ol Accounting for Leases Current Standard130 Questions

Exam 19: Accounting for Employee Compensation and Benefits137 Questions

Exam 21: Accounting Corrections and Error Analysis106 Questions

Exam 22: The Statement of Cash Flows134 Questions

Select questions type

Financial statements issued under IFRS require additional disclosures relating to executive compensation for related-party transactions.

(True/False)

4.9/5  (38)

(38)

If a subsequent event relates to a condition that existed at the balance sheet date, then the financial statements should be adjusted.

(True/False)

4.9/5  (44)

(44)

If an auditor's independence is impaired during an audit, an adverse opinion will be issued.

(True/False)

4.7/5  (39)

(39)

When preparing the operating activities section of the statement of cash flows under the indirect method, gains on sale of equipment are subtracted from net income.

(True/False)

4.8/5  (38)

(38)

Hackett Company's prepaid rent was $9,000 at December 31 Year 1 and $12,000 at December 31, Year 2. Hackett reported rent expense of $41,000 on its Year 2 income statement. What would be reported as cash paid for rent on the statement of cash flows?

(Multiple Choice)

4.8/5  (45)

(45)

In order to be a cash equivalent, an investment must have a maturity date of three months or less when purchased.

(True/False)

4.7/5  (37)

(37)

The statement of net income is the first financial statement prepared.

(True/False)

5.0/5  (34)

(34)

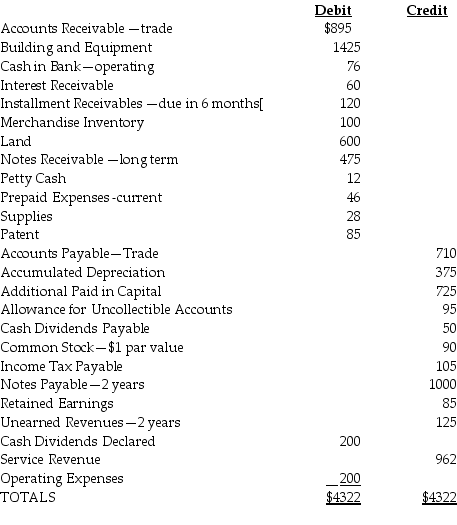

San Pedro Industries

Presented below are selected accounts from the adjusted trial balance ($ Millions) for San Pedro Industries for June 30 of the current year.

-Prepare a classified balance sheet using the account format for San Pedro Industries.

-Prepare a classified balance sheet using the account format for San Pedro Industries.

(Essay)

4.7/5  (31)

(31)

Matthews Company Presented below is selected financial information for Matthews Corporation for the most recent fiscal year ended December 31 ($ millions)

Current assets: Current liabilities: Cash and cash equivalents \ 2,462 Accounts payable \ 5,040 Short-term investment 1,406 Other current liabilities 2,707 Receivables, net 1,270 Total current liabilities 7,747 Merchandise inventories 5,184 Noncurrent liabilities 2,439 Other current assets 1,357 Shareholders' Equity 5,020 Total current assets 11,679 Total liabilities and shareholders' equity \ 15,206 Noncurrent assets 3,527 Total assets \ 15,206 Revenues \ 40,339 Costs and Expenses Operating Income 1,450 Other income/expense (including interest expense of \ 70) Income before income tax 1,407 Income tax expense Net income

Statement of Cash Flows (excerpt)

For the most recent fiscal year ended December 31

Interest paid $110

Previous Year's Financial Data Total Assets Shareholders' Equity The interest coverage ratio for Matthews Corporation is ________. (Round your answer to two decimal places, X.XX.)

(Multiple Choice)

4.8/5  (40)

(40)

Compare and contrast the presentation of assets under U.S. GAAP versus IFRS reporting.

(Essay)

4.9/5  (39)

(39)

Presented below are activities from Ford Enterprises, Inc.

Activity Purchase of buildings with cash Issuance of treasury stock Payments to vendors Sale of old equipment Sales to customers for cash Repayment of notes to bank Issuance of bonds payable Purchase of municipal bonds Receipt of interest on municipal bonds

Required: Please indicate whether each of these activities is classified as an (O)perating, (I)nvesting, or (F)inancing Activity on the statement of cash flows.

(Essay)

4.7/5  (34)

(34)

Which of the following is not a disclosure of a related-party transaction?

(Multiple Choice)

4.9/5  (44)

(44)

A subsequent event is a significant event that occurs after the date of the fiscal year-end, but before the financial statements are issued or available to be issued. Explain how these significant events are disclosed.

(Essay)

4.9/5  (36)

(36)

All of the following are required disclosures of the board members except ________.

(Multiple Choice)

4.9/5  (31)

(31)

Presented below are financial statements for Brownsville Industries:

Brownsville Industries Balance Sheet At June 30 Cash \ 26,000 Short-Term Investments 51,000 Accounts Receivable (net) 125,000 Merchandise Inventory 82,400 Property, Plant, and Equipment, net 325,000 Intangible Assets Total Assets Current Liabilities \ 97,500 11\% Bonds payable, long-term 200,000 Common Stock 10,000 Paid in Capital in excess of par 40,000 Retained Earnings Total Liabilities and Equity

Brownsville Industries Income Statement For the Year Ended June 30 Sales \ 750,000 Cost of Goods Sold 395,000 Gross Profit \ 355,000 Operating Expenses 155,400 Operating Income \ 199,600 Interest Expense Income before Income Taxes \ 177,600 Income Taxes Net Income \ 124,320

Prior year data Total Assets \ 525,000 Shareholders' Equity

Compute the following ratios

a. Current ratio

b. Debt to Equity Ratio

c. Interest Coverage Ratio(Assume interest expense equals interest paid.)

d. Return on Assets

e. Financial Leverage

f. Return on Equity

What do these ratios reveal about the financial condition of Brownsville Industries?

(Essay)

4.9/5  (28)

(28)

Which of the following is classified as an investing activity on a statement of cash flows?

(Multiple Choice)

4.8/5  (38)

(38)

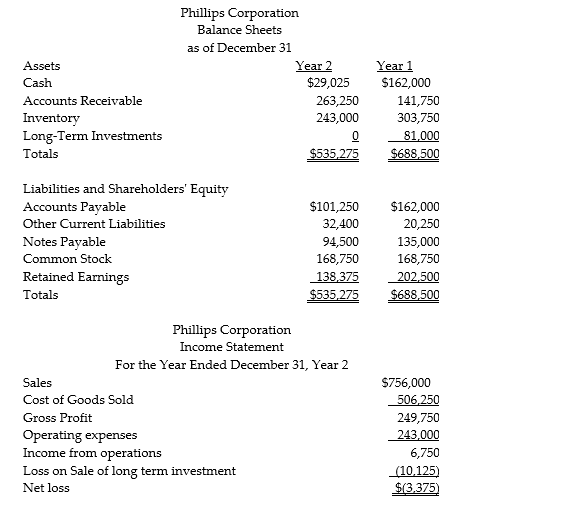

Presented below are the December 31 financial statements for Phillips Corporation (in $ Millions).

Cash dividends of $60,750 were paid to shareholders during Year 2.

Prepare a statement of cash flows using the direct method.

Cash dividends of $60,750 were paid to shareholders during Year 2.

Prepare a statement of cash flows using the direct method.

(Essay)

5.0/5  (40)

(40)

Teague Industries Presented below is selected financial data for Teague Industries for the current year:

Current assets: Current liabilities Cash and cash equivalents \ 3,583 Accounts payable \ 5,345 Short-term investments 1,635 Other current liabilities Receivables, net 1,881 Total current liabilities 8,277 Merchandise inventories 6,245 Noncurrent liabilities 5,176 Other current assets 1,965 Shareholders' Equity Total current assets 15,309 Total liabilities and shareholders' equity \ 19,663 Noncurrent assets 4,354 Total assets \ 19,663 Revenues \ 50,826 Costs and Expenses 45,963 Operating Income 4,863 Other income/expense (including interest expense of \ 50 ) (26) Income before income tax 4,837 Income taxexpense (1,449) Net income \ 3,388

Previous Years' Financial Data

Total Assets \ 17,220 Shareholders' Equity 3,970

The debt to equity ratio for Teague Industries is ________. (Round your answer to two decimal places, X.XX.)

(Multiple Choice)

4.8/5  (42)

(42)

Showing 141 - 160 of 177

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)