Exam 4: Review of the Accounting Cycle

Exam 1: The Financial Reporting Environment80 Questions

Exam 2: Financial Reporting Theory186 Questions

Exam 3: Judgment and Applied Financial Accounting Research144 Questions

Exam 4: Review of the Accounting Cycle187 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income145 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report177 Questions

Exam 7: Accounting and the Time Value of Money117 Questions

Exam 8: Revenue Recognition164 Questions

Exam 8: Extenssion: Ol Revenue Recognition Previous Standard110 Questions

Exam 9: Short-Term Operating Assets: Cash and Receivables134 Questions

Exam 10: Short-Term Operating Assets: Inventory135 Questions

Exam 11: Long-Term Operating Assets: Acquisition, Cost Allocation168 Questions

Exam 12: Long-Term Operating Assets: Departures From Historical Cost141 Questions

Exam 13: Operating Liabilities and Contingencies108 Questions

Exam 14: Financing Liabilities181 Questions

Exam 15: Accounting for Stockholders Equity125 Questions

Exam 16: Investing Assets179 Questions

Exam 17: Accounting for Income Taxes146 Questions

Exam 18: Accounting for Leases148 Questions

Exam 18: Extension: Ol Accounting for Leases Current Standard130 Questions

Exam 19: Accounting for Employee Compensation and Benefits137 Questions

Exam 21: Accounting Corrections and Error Analysis106 Questions

Exam 22: The Statement of Cash Flows134 Questions

Select questions type

True North Real Estate Management failed to adjust its Unearned Rent Revenue account for the $25,000 that had been earned during the current year. What effect does this omission have on the current year financial statements?

(Multiple Choice)

4.8/5  (38)

(38)

If a company initially records a deferred revenue as a liability, an adjusting entry must be made at the end of the period to increase the revenue account.

(True/False)

4.8/5  (40)

(40)

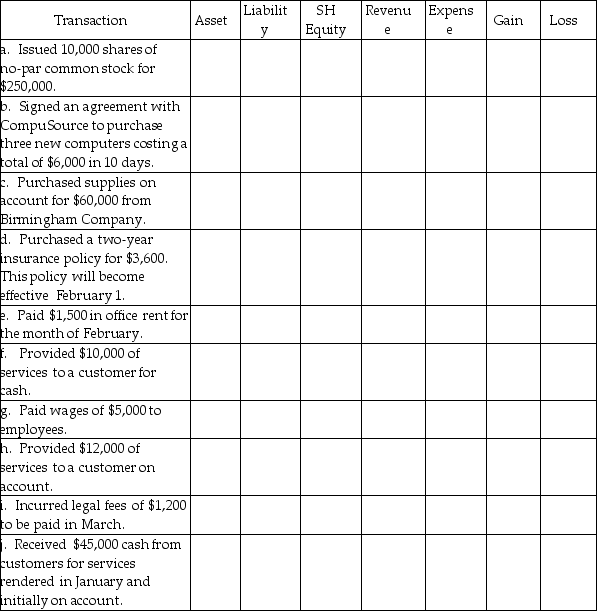

Murphy Corporation engaged in the following transactions during the month of February. Please analyze these transactions and indicate whether they cause an increase (+) or decrease (-) in the balance sheet and income statement accounts.

(Essay)

4.7/5  (39)

(39)

If an unearned revenue is initially recorded as a liability, the end-of-period adjusting entry records the earned portion.

(True/False)

4.8/5  (45)

(45)

If a company does not adjust a prepaid expense initially recorded as an asset, expenses will be overstated.

(True/False)

4.8/5  (36)

(36)

The accounting equation may be stated as Assets = Liabilities + Shareholders' Equity.

(True/False)

4.9/5  (46)

(46)

Douglas Corporation paid $6,000 for monthly rental on its warehouse. This transaction ________.

(Multiple Choice)

4.7/5  (35)

(35)

Mobile Corporation had the following transactions for the month of January. Record these transactions along with explanations. If no entry is required, state "No Entry."

a. Issued 10,000 shares of no-par common stock for $250,000.

b. Signed an agreement with CompuSource to purchase three new computers costing a total of $6,000 in 10 days. Computers will be used by employees of Mobile.

c. Purchased office furniture for $70,000 on account from Birmingham Company.

d. Purchased a two-year insurance policy for $3,600. Paid cash. This policy will become effective February 1.

e. Paid $1,500 in office rent for the month of January.

f. Accepted delivery of the new computers and paid cash.

g. Paid wages of $5,000 to employees.

h. Provided services on account for $80,000.

i. Paid $50,000 to Birmingham Company on account.

j. Received payment in full from customers in part (h).

k. Paid an electricity bill for $325.

(Essay)

4.8/5  (35)

(35)

Edmond Office Equipment borrowed $70,000 at a 5% annual interest rate on July 1. Principal and interest are due on December 31. The company's fiscal year ends on October 31. What adjusting entry should be made on that date? (Do not round intermediary calculations. Only round your final answer to the nearest dollar.)

(Multiple Choice)

4.7/5  (48)

(48)

Deferrals occur when a company receives or pays cash before recognizing the revenue or expense in the financial statements.

(True/False)

4.9/5  (38)

(38)

Jones Company sold merchandise on account for $70,000. This merchandise cost $52,000. The company uses the perpetual method of accounting for inventory. What would be the correct journal entry or entries to record the transaction?

(Multiple Choice)

4.9/5  (36)

(36)

Step 4 in completing the worksheet is to place the adjusted trial balance amounts in the ________ columns.

(Multiple Choice)

4.9/5  (40)

(40)

The issuance of common stock for cash would be recorded by a ________.

(Multiple Choice)

4.8/5  (32)

(32)

The statement of cash flows is prepared after all other financial statements have been prepared.

(True/False)

4.8/5  (37)

(37)

Accruals occur when a company receives or pays cash before recognizing the revenue or expense in the financial statements.

(True/False)

4.9/5  (33)

(33)

St. Augustine Properties collected advance rentals of $350,000 from its customers during the year. The balance in the unearned rent revenue account increased from $20,000 on January 1 to $35,000 on December 31. Rents earned during the year totaled ________.

(Multiple Choice)

4.8/5  (37)

(37)

On January 1, the Thunderball Hockey Association sold 1,000 season passes for $110 each. The season lasts from February through May. If the amount received was credited to unearned ticket revenue, what adjusting entry will be made on February 28?

(Multiple Choice)

4.9/5  (40)

(40)

Balance sheet accounts are the first accounts to be listed on the unadjusted trial balance.

(True/False)

4.8/5  (34)

(34)

Nature's Way used and paid for the services of its employees. As a result, it will ________.

(Multiple Choice)

4.8/5  (33)

(33)

Showing 81 - 100 of 187

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)