Exam 10: Protecting Your Property

Exam 1: Understanding the Financial Planning Process143 Questions

Exam 2: Using Financial Statements and Budgets184 Questions

Exam 3: Preparing Your Taxes201 Questions

Exam 4: Managing Your Cash and Savings193 Questions

Exam 5: Making Automobile and Housing Decisions222 Questions

Exam 6: Using Credit180 Questions

Exam 7: Using Consumer Loans161 Questions

Exam 8: Insuring Your Life157 Questions

Exam 9: Insuring Your Health165 Questions

Exam 10: Protecting Your Property195 Questions

Exam 11: Investment Planning196 Questions

Exam 12: Investing in Stocks and Bonds195 Questions

Exam 13: Investing in Mutual Funds174 Questions

Exam 14: Planning for Retirement226 Questions

Exam 15: Preserving Your Estate178 Questions

Select questions type

A homeowner's policy does not provide protection for the personal property of

(Multiple Choice)

4.8/5  (36)

(36)

The asset most likely to be specifically itemized in a property insurance endorsement is

(Multiple Choice)

4.9/5  (41)

(41)

Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.1779:1779

-A mobile home is [less | more] likely to suffer a complete loss than a conventional house.

(Short Answer)

4.9/5  (45)

(45)

The personal liability umbrella policy typically includes coverage for liability losses that are in excess of the limits purchased in the comprehensive personal liability coverage provided in the homeowners' policy.

(True/False)

4.9/5  (35)

(35)

Property insurance is meant to protect property owners from two basic types of exposures,physical loss of property and loss through depreciation.

(True/False)

4.9/5  (29)

(29)

Homeowner's property insurance does not provide protection on the

(Multiple Choice)

4.9/5  (39)

(39)

Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.1779:1779

-A renters' policy typically [does | does not] provide protection against liability claims.

(Short Answer)

4.8/5  (33)

(33)

George and Nancy had a $30,000 repair bill on their home after the tornado went through town.Their policy contained the usual 80% co-insurance clause.Their home's replacement value was $150,000;their policy coverage was $110,000 with a $250 deductible.

a.How much insurance should they have carried to meet the coinsurance obligation?

b.What percentage of this loss will the insurance company pay?

c.How much of the loss will George and Nancy have to absorb? (Show all work.)

(Essay)

4.7/5  (44)

(44)

The most common definition of actual cash value is purchase price less depreciation.

(True/False)

4.7/5  (46)

(46)

Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.1779:1779

-Your $10,000 stamp collection would be best protected under [your HO policy | a personal property floater].

(Short Answer)

4.8/5  (35)

(35)

Your car is damaged by fire while parked in your garage.Protection would be provided by

(Multiple Choice)

4.8/5  (36)

(36)

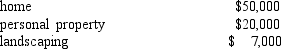

Carl and Alexandra purchased a $200,000 homeowners policy for their house in 1988.They have renewed the policy each year since and have replacement coverage.This policy has a $1,000 deductible.Their home now has a replacement value of $275,000.Last week they came home to find a small fire which caused the following damages:  Assume Carl and Alexandra have a standard HO-3 policy with personal property covered at 50% and landscaping covered for 10%.How much will the insurance pay for the losses of their personal property and landscaping?

Assume Carl and Alexandra have a standard HO-3 policy with personal property covered at 50% and landscaping covered for 10%.How much will the insurance pay for the losses of their personal property and landscaping?

(Multiple Choice)

4.9/5  (41)

(41)

The type of car you drive has little effect on your auto insurance premiums.

(True/False)

4.8/5  (41)

(41)

To save premium costs,one should decrease her deductible and liability coverage on a homeowners' policy.

(True/False)

4.7/5  (42)

(42)

Section I of a homeowner's insurance policy covers the insured's dwelling unit,accompanying structures,and personal liaiblity.

(True/False)

4.8/5  (29)

(29)

The right of ____ gives the insurer the right to recover its costs from the at-fault party after the company has paid a claim to its insured.

(Multiple Choice)

4.9/5  (36)

(36)

Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.1779:1779

-If your furniture in your rented apartment is destroyed by a fire,it [would | would not] be covered by your landlord's policy.

(Short Answer)

4.9/5  (35)

(35)

Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.1779:1779

-Bill was the at-fault party when you and he collided.Your insurance company has paid for the damages to your car.Now,it intends to recover this money from Bill.This is the right of [subrogation | indemnification].

(Short Answer)

4.7/5  (40)

(40)

HO coinsurance requires the insured to carry insurance protection equal to the market value of the house.

(True/False)

4.9/5  (36)

(36)

Showing 161 - 180 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)