Exam 12: State and Local Taxes

Exam 1: Business Income, Deductions, and Accounting Methods99 Questions

Exam 2: Property Acquisition and Cost Recovery107 Questions

Exam 3: Property Dispositions110 Questions

Exam 4: Entities Overview80 Questions

Exam 5: Corporate Operations106 Questions

Exam 6: Accounting for Income Taxes100 Questions

Exam 7: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 8: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 9: Forming and Operating Partnerships106 Questions

Exam 10: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 11: S Corporations134 Questions

Exam 12: State and Local Taxes117 Questions

Exam 13: The Us Taxation of Multinational Transactions89 Questions

Exam 14: Transfer Taxes and Wealth Planning123 Questions

Select questions type

Which of the following is not one of the Complete Auto Transit's criteria for whether a state can tax nondomiciliary companies?

(Multiple Choice)

4.9/5  (40)

(40)

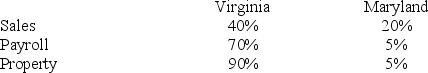

Tennis Pro has the following sales, payroll, and property factors:

What would Tennis Pro's Virginia and Maryland apportionment factors be if Virginia used a double-weighted sales four-factor method and Maryland used a single-factor sales formula?

What would Tennis Pro's Virginia and Maryland apportionment factors be if Virginia used a double-weighted sales four-factor method and Maryland used a single-factor sales formula?

(Essay)

5.0/5  (37)

(37)

The annual value of rented property is not included in the property factor.

(True/False)

4.8/5  (34)

(34)

Which of the following law types is not a primary authority source?

(Multiple Choice)

4.8/5  (40)

(40)

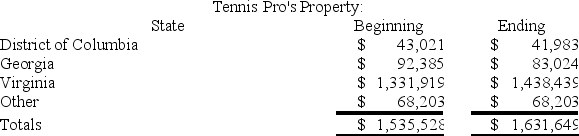

Gordon operates the Tennis Pro Shop in Blacksburg, Virginia. Tennis Pro has property as follows:

What is Tennis Pro's Virginia property numerator and property factor? (Round the property factor to two places.)

What is Tennis Pro's Virginia property numerator and property factor? (Round the property factor to two places.)

(Essay)

4.7/5  (32)

(32)

Many states are either starting to or are in the process of expanding the types of services subject to sales tax.

(True/False)

4.9/5  (38)

(38)

Which of the following is not a general rule for allocating nonbusiness income?

(Multiple Choice)

4.9/5  (38)

(38)

Public Law 86-272 protects solicitation from income taxation. Which of the following activities exceeds the solicitation threshold?

(Multiple Choice)

4.9/5  (37)

(37)

Gordon operates the Tennis Pro Shop in Blacksburg, Virginia. The shop sells, manufactures, and customizes tennis racquets for serious amateurs. Virginia has a 5 percent sales tax. Tennessee has a 4 percent sales tax. Determine the sales and use tax liability that the shop must collect and remit if it sells a $500 racquet to a Tennessee resident that purchases the merchandise in the Virginia retail store?

(Short Answer)

4.8/5  (39)

(39)

Which of the following is incorrect regarding nondomiciliary businesses?

(Multiple Choice)

4.8/5  (37)

(37)

Businesses engaged in interstate commerce are subject to income tax in every state in which they operate.

(True/False)

4.9/5  (43)

(43)

What was the Supreme Court's holding in National Bellas Hess?

(Multiple Choice)

4.8/5  (40)

(40)

List the steps necessary to determine an interstate business's state income tax liability.

(Essay)

4.8/5  (35)

(35)

In which of the following state cases did the state not assert economic income tax nexus?

(Multiple Choice)

4.9/5  (47)

(47)

Tennis Pro is headquartered in Virginia. Assume it has a Kentucky state income tax base of $220,000. Of this amount, $40,000 was nonbusiness income. Assume that Tennis Pro's Kentucky sales, payroll, and property apportionment factor are 12, 5, and 3 percent, respectively. Assume that Kentucky uses a single-factor sales formula apportionment method. The nonbusiness income allocated to Kentucky was $1,000. Assuming Kentucky's corporate tax rate is 6 percent, what is Tennis Pro's Kentucky state income tax liability?

(Essay)

4.8/5  (31)

(31)

Gordon operates the Tennis Pro Shop in Blacksburg, Virginia. The shop sells, manufactures, and customizes tennis racquets for serious amateurs. Virginia has a 5 percent sales tax. Arizona has a 6 percent sales tax, but Arizona sales thresholds don't exceed the Wayfair limits. Determine the sales tax liability that the shop must collect and remit if it sells a $1,000 racquet order to an Arizona customer (assume the shop has no sales personnel or property in Arizona) that purchases the merchandise from the Virginia store over the internet?

(Essay)

4.9/5  (45)

(45)

A state's apportionment formula usually is applied using some variation of sales, payroll, and property factors.

(True/False)

4.8/5  (34)

(34)

Tennis Pro is headquartered in Virginia. Assume it has a state income tax base of $200,000. Of this amount, $60,000 was nonbusiness income. Assume that Tennis Pro's Virginia apportionment factor is 73.28 percent. The nonbusiness income allocated to Virginia was $23,000. Assuming a Virginia corporate tax rate of 5.5 percent, what is Tennis Pro's Virginia state income tax liability? (Round your answer to the nearest whole number.)

(Essay)

4.7/5  (38)

(38)

Showing 41 - 60 of 117

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)