Exam 2: Property Acquisition and Cost Recovery

Exam 1: Business Income, Deductions, and Accounting Methods99 Questions

Exam 2: Property Acquisition and Cost Recovery107 Questions

Exam 3: Property Dispositions110 Questions

Exam 4: Entities Overview80 Questions

Exam 5: Corporate Operations106 Questions

Exam 6: Accounting for Income Taxes100 Questions

Exam 7: Corporate Taxation: Nonliquidating Distributions100 Questions

Exam 8: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 9: Forming and Operating Partnerships106 Questions

Exam 10: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 11: S Corporations134 Questions

Exam 12: State and Local Taxes117 Questions

Exam 13: The Us Taxation of Multinational Transactions89 Questions

Exam 14: Transfer Taxes and Wealth Planning123 Questions

Select questions type

Jaussi purchased a computer several years ago for $2,200 and used it for personal purposes. On November 10th of the current year, when the fair market value of the computer was $800, Jaussi converted it to business use. What is Jaussi's tax basis for the computer?

(Essay)

4.8/5  (37)

(37)

Depreciation is currently computed under the Modified Accelerated Cost Recovery System (MACRS).

(True/False)

4.7/5  (37)

(37)

Which of the following is not usually included in an asset's tax basis?

(Multiple Choice)

4.9/5  (35)

(35)

Depletion is the method taxpayers use to recover their capital investment in natural resources.

(True/False)

4.9/5  (30)

(30)

Deirdre's business purchased two assets during the current year (a full 12-month tax year). On January 20 Deirdre placed in service computer equipment (five-year property) with a basis of $15,000 and on September 1 placed in service machinery (seven-year property) with a basis of $15,000. Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation). (Use MACRS Half-Year Convention Table.) (Round final answer to the nearest whole number.)

(Multiple Choice)

4.8/5  (39)

(39)

Littman LLC placed in service on July 29, 2019, machinery and equipment (seven-year property) with a basis of $600,000. Littman's income for the current year before any depreciation deduction was $100,000. Which of the following statements is true to maximize Littman's total depreciation deduction for 2019? (Use MACRS Table 1.)

(Multiple Choice)

4.8/5  (32)

(32)

Daschle LLC completed some research and development during June of the current year. The related costs were $60,000. If Daschle wants to capitalize and amortize the costs as quickly as possible, what is the total amortization amount Daschle may deduct during the current year?

(Multiple Choice)

4.8/5  (39)

(39)

Poplock LLC purchased a warehouse and land during the current year for $350,000. The purchase price was allocated as follows: $275,000 to the building and $75,000 to the land. The property was placed in service on August 12. Calculate Poplock's maximum depreciation for this first year. (Use MACRS Table 5.) (Round final answer to the nearest whole number.)

(Multiple Choice)

4.8/5  (42)

(42)

Bonnie Jo used two assets during the current year. The first was computer equipment with an original basis of $15,000, currently in the second year of depreciation and depreciated under the half-year convention. This asset was disposed of on October 1st of the current year. The second was furniture with an original basis of $24,000, placed in service during the first quarter, currently in the fourth year of depreciation, and depreciated under the mid-quarter convention. What is Bonnie Jo's depreciation deduction for the current year? (Round final answer to the nearest whole number.) (Use MACRS Table 1 and Table 2.)

(Essay)

4.8/5  (34)

(34)

Which of the following assets is eligible for §179 expensing?

(Multiple Choice)

4.8/5  (37)

(37)

Tasha LLC purchased furniture (seven-year property) on April 20 for $20,000 and used the half-year convention to depreciate it. Tasha did not take §179 or bonus depreciation in the year it acquired the furniture. During the current year, which is the fourth year Tasha LLC owned the property, the property was disposed of on December 15. Calculate the maximum depreciation expense. (Use MACRS Table 2 and Exhibit 10-6.) (Round final answer to the nearest whole number.)

(Multiple Choice)

4.9/5  (33)

(33)

Kristine sold two assets on March 20th of the current year. The first was machinery with an original basis of $51,000, currently in the fourth year of depreciation, and depreciated under the half-year convention. The second was furniture with an original basis of $16,000, placed in service during the fourth quarter, currently in the third year of depreciation, and depreciated under the mid-quarter convention. What is Kristine's depreciation deduction for the current year if the depreciation recovery period is seven years? (Use MACRS Table 1 and Table 2 and Exhibit 10-6.) (Round final answer to the nearest whole number.)

(Essay)

4.7/5  (35)

(35)

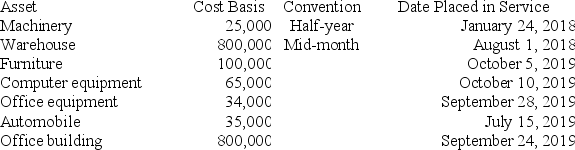

Boxer LLC has acquired various types of assets recently used 100 percent in its trade or business. Below is a list of assets acquired during 2018 and 2019:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2018, but would like to take advantage of the §179 expense and bonus depreciation for 2019 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2019. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10. ) (Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2018, but would like to take advantage of the §179 expense and bonus depreciation for 2019 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2019. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10. ) (Round final answer to the nearest whole number.)

(Essay)

4.8/5  (31)

(31)

In general, a taxpayer should select longer-lived property for the §179 immediate expensing election.

(True/False)

4.8/5  (32)

(32)

Arlington LLC purchased an automobile for $55,000 on July 5, 2019. What is Arlington's depreciation deduction for 2019 if its business-use percentage is 75 percent? (Ignore any possible bonus depreciation.) (Use Exhibit 10-10.)

(Multiple Choice)

4.8/5  (40)

(40)

All assets subject to amortization have the same recovery period.

(True/False)

4.8/5  (39)

(39)

The MACRS recovery period for automobiles and computers is:

(Multiple Choice)

4.9/5  (37)

(37)

Tom Tom LLC purchased a rental house and land during the current year for $150,000. The purchase price was allocated as follows: $100,000 to the building and $50,000 to the land. The property was placed in service on May 22. Calculate Tom Tom's maximum depreciation for this first year. (Use MACRS Table 3.)

(Multiple Choice)

4.8/5  (38)

(38)

Businesses deduct percentage depletion when they sell the natural resource and they deduct cost depletion in the year they produce or extract the natural resource.

(True/False)

4.9/5  (38)

(38)

Showing 81 - 100 of 107

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)