Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources

Exam 1: Financial Statements and Business Decisions126 Questions

Exam 2: Investing and Financing Decisions and the Accounting System103 Questions

Exam 3: Operating Decisions and the Accounting System109 Questions

Exam 4: Adjustments, Financial Statements, and the Quality of Earnings133 Questions

Exam 5: Communicating and Interpreting Accounting Information107 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash134 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory162 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources150 Questions

Exam 9: Reporting and Interpreting Liabilities157 Questions

Exam 10: Reporting and Interpreting Bond Securities112 Questions

Exam 11: Reporting and Interpreting Stockholders Equity156 Questions

Exam 12: Statement of Cash Flows138 Questions

Exam 13: Analyzing Financial Statements126 Questions

Exam 14: Reporting and Interpreting Investments in Other Corporations100 Questions

Select questions type

In periods of falling prices, FIFO will result in the same ending inventory valuation as the average cost formula.

(True/False)

4.9/5  (44)

(44)

An error that understates the ending inventory will cause the cost of goods sold for the period to be understated.

(True/False)

4.8/5  (39)

(39)

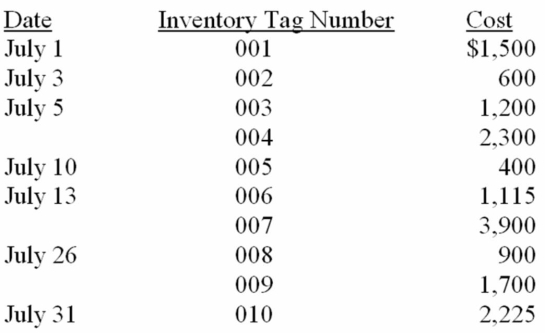

Dittner Inc. opened for business on July 1, 2013 selling unique jewellery purchased from local artisans. During the month the company made the following purchases:

On July 31, only inventory items 006, 008, and 010 remained in inventory. Requirements:

(a) Determine the cost of goods sold for Harris Inc. for the month of July using the specific identification cost determination method.

(b) Discuss whether or not specific identification is an appropriate cost determination method for this company.

On July 31, only inventory items 006, 008, and 010 remained in inventory. Requirements:

(a) Determine the cost of goods sold for Harris Inc. for the month of July using the specific identification cost determination method.

(b) Discuss whether or not specific identification is an appropriate cost determination method for this company.

(Essay)

4.8/5  (48)

(48)

The following information was taken from the 20B income statement of Milburn Company: Pretax profit, $12,000; Total operating expenses (not including income taxes), $20,000; Sales revenue, $120,000; Beginning inventory, $8,000; and Purchases,

$90,000. Compute the amount of the ending inventory.

(Multiple Choice)

4.9/5  (31)

(31)

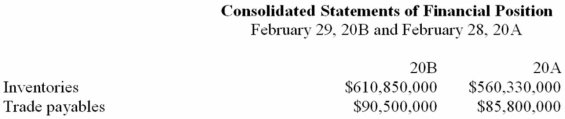

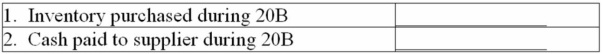

All Sports Inc. manufactures sporting equipment and clothing. Its recent annual report included the following on its statement of financial position:

In addition to the above statement of financial position information, All Sports Inc. reported cost of goods sold on its income statement of $53,800,000,000. Calculate the following:

In addition to the above statement of financial position information, All Sports Inc. reported cost of goods sold on its income statement of $53,800,000,000. Calculate the following:

(Essay)

4.8/5  (32)

(32)

A company that has decreased its inventory between years will cause a decrease in cash flow from operations.

(True/False)

4.8/5  (37)

(37)

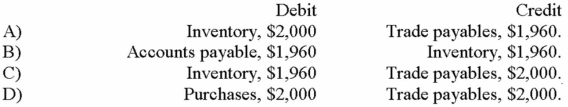

If merchandise for resale is purchased for $2,000, terms 2/10, n/30, the entry to record the purchase should be which of the following (assuming a periodic inventory system and the gross method)?

(Multiple Choice)

4.8/5  (39)

(39)

Richmond Company had the following information taken from its 20A adjusted trial balance: Sales, $200,000; Sales Discounts, $4,000; Beginning Inventory, $10,000; and Purchases, $140,000. A physical count of the merchandise on hand at the end of the year showed $20,000. Compute the gross margin (gross profit) that would appear in the statement of earnings.

(Multiple Choice)

4.7/5  (40)

(40)

An error in the ending inventory of the current period will have a similar but inverse effect on profit of the next accounting period.

(True/False)

4.8/5  (34)

(34)

A company recorded net purchases of $20.3 billion for 20B. In 20A, ending trade payables was $1.2 billion and in 20B, it was $1.6 billion. How much cash was paid to suppliers in 20B?

(Multiple Choice)

4.7/5  (39)

(39)

Showing 141 - 150 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)