Exam 3: Operating Decisions and the Accounting System

Exam 1: Financial Statements and Business Decisions126 Questions

Exam 2: Investing and Financing Decisions and the Accounting System103 Questions

Exam 3: Operating Decisions and the Accounting System109 Questions

Exam 4: Adjustments, Financial Statements, and the Quality of Earnings133 Questions

Exam 5: Communicating and Interpreting Accounting Information107 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash134 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory162 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Intangibles; and Natural Resources150 Questions

Exam 9: Reporting and Interpreting Liabilities157 Questions

Exam 10: Reporting and Interpreting Bond Securities112 Questions

Exam 11: Reporting and Interpreting Stockholders Equity156 Questions

Exam 12: Statement of Cash Flows138 Questions

Exam 13: Analyzing Financial Statements126 Questions

Exam 14: Reporting and Interpreting Investments in Other Corporations100 Questions

Select questions type

For each item below, indicate whether the account will be debited or credited:

1. Decrease in Accounts Payable

2. Increase in Dividends

3. Increase in Common Shares

4. Increase in Unearned Revenue

5. Decrease in Interest Payable

6. Increase in Prepaid Insurance

7. Decrease in Wages Expense

8. Decrease in Supplies

9. Increase in Revenues

10. Decrease in Accounts Receivable

(Essay)

4.7/5  (38)

(38)

Revenue recognition most commonly occurs at the point of delivery of goods or services to the customer.

(True/False)

4.8/5  (36)

(36)

A high total asset turnover signifies efficient management of assets; a low asset turnover ratio signifies less efficient management.

(True/False)

4.8/5  (29)

(29)

Revenues are decreases in assets or settlements of liabilities from ongoing operations.

(True/False)

4.9/5  (27)

(27)

Expenses incurred, but not yet paid, create a receivable (i.e., an asset) until payment occurs.

(True/False)

4.9/5  (31)

(31)

Operating cash inflows and outflows are primarily connected to which of the following?

(Multiple Choice)

4.8/5  (38)

(38)

The division of business activities into a series of equal periods for accounting purposes is known as the periodicity assumption.

(True/False)

4.9/5  (44)

(44)

A company receives a $25,000 cash deposit from a customer on March 15 but will not deliver the goods until April 20. Which of the following statements is false?

(Multiple Choice)

4.8/5  (32)

(32)

Which one of the following represents the expanded basic accounting equation?

(Multiple Choice)

4.9/5  (36)

(36)

Explain why the profit reported on the statement of earnings is usually not equal to net cash flows from operating activities on the statement of cash flows.

(Essay)

4.9/5  (42)

(42)

Income tax expense will appear on the statement of financial position.

(True/False)

4.8/5  (35)

(35)

Revenue is always recognized when which of the following occurs?

(Multiple Choice)

4.9/5  (40)

(40)

What would be the effect on December's statement of earnings of a utility bill received on December 27, 2013 but which will not be paid until January 10, 2014?

(Multiple Choice)

5.0/5  (39)

(39)

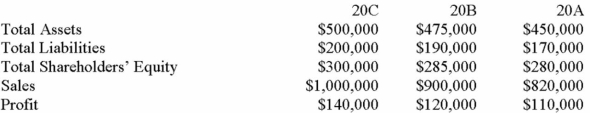

The following data is from Gauthier Machine Shop:

Compute Gauthier Machine Shop's asset turnover ratio for the two most recent years (a) 20C __________

(b) 20B __________

Compute Gauthier Machine Shop's asset turnover ratio for the two most recent years (a) 20C __________

(b) 20B __________

(Short Answer)

4.8/5  (41)

(41)

Profit differs from cash flow from operations because the revenue recognition and matching principle result in the recognition of revenues and related expenses that are independent of the timing of cash receipts and payments.

(True/False)

4.8/5  (42)

(42)

Collection of a customer's account has an impact on total assets.

(True/False)

4.7/5  (43)

(43)

In applying the revenue principle to a given transaction, the most important moment or period in time is when which of the following happens?

(Multiple Choice)

4.9/5  (33)

(33)

Calculate the effective tax rate for a company that reports an income tax expense of $3.0 million, profit of $7.5 million, and income before taxes of $10.5 million.

(Multiple Choice)

4.9/5  (35)

(35)

The double-entry system of accounting refers to the placement of a double line at the end of a column of figures.

(True/False)

4.7/5  (41)

(41)

Showing 61 - 80 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)