Exam 4: Individual Income Tax Overview, Dependents, and Filing Status

Exam 1: An Introduction to Tax113 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations115 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status125 Questions

Exam 5: Gross Income and Exclusions130 Questions

Exam 6: Individual Deductions95 Questions

Exam 7: Investments74 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery102 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation99 Questions

Exam 13: Retirement Savings and Deferred Compensation112 Questions

Exam 14: Tax Consequences of Home Ownership108 Questions

Select questions type

The Inouyes filed jointly in 2019. Their AGI is $78,000. They reported $2,000 of qualified business income and $22,000 of itemized deductions. They have two children, one of whom qualifies as their dependent as a qualifying child. The 2019 standard deduction amount for MFJ taxpayers is $24,400. What is the total amount of from AGI deductions they are allowed to claim on their 2019 tax return?

(Essay)

4.7/5  (35)

(35)

In February of 2018, Lorna and Kirk were married. During 2019, Lorna received $40,000 of compensation from her employer and Kirk received $30,000 of compensation from his employer. The couple together reported $2,000 of itemized deductions. Lorna and Kirk filed separately in 2019. What is Lorna's taxable income and what is her tax liability? (Use the applicable tax rate schedule and round your answer to the nearest whole number.)

(Essay)

4.9/5  (34)

(34)

The test for a qualifying child includes a gross income restriction while the test for qualifying relative does not.

(True/False)

4.8/5  (46)

(46)

From AGI deductions are generally more valuable to taxpayers than for AGI deductions.

(True/False)

4.9/5  (36)

(36)

Which of the following statements regarding exclusions and/or deferrals is false?

(Multiple Choice)

4.9/5  (34)

(34)

Filing status determines all of the following except ________.

(Multiple Choice)

4.9/5  (41)

(41)

To determine filing status, a taxpayer's marital status is determined on January 1 of each tax year in question.

(True/False)

4.9/5  (38)

(38)

From AGI deductions are commonly referred to as deductions "below the line."

(True/False)

5.0/5  (37)

(37)

Greg is single. During 2019, he received $60,000 of salary from his employer. That was his only source of income. He reported $3,000 of for AGI deductions and $9,000 of itemized deductions. The 2019 standard deduction amount for a single taxpayer is $12,200. What is Greg's taxable income?

(Essay)

4.8/5  (36)

(36)

The relationship requirement is more broadly defined (includes more relationships)for a qualifying relative than for a qualifying child.

(True/False)

4.9/5  (41)

(41)

In addition to the individual income tax, individuals may be required to pay taxes imposed on tax bases other than the individual's regular taxable income.

(True/False)

4.9/5  (33)

(33)

Taxpayers may prepay their tax liability through withholdings and through estimated tax payments.

(True/False)

4.8/5  (25)

(25)

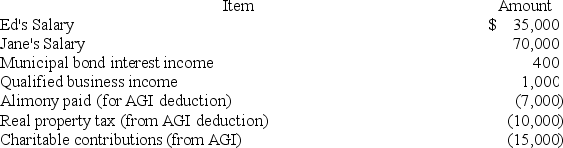

Jane and Ed Rochester are married with a 2-year-old child, who lives with them and whom they support financially. In 2019, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2019 standard deduction amount for MFJ taxpayers is $24,400.

What is the couple's taxable income?

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2019 standard deduction amount for MFJ taxpayers is $24,400.

What is the couple's taxable income?

(Essay)

4.7/5  (35)

(35)

Katy has one child, Dustin, who is 18 years old at the end of the year. Dustin lived at home for three months during the year before leaving home to work full time in another city. During the year, Dustin earned $15,000. Katy provided more than half of Dustin's support for the year. Which of the following statements regarding whether Katy may claim Dustin as a dependent for the current year is accurate?

(Multiple Choice)

4.9/5  (33)

(33)

John Maylor is a self-employed plumber of John's John Service, his sole proprietorship. In the current year, John's John Service had revenue of $120,000 and $40,000 of business expenses.

John also received $2,000 of interest income from corporate bonds.

What is John's adjusted gross income, assuming he had no other income or expenses? (ignore any deduction for self-employment tax.)

(Essay)

4.8/5  (30)

(30)

If a taxpayer does not provide more than half the support of a child, that child cannot qualify as the taxpayer's qualifying child.

(True/False)

4.8/5  (32)

(32)

Sam and Tracy have been married for 25 years. They have filed a joint return every year of their marriage. They have two sons, Christopher and Zachary. Christopher is 19 years old and Zachary is 14 years old. Christopher lived in his parents' home from January through August and he lived in his own apartment from September through December. During the year, Christopher attended college for one month before dropping out. Christopher's living expenses totaled $12,000 for the year. Of that, Christopher paid $5,000 from income he received while working a part-time job. Sam and Tracy provided the remaining $7,000 of Christopher's support. Zachary lived at home the entire year and did not earn any income. Whom are Sam and Tracy allowed to claim as dependents?

(Essay)

4.8/5  (33)

(33)

Showing 41 - 60 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)