Exam 15: Specimen Financial Statements: Pepsico, Inc

Exam 1: Accounting in Action257 Questions

Exam 2: The Recording Process206 Questions

Exam 3: Adjusting the Accounts260 Questions

Exam 4: Completing the Accounting Cycle236 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories235 Questions

Exam 7: Fraud, Internal Control, and Cash232 Questions

Exam 8: Accounting for Receivables239 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets310 Questions

Exam 10: Liabilities309 Questions

Exam 11: Corporations: Organization, Stock Transactions343 Questions

Exam 12: Statement of Cash Flows202 Questions

Exam 13: Financial Statement Analysis271 Questions

Exam 14: Specimen Financial Statements: Apple Inc66 Questions

Exam 15: Specimen Financial Statements: Pepsico, Inc211 Questions

Exam 16: Specimen Financial Statements: the Coca-Cola Company39 Questions

Exam 17: Specimen Financial Statements: Amazoncom, Inc85 Questions

Exam 18: Specimen Financial Statements: Wal-Mart Stores, Inc39 Questions

Select questions type

Unrealized gains and losses are recognized on trading debt securities.

(True/False)

4.8/5  (24)

(24)

Vangaurd Co. purchased 80, 5% McLaughlin Company bonds for $80,000 cash. Interest is payable annually on January 1. The entry to record the purchase would include debit to

(Multiple Choice)

4.8/5  (47)

(47)

If an investor owns between 20% and 50% of an investee's common stock, it is presumed that the investor has significant influence on the investee.

(True/False)

4.8/5  (27)

(27)

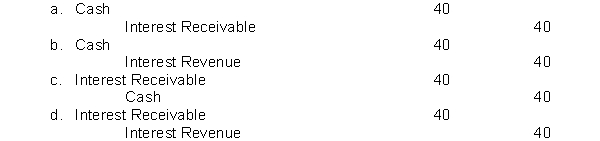

On January 1, 2017, the LaRoche Company purchased at face value, a $1,000, 4%, bond that pays interest on January 1. LaRoche Company has a calendar year end. The entry for the receipt of interest on January 1, 2018, is

(Short Answer)

4.8/5  (35)

(35)

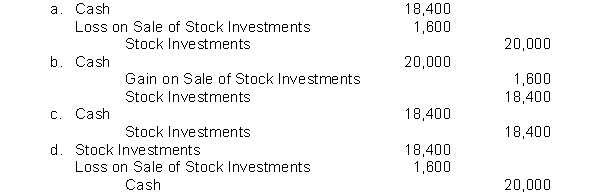

Crosby Corporation sells 400 shares of common stock being held as an investment. The shares were acquired six months ago at a cost of $50 a share. Crosby sold the shares for $46 a share. The entry to record the sale is:

(Short Answer)

4.7/5  (35)

(35)

The company whose stock is owned by the parent company is called the

(Multiple Choice)

4.7/5  (39)

(39)

At January 1, 2017, the equity securities portfolio held by Darma Corporation consisted of the following investments:

1. 2,500 shares of H2 common stock purchased for $43 per share.

2. 1,500 shares of Krypto common stock purchased for $50 per share.

At December 31, 2017, the fair values per share were H2 $36 and Krypto $54.

Instructions

(a) Prepare a schedule showing the cost and fair value of the portfolio at December 31, 2017.

(b) Prepare the adjusting entry to report the portfolio at fair value at December 31, 2017.

(Essay)

4.7/5  (34)

(34)

Which of the following is not a category used for valuing and reporting investments?

(Multiple Choice)

4.9/5  (42)

(42)

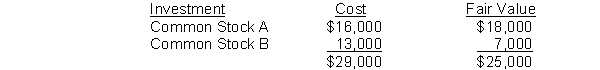

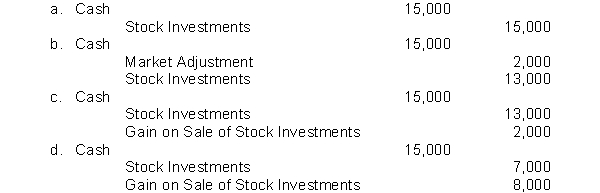

Deutsche Corporation's equity securities portfolio at the end of the year is as follows:  Deutsche subsequently sells Common Stock B for $15,000. What entry is made to record the sale?

Deutsche subsequently sells Common Stock B for $15,000. What entry is made to record the sale?

(Short Answer)

4.9/5  (44)

(44)

On January 5, 2017, JBC Company purchased the following stock investments:

300 shares Getz Corporation common stock for $4,800.

500 shares Keller Corporation common stock for $10,000.

600 shares R-tel Corporation common stock for $18,000.

Assume that JBC Company cannot exercise significant influence over the activities of the investee companies and that the cost method is used to account for the investments.

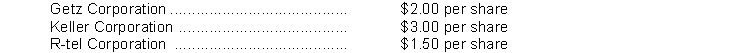

On June 30, 2017, JBC Company received the following cash dividends:  On November 15, 2017, JBC Company sold 100 shares of R-tel Corporation common stock for $3,600.

On December 31, 2017, the fair value of the securities held by JBC Company is as follows: Per Share Getz Corporation common stock \ 12 Keller Corporation common stock 16 R-tel Corporation common stock 33 Instructions

Prepare the appropriate journal entries that the JBC Company should make on the following dates: January 5,2017

June 30,2017

November 15, 2017

December 31,2017

On November 15, 2017, JBC Company sold 100 shares of R-tel Corporation common stock for $3,600.

On December 31, 2017, the fair value of the securities held by JBC Company is as follows: Per Share Getz Corporation common stock \ 12 Keller Corporation common stock 16 R-tel Corporation common stock 33 Instructions

Prepare the appropriate journal entries that the JBC Company should make on the following dates: January 5,2017

June 30,2017

November 15, 2017

December 31,2017

(Essay)

4.8/5  (42)

(42)

In accordance with the historical cost principle, the cost of debt investments includes brokerage fees and accrued interest.

(True/False)

4.7/5  (41)

(41)

Hardin Park Company had these transactions pertaining to stock investments Feb. 1 Purchased 5,000 shares of Raley Company (10%) for $89,000 cash.

June 1 Received cash dividends of $1 per share on Raley stock.

Oct) 1 Sold 2,000 shares of Raley stock for 39,000.

Dec) 1 Received cash dividends of $2 per share on Reley stock.

The entry to record the purchase of the Raley stock would include a

(Multiple Choice)

4.7/5  (31)

(31)

Eaton Company had the following transactions pertaining to its short-term stock investments.

Jan. 1 Purchased 900 shares of Stafford Company stock for $11,880 cash.

June 1 Received cash dividends of $0.60 per share on the Stafford Company stock.

Sept. 15 Sold 450 shares of the Stafford Company stock for $5,200.

Dec. 1 Received cash dividends of $0.60 per share on the Stafford Company stock.

Instructions

(a) Journalize the transactions.

(b) Indicate the income statement effects of the transactions.

(Essay)

4.8/5  (31)

(31)

Barcelona Company owns 40% interest in the stock of ABX Corporation. During the year, ABX pays $40,000 in dividends to Barcelona, and reports $300,000 in net income. Barcelona Company's investment in ABX will increase Barcelona net income by

(Multiple Choice)

5.0/5  (41)

(41)

Information pertaining to stock investments in 2017 by Com-ex Corporation follows:

Acquired 15% of the 200,000 shares of common stock of Buffalo Company at a total cost of $9 per share on January 1, 2017. On July 1, Buffalo Company declared and paid a cash dividend of $1.90 per share. On December 31, Buffalo reported net income was $675,000 for the year.

Obtained significant influence over Eta Company by buying 30% of Eta's 120,000 outstanding shares of common stock at a total cost of $25 per share on January 1, 2017. On June 15, Eta Company declared and paid a cash dividend of $2.50 per share. On December 31, Eta's reported net income was $330,000.

Instructions

Prepare all necessary journal entries for 2017 for Com-ex Corporation.

(Essay)

4.8/5  (35)

(35)

Distinguish between the cost and equity methods of accounting for investments in stocks.

(Essay)

4.8/5  (44)

(44)

When investing excess cash for short periods of time, corporations invest in debt securities and stock securities.

(True/False)

4.7/5  (42)

(42)

Under the equity method, the Stock Investments account is increased when the

(Multiple Choice)

4.7/5  (43)

(43)

In recognizing a decline in the fair value of short-term stock investments, an Unrealized Loss account is debited because

(Multiple Choice)

4.9/5  (40)

(40)

FTX Company owns 10% interest in the stock of Zip Corporation. During the year, Zip pays $5,000 in dividends to FTX, and reports a net loss of $100,000. FTX Company's investment in Zip will affect FTX net income by a

(Multiple Choice)

4.8/5  (41)

(41)

Showing 181 - 200 of 211

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)