Exam 17: Introduction to Fund Accounting

Why is depreciation on fixed assets not recorded in the records of expendable fund entities?

Assets acquired with the resources of an expendable fund entity do not represent expendable financial resources but rather reflect the purposes for which the financial resources have been used.Thus, they are recorded and reported as expenditures of, rather than as assets of, the expendable fund entity.Depreciation is not accounted for in the records of an expendable fund entity for the same reasons that fixed assets are excluded from the records of such entities.Expenditures, not expenses, are measured in fund accounting.

Acquisitions of fixed assets require the use of financial resources and are accounted for as expenditures.Depreciation of such assets is not a use of the financial resources of an expendable fund entity and thus is not properly recorded in the accounts of such entities.Inclusion of depreciation expense in the operating statement of an expendable fund entity would confuse two fundamentally different measurements - expenditures and expenses.

What columns would you suggest for a subsidiary ledger account in order that it might be a subsidiary not only to the "appropriations" control account but also the "encumbrances" and the "expenditures" control accounts?

There should be columns for the following balances: Appropriations, Encumbrances, Expenditures, Total Encumbrances and Expenditures, and Unencumbered Balance.

The reserve for encumbrances account is properly considered to be a

D

Which type of fund entities are used to account for the activities of nonbusiness organizations that are similar to those of business enterprises?

Under GASB Statement No.34, a government-wide financial statement should include a:

What is the significance of the "unreserved fund balance" of an expendable fund entity?

The GASB has the responsibility for establishing financial accounting standards for all of the following entities except:

If a credit was made to the fund balance in the process of recording a budget for a governmental unit, it can be assumed that

The term used to describe the application of accounting to expendable fund entities is the

In accounting for and reporting inventory in the financial statements, the "Reserve for Inventory" account is used under

What journal entry should be made at the end of the fiscal year to close out encumbrances for which goods and services have not been received?

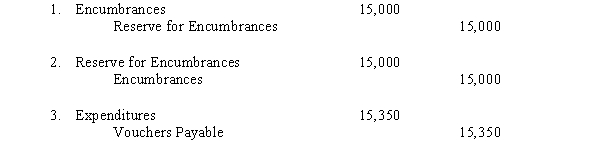

The following related entries were recorded in sequence in the general fund of a municipality:  The sequence of entries indicates that

The sequence of entries indicates that

Is the year-end balance in the Reserve for En-cumbrances account a liability? Explain.

Distinguish between an appropriation, an en-cumbrance encumbrance, an expenditure, and a disbursement.

What are the revenue-recognition criteria for expendable fund entities? How do these criteria differ from revenue-recognition criteria for profit-oriented enterprises?

Why may it be difficult or impossible for a governmental unit to determine the total cost of performing a particular activity or function?

Business Ethics Question from the Textbook

At State College, where football has long reigned asking and fans are near fanatical in their attendance, the frenzy for football tickets has recently reached an all-time high.With requests for home game tickets at an unprecedented level, prices on everything from parking passes to hotel rooms to home rentals have soared beyond belief.Parking passes were going for $500 on eBay, and hotel rates have doubled-and in some cases nearly tripled-reaching as high as $650 per night at some hotels.

Expenditures may be classified by function, activity, object, or organizational unit.Give an ex-ample of each classification for a municipality.Which classification is the most appropriate for

external financial reporting?

How does the adoption of a budget for a general fund entity differ from the adoption of a budget by a commercial unit?

The "reserve for encumbrances-prior year" account represents amounts recorded by a governmental unit for

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)