Exam 7: Reporting and Analyzing Receivables

Exam 1: Introduction to Financial Statements183 Questions

Exam 2: A Further Look at Financial Statements201 Questions

Exam 3: The Accounting Information System226 Questions

Exam 4: Merchandising Operations and the Multiple-Step Income Statement221 Questions

Exam 5: Reporting and Analyzing Inventory201 Questions

Exam 6: Fraud, Internal Control, and Cash209 Questions

Exam 7: Reporting and Analyzing Receivables220 Questions

Exam 8: Reporting and Analyzing Long-Lived Assets227 Questions

Exam 9: Reporting and Analyzing Liabilities245 Questions

Exam 10: Reporting and Analyzing Stockholders Equity215 Questions

Exam 11: Statement of Cash Flows170 Questions

Exam 12: Financial Analysis: The Big Picture211 Questions

Exam 13: Managerial Accounting151 Questions

Exam 14: Job Order Costing150 Questions

Exam 15: Process Costing129 Questions

Exam 16: Activity-Based Costing147 Questions

Exam 17: Cost-Volume-Profit156 Questions

Exam 18: Cost-Volume-Profit Analysis: Additional Issues81 Questions

Exam 19: Incremental Analysis166 Questions

Exam 20: Budgetary Planning158 Questions

Exam 21: Budgetary Control and Responsibility Accounting154 Questions

Exam 22: Standard Costs and Balanced Scorecard161 Questions

Exam 23: Planning for Capital Investments156 Questions

Select questions type

Under the allowance method, when a year-end adjustment is made for estimated uncollectible accounts

(Multiple Choice)

4.9/5  (32)

(32)

One might infer from a debit balance in Allowance for Doubtful Accounts that

(Multiple Choice)

5.0/5  (29)

(29)

To record estimated uncollectible accounts using the allowance method, the adjusting entry would be a

(Multiple Choice)

4.9/5  (36)

(36)

The receivable that is usually evidenced by a formal instrument of credit is a(n)

(Multiple Choice)

4.8/5  (34)

(34)

Thompson Corporation's unadjusted trial balance includes the following balances (assume normal balances): - Accounts receivable

- Allowance for doubtful accounts Bad debts are estimated to be 6% of outstanding receivables. What amount of bad debt expense will the company record?

(Multiple Choice)

4.8/5  (36)

(36)

Wilton sells softball equipment. On November 14, they shipped $4,000 worth of softball uniforms to Paola Middle School, terms 2/10, n/30. On November 21, they received an order from Douglas High School for $2,400 worth of custom printed bats to be produced in December. On November 30, Paola Middle School returned $400 of defective merchandise. Wilton has received no payments from either school as of month end. What amount will be recognized as net accounts receivable on the balance sheet as of November 30?

(Multiple Choice)

4.8/5  (33)

(33)

A note receivable is a written promise by the maker to the payee to pay a specified amount of money at a definite time.

(True/False)

4.7/5  (34)

(34)

When using the allowance method year-end adjustments for bad debt expense must be made.

(True/False)

4.8/5  (43)

(43)

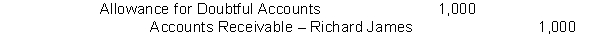

The bookkeeper recorded the following journal entry  Which one of the following statements is false?

Which one of the following statements is false?

(Multiple Choice)

4.9/5  (40)

(40)

All of the following statements regarding the financial statement presentation of receivables are true except:

(Multiple Choice)

4.8/5  (46)

(46)

Dorman Company had the following items to report on its balance sheet: Em ployee advances \ 1,580 Amounts owed by customers for the sale of services (due in 30 days) 3,050 Refundable income taxes 1,120 Interest receivable 950 Accepted a formal instrum ent of credit for services (due in 18 months) 2,220 A loan to company president 10,000 Dishonored a note for principal and interest which will eventually be collected 1,380 Based on this information, what amount should appear in the "Other Receivables" category?

(Multiple Choice)

4.8/5  (33)

(33)

When an account is written off using the allowance method, the

(Multiple Choice)

4.8/5  (43)

(43)

Windsor Corporation sells its goods on terms of 2/10, n/30. It has an accounts receivable turnover of 6. What is its average collection period (days)?

(Multiple Choice)

4.8/5  (44)

(44)

The accounts receivable turnover ratio is computed by dividing total sales by the average net receivables during the year.

(True/False)

4.9/5  (36)

(36)

Under the allowance method, Bad Debt Expense is debited when an account is deemed uncollectible and must be written off.

(True/False)

4.7/5  (40)

(40)

If a retailer accepts a national credit card such as Visa, the retailer must maintain detailed records of customer accounts.

(True/False)

4.8/5  (35)

(35)

Showing 61 - 80 of 220

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)