Exam 6: Banking Procedure and Control of Cash

Exam 1: Accounting Concepts and Procedures124 Questions

Exam 2: Debits and Credits: Analyzing and Recording Business Transactions125 Questions

Exam 3: Beginning the Accounting Cycle125 Questions

Exam 4: The Accounting Cycle Continued126 Questions

Exam 5: The Accounting Cycle Completed126 Questions

Exam 6: Banking Procedure and Control of Cash125 Questions

Exam 7: Calculating Pay and Payroll Taxes: the Beginning of the Payroll Process138 Questions

Exam 8: Paying,recording,and Reporting Payroll and Payroll Taxes:113 Questions

Exam 9: Sales and Cash Receipts125 Questions

Exam 10: Purchases and Cash Payments125 Questions

Exam 11: Preparing a Worksheet for a Merchandise Company124 Questions

Exam 12: Completion of the Accounting Cycle for a Merchandise Company123 Questions

Exam 13: Accounting for Bad Debts119 Questions

Exam 14: Notes Receivable and Notes Payable132 Questions

Exam 15: Accounting for Merchandise Inventory124 Questions

Exam 16: Accounting for Property,plant,equipment,and Intangible Assets147 Questions

Exam 17: Partnership130 Questions

Exam 18: Corporations: Organizations and Stock124 Questions

Exam 19: Corporations: Stock Values,dividends,treasury Stocks,122 Questions

Exam 20: Corporations and Bonds Payable138 Questions

Exam 21: Statement of Cash Flows123 Questions

Exam 22: Analyzing Financial Statements121 Questions

Exam 23: The Voucher System133 Questions

Exam 24: Departmental Accounting140 Questions

Exam 25: Manufacturing Accounting126 Questions

Select questions type

List at least five company policies that would be included in an internal control system.

Free

(Essay)

4.8/5  (41)

(41)

Correct Answer:

1.Responsibilities and duties of employees will be divided.

2.All cash receipts will be deposited into the bank daily.

3.All cash payments except petty cash will be made by check.

4.Employees will be rotated.

5.All checks will be authorized.

6.All documents upon payment will be stamped paid.

7.All checks will be pre-numbered.

8.Monthly bank statements will be sent to and reconciled by someone other than the employees who handle,record or deposit cash.

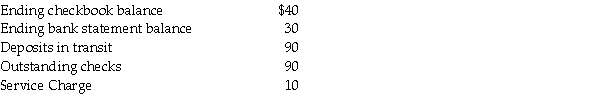

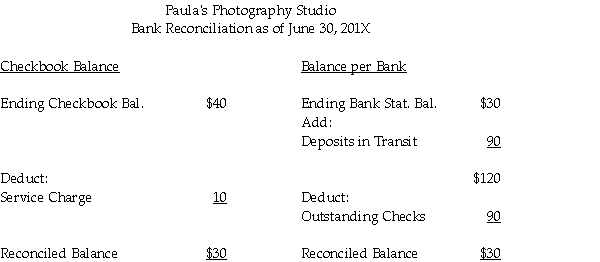

From the following information,prepare the bank reconciliation for Paula's Photography Studio for June.

Free

(Essay)

4.8/5  (31)

(31)

Correct Answer:

The entry to replenish a $300 petty cash fund,which has cash of $140 and valid receipts for $148,would include:

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

A

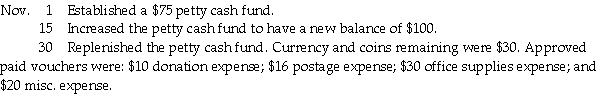

Prepare journal entries for the following petty cash fund transactions:

(Essay)

5.0/5  (43)

(43)

If the ending balance in the Cash Short and Over account is a debit,it indicates that cash shortages have exceeded cash overages for the period.

(True/False)

4.8/5  (44)

(44)

The credit recorded in the journal entry to establish the petty cash fund is to:

(Multiple Choice)

4.8/5  (30)

(30)

The Petty Cash account is used to pay for small items such as postage stamps and supplies.

(True/False)

4.8/5  (35)

(35)

A payment for $51 is incorrectly recorded on the checkbook stub as $15.The $36 error should be shown on the bank reconciliation as:

(Multiple Choice)

4.8/5  (36)

(36)

The bank charged another company's deposit to our account.This would be included on the bank reconciliation as a(n):

(Multiple Choice)

4.9/5  (45)

(45)

Which of the following transactions would most likely NOT be recorded in an auxiliary petty cash record?

(Multiple Choice)

4.9/5  (35)

(35)

Determine the adjusted cash balance per bank for Sam's Packaging on November 30,from the following information:

Cash balance on the bank statement \ 3,350 Customer's check returned-NSF 500 Customer's note collected by the bank 600 Deposits in transit, November 30 1,400 Outstanding checks, November 30 3,650

(Multiple Choice)

4.7/5  (40)

(40)

Which of the following accounts would most likely be debited in the replenishment of petty cash?

(Multiple Choice)

4.9/5  (30)

(30)

When completing a bank reconciliation,explain why all adjustments to the checkbook balance require journal entries?

(Short Answer)

4.8/5  (34)

(34)

Prepare the required journal entries from the bank reconciliation below as of the end of June:

The balance per general ledger is $200.

There is a debit memo for interest expense,$125.

There is a debit memo for a customer's NSF check $430.

Outstanding checks amount to $2,000.

This month's service charge amounts to $50.

Deposits in transit amount to $1,500.

(Essay)

4.9/5  (38)

(38)

Determine the reconciled bank balance given the following:

The balance per bank statement is $ 110.

The balance per general ledger is $107.

There is a credit memo for a note collected,$408.

There is a credit memo for interest earned,$25.

There is a debit memo for a customer's NSF check $350.

Deposits in transit,$850.

Outstanding checks amount to $845.

This month's service charge amounts to $50.

There is a debit memo for check printing fees,$25.

$ ________

(Short Answer)

4.8/5  (37)

(37)

________ Owner withdrew $1,000 from the company for personal use

(Short Answer)

4.9/5  (40)

(40)

Showing 1 - 20 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)