Exam 8: Property Transactions: Capital Gains and Losses

Exam 1: Introduction to Taxation98 Questions

Exam 2: Working With the Tax Law102 Questions

Exam 3: Taxes on the Financial Statements68 Questions

Exam 4: Gross Income96 Questions

Exam 5: Business Deductions208 Questions

Exam 6: Losses and Loss Limitations185 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges118 Questions

Exam 8: Property Transactions: Capital Gains and Losses109 Questions

Exam 9: Individuals As the Taxpayer105 Questions

Exam 10: Individuals: Income, Deductions, and Credits119 Questions

Exam 11: Individuals As Employees and Proprietors131 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules128 Questions

Exam 13: Corporations: Earnings and Profits and Distributions125 Questions

Exam 14: Partnerships and Limited Liability Entities122 Questions

Exam 15: S Corporations118 Questions

Exam 16: Multijurisdictional Taxation145 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax132 Questions

Exam 18: Comparative Forms of Doing Business97 Questions

Select questions type

The maximum amount of the unrecaptured § 1250 gain 25% gain) is the depreciation taken on real property sold at a recognized gain.

(True/False)

4.9/5  (29)

(29)

Which of the following events could result in § 1250 depreciation recapture?

(Multiple Choice)

4.9/5  (40)

(40)

The subdivision of real property into lots for resale when no substantial physical improvements have been made to the property never causes the gain from sale of the lots to be treated as ordinary income.

(True/False)

4.7/5  (36)

(36)

Vertigo, Inc., has a 2018 net § 1231 loss of $64,000 and had a $32,000 net § 1231 gain in 2017.For 2018, Vertigo's net § 1231 loss is treated as:

(Multiple Choice)

4.9/5  (36)

(36)

Ryan has the following capital gains and losses for 2018: $6,000 STCL, $5,000 28% gain, $2,000 25% gain, and $6,000 0%/15%/20% gain.Which of the following is correct:

(Multiple Choice)

4.8/5  (31)

(31)

Section 1231 property includes nonpersonal use property where casualty gains exceed casualty losses for the taxable year.

(True/False)

4.9/5  (32)

(32)

Stanley operates a restaurant as a sole proprietorship.Which of the following items are capital assets in the hands of Stanley?

(Multiple Choice)

4.8/5  (39)

(39)

In 2018, Satesh has $5,000 short-term capital loss, $13,000 0%/15%/20% long-term capital gain, and $7,000 qualified dividend income.Satesh is single and has other taxable income of $15,000.Which of the following statements is correct?

(Multiple Choice)

4.8/5  (34)

(34)

A lessor is paid $45,000 by its commercial tenant as a lease cancellation fee.The tenant wanted to get out of its lease so it could move to a different building.The lessor had held the lease for three years before it was canceled.The lessor had a zero tax basis for the lease.The lessor has received:

(Multiple Choice)

4.8/5  (29)

(29)

The Code contains two major depreciation recapture provisions: § 1245 and § 1250.

(True/False)

4.9/5  (41)

(41)

Casualty gains and losses from nonpersonal use assets are not netted against casualty gains and losses from personal use assets.

(True/False)

4.8/5  (40)

(40)

The holding period of property given up in a like-kind exchange includes the holding period of the asset received if the property that has been exchanged is a capital asset.

(True/False)

4.9/5  (40)

(40)

If the holder of an option fails to exercise the option, the lapse of the option is considered a sale or exchange on the option expiration date.

(True/False)

4.9/5  (44)

(44)

Lease cancellation payments received by a lessor are always ordinary income because they are considered to be in lieu of rental payments.

(True/False)

4.8/5  (40)

(40)

In 2017, Jenny had a $12,000 net short-term capital loss and deducted $3,000 as a capital loss deduction.In 2018, Jenny has a $18,000 0%/15%/20% long-term capital gain and no other capital gain or loss transactions.Which of the statements below is correct for 2018?

(Multiple Choice)

4.9/5  (41)

(41)

Spencer has an investment in two parcels of vacant land.Parcel 1 is a capital asset and parcel 2 is a § 1231 asset.Spencer already has short-term capital loss for the year he would like to offset with capital gain.Spencer has § 1231 lookback loss that exceeds the gain from the disposition of either land parcel.Spencer only wants to sell one land parcel and each of them would yield the same amount of gain.The gain that would be recognized exceeds the short- term capital loss Spencer already has.Which of the statements below is correct?

(Multiple Choice)

4.8/5  (35)

(35)

To compute the holding period, start counting on the day after the property was acquired and include the day of disposition.

(True/False)

4.8/5  (36)

(36)

If there is a net § 1231 loss, it is treated as an ordinary loss.

(True/False)

4.9/5  (39)

(39)

The "tax status" of an asset refers to whether the asset is a capital asset, a § 1231 asset, or an ordinary asset.

(True/False)

4.8/5  (37)

(37)

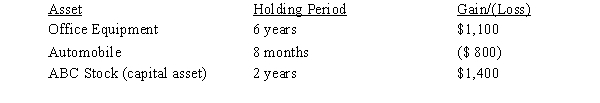

The following assets in Jack's business were sold in 2018:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 the year of sale), Jack should report what amount of net capital gain and net ordinary income?

A)$1,700 LTCG.

B)$600 LTCG and $300 ordinary gain.

C)$1,400 LTCG and $300 ordinary gain.

D)$2,500 LTCG and $800 ordinary loss.

E)None of the above.

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 the year of sale), Jack should report what amount of net capital gain and net ordinary income?

A)$1,700 LTCG.

B)$600 LTCG and $300 ordinary gain.

C)$1,400 LTCG and $300 ordinary gain.

D)$2,500 LTCG and $800 ordinary loss.

E)None of the above.

(Short Answer)

5.0/5  (34)

(34)

Showing 81 - 100 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)