Exam 12: Intangible Assets and Goodwill

Exam 1: The Canadian Financial Reporting Environment29 Questions

Exam 2: Conceptual Framework Underlying Financial Reporting54 Questions

Exam 3: The Accounting Information System54 Questions

Exam 4: Reporting Financial Performance61 Questions

Exam 5: Financial Position and Cash Flows49 Questions

Exam 6: Revenue Recognition63 Questions

Exam 7: Cash and Receivables53 Questions

Exam 8: Inventory99 Questions

Exam 9: Investments90 Questions

Exam 10: Property, Plant, and Equipment: Accounting Model Basics63 Questions

Exam 11: Depreciation, Impairment, and Disposition62 Questions

Exam 12: Intangible Assets and Goodwill52 Questions

Select questions type

Which of the following is not a characteristic of intangible assets? Intangible assets must be

(Multiple Choice)

4.8/5  (36)

(36)

The proper accounting for the costs incurred in creating computer software products that are to be sold, leased, or otherwise marketed to external parties, is to

(Multiple Choice)

4.7/5  (38)

(38)

If a trademark is developed by the enterprise itself, the costs should be

(Multiple Choice)

4.9/5  (37)

(37)

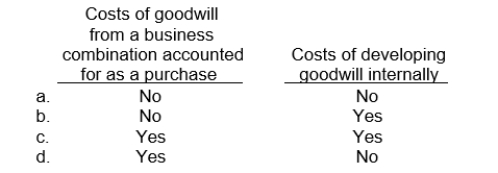

Which of the following costs of goodwill should be capitalized?

(Short Answer)

4.8/5  (31)

(31)

Which of the following statements best describes the accounting treatment for pre- opening costs for new businesses?

(Multiple Choice)

4.7/5  (29)

(29)

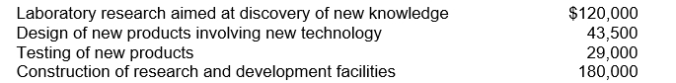

Decker Inc.incurred the following costs during the year ended December 31, 2010:  The total amount to be classified as development costs in 2010 is

The total amount to be classified as development costs in 2010 is

(Multiple Choice)

4.9/5  (42)

(42)

On January 2, 2007, Mortensen, Ltd.purchased a patent for a new consumer product for $90,000.At the time of purchase, the patent was valid for 15 years; however, the patent's useful life was estimated to be only 10 years due to the competitive nature of the product.

On December 31, 2010, the product was permanently withdrawn from sale under

Governmental order because of a potential health hazard in the product.What amount should Mortensen charge against income during 2010, assuming amortization is recorded

At the end of each year?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following intangible assets should not be amortized?

(Multiple Choice)

4.9/5  (34)

(34)

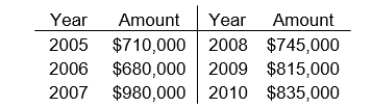

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-Assuming that excess earnings are expected to continue for 8 years, and ignoring the time value of money, estimated goodwill is

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-Assuming that excess earnings are expected to continue for 8 years, and ignoring the time value of money, estimated goodwill is

(Multiple Choice)

4.7/5  (39)

(39)

If the fair value of the net asset acquired is greater than the purchase price the amount is:

(Multiple Choice)

4.7/5  (27)

(27)

Which of the following is an appropriate method to determine when the development stage is over for an enterprise in the development stage?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is not a method of calculating goodwill?

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following statements best describes when goodwill should be tested for impairment under IFRS?

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following statements best describes when goodwill should be tested for impairment under Private Entity GAAP?

(Multiple Choice)

4.8/5  (31)

(31)

The owners of Dallas' Electronics Store are contemplating selling the business to new interests.The cumulative earnings for the past 5 years amounted to $900,000 including extraordinary gains of $30,000.The annual earnings based on an average rate of return on investment for this industry would have been $138,000.If excess earnings are to be capitalized at 15%, then implied goodwill should be

(Multiple Choice)

4.8/5  (38)

(38)

Use the following information for questions

Jessup Corp.will acquire a controlling stake in the outstanding shares of Parasol Inc.for

$9.2 million in cash.

-Parasol's average annual net income is $75,000 above the average for Parasol's industry. Assuming Jessup estimates goodwill by capitalizing excess earnings at 14%, the estimate of goodwill is

(Multiple Choice)

4.8/5  (29)

(29)

Santo Corporation was granted a patent on a product on January 1, 2010.To protect its patent, the corporation purchased on January 1, 2009 a patent on a competing product which was originally issued on January 10, 2005.Because of its unique plan, Santo Corporation does not feel the competing patent can be used in producing a product.The cost of the competing patent should be

(Multiple Choice)

4.8/5  (34)

(34)

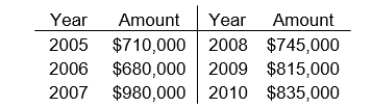

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-During 2010, Kurz Company purchased the net assets of Sims Corporation for $635,000. On the date of the transaction, Sims had no long-term investments in marketable securities and had $200,000 of liabilities.The fair value of Sims' assets, when acquired were as follows:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-During 2010, Kurz Company purchased the net assets of Sims Corporation for $635,000. On the date of the transaction, Sims had no long-term investments in marketable securities and had $200,000 of liabilities.The fair value of Sims' assets, when acquired were as follows:  How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

How should the $365,000 difference between the fair value of the net assets acquired ($1 million) and the cost ($635,000) be accounted for by Kurz?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 21 - 40 of 52

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)