Exam 8: Simple Interest Applications

Exam 1: Review of Arithmetic143 Questions

Exam 2: Review of Basic Algebra273 Questions

Exam 3: Ratio, Proportion, and Percent210 Questions

Exam 4: Linear Systems116 Questions

Exam 5: Cost-Volume-Profit Analysis and Break-Even47 Questions

Exam 6: Trade Discounts, Cash Discounts, Markup, and Markdown170 Questions

Exam 7: Simple Interest132 Questions

Exam 8: Simple Interest Applications87 Questions

Exam 9: Compound Interest - Future Value and Present Value172 Questions

Exam 10: Compound Interest - Further Topics77 Questions

Exam 11: Ordinary Simple Annuities104 Questions

Exam 12: Ordinary General Annuities104 Questions

Exam 13: Annuities Due, Deferred Annuities, and Perpetuities182 Questions

Exam 14: Amortization of Loans, Residential Mortgages, and Sinking Funds132 Questions

Exam 15: Bond Valuation87 Questions

Exam 16: Investment Decision Applications78 Questions

Select questions type

Bradley purchased a 91-day, $100 000 T-bill on its issue date for $99 237.96. What was the original yield of the T-bill?

(Essay)

4.8/5  (38)

(38)

Find the proceeds of a six-month note for $966 dated September 16, 2012, with interest at 5.45% if money is worth 5.75% on November 4, 2012.

(Essay)

4.9/5  (37)

(37)

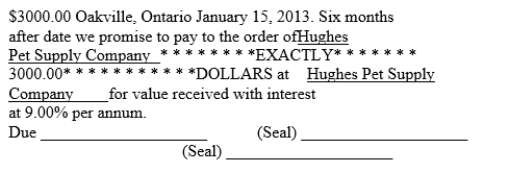

For the following promissory note, determine the amount of interest due at maturity.

(Essay)

4.8/5  (43)

(43)

A promissory note has a face value of $5175.00 and it has a date of issue of April 2 this year. The term is for 5 months. The rate of interest is 6.75%. What is the maturity value of the note?

(Multiple Choice)

4.7/5  (35)

(35)

Find the maturity value of a six-month, $642 note dated November 1, 2013, earning interest at 7.5%.

(Essay)

4.9/5  (38)

(38)

You borrow $4000 on August 2nd this year. Your demand loan carries an interest rate of 8.41%. You make partial payments of $500 on September 15th and $1575 on October 17th. You want to make a final payment to pay off the remaining outstanding balance on November 21st. What is the size of your final payment? Use the declining balance method.

(Multiple Choice)

4.9/5  (25)

(25)

Tracey bought a 182-day Government of Canada treasury bill at the price to yield an annual rate of return of 4.68%.

a)What was the price paid by Tracey if the T-bill has a face value of $100 000?

b)Later the same day, Tracey sold this T-bill to a large corporation to yield 4.48%. What was Tracey's profit on this transaction?

(Essay)

4.7/5  (40)

(40)

An investor purchased $250 000 in 91-day T-bills on the issue date for $248 157.56. After holding the T-bills for 37 days, she sold them for a yield of 3.25%.

a)What was the original yield of the T-bills?

b)For how much did the investor sell the T-bills?

c)What rate of return (per annum)did the investor realize while holding this T-bill?

(Essay)

4.7/5  (36)

(36)

Marty took a $5000 loan from a financial institute at a rate of 6%, which should be repaid in two equal installments of $2575.25 made every 4 months. How much more interest would have been paid, had Marty paid it in a single installment after 8 months?

(Multiple Choice)

4.8/5  (32)

(32)

Syed bought 168 day Government of Canada T-Bills on 30 April 2016, yielding 0.6%. The face value of the bills was $55 000. He immediately sold it to a client at a higher price that presented a yield to the client of 0.54%. What profit did Syed make?

(Multiple Choice)

4.9/5  (33)

(33)

Lee is planning to buy furniture worth $7000 from Leons. He can buy on his MasterCard and pay it within 7 days following the grace period of 21 days. His second option is to buy on the personal (unsecured)line of credit and pay it back after 6 months. His third option is to use secured line of credit and pay it back in 9 months. MasterCard charges an interest rate of 19.9%. Unsecured line of credit charges a rate of prime (3%)plus 3% and secured line of credit charges a rate of prime plus 0.5%. What is his best option?

(Multiple Choice)

4.7/5  (40)

(40)

Sean borrowed $3000.00 from Sepaba Savings and Loan. The line of credit agreement provided for repayment of the loan in three equal monthly payments plus interest at 6.00% per annum calculated on the unpaid balance. Determine the total interest cost.

(Essay)

4.7/5  (36)

(36)

A 60-day non-interest-bearing promissory note for $10 000 is dated June 1, 2013. Compute the present value of the note on June 14, 2013, if money is worth 5%.

(Essay)

5.0/5  (32)

(32)

You bought a $100 000 91-day T-bill for $99 453.67 61 days before maturity. What discount rate was used?

(Multiple Choice)

4.9/5  (41)

(41)

Amertech borrowed $32 000.00 from Balzac Credit Union on May 17 at 12%. The interest rate was changed to 14.11% effective July 1 and to 13.27% effective October 1. The loan was repaid by payments of $17 000.000 on July 15 and the balance, including the accumulated interest, on November 20. How much did the loan cost?

(Essay)

4.9/5  (43)

(43)

A government of Ontario 364-day T-bills with a face value of $50 000 were purchased on January 2 for $48 000.76. The T-bills were sold on September 28 for $48 999.99.

a)What was the market yield rate on January 2?

b)What was the yield rate on September 28?

c)What was the rate of return realized?

(Essay)

4.9/5  (43)

(43)

Dirk Propp borrowed $14 300.00 for investment purposes on May 19 on a demand note providing for a variable rate of interest and payment of any accrued interest on December 31. He paid $1300.00 on June 28, $1450 on September 25, and $4200.00 on November 15. How much is the final payment on December 31 if the rate of interest was 11.5% on May 19, 8.21% effective August 1, and 6.35% effective November 1? Use the declining balance method.

(Essay)

4.8/5  (37)

(37)

A $2850, five-month promissory note with interest at 6.15% is issued on June 1. Compute the proceeds of the note on August 13, when money is worth 7.5%.

(Essay)

4.7/5  (41)

(41)

The maturity value of a 155-day 7.5% note dated March 14 is $1721.74. Compute the face value of the note.

(Essay)

4.8/5  (31)

(31)

Average rate of return or yield on a 6-month Government of Canada treasury bills sold on June 18, 2013 was 1.04% (http://www.bankofcanada.ca/rates/interest-rates/t-bill-yields/). At this yield, what price was paid for a T-bill with a face value of $50 000?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 61 - 80 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)