Exam 4: Time Value of Money

Exam 1: An Overview of Financial Management and the Financial Environment39 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes75 Questions

Exam 3: Analysis of Financial Statements103 Questions

Exam 4: Time Value of Money163 Questions

Exam 5: Bonds, Bond Valuation, and Interest Rates100 Questions

Exam 6: Risk and Return146 Questions

Exam 7: Corporate Valuation and Stock Valuation91 Questions

Exam 8: Financial Options and Applications in Corporate Finance27 Questions

Exam 9: The Cost of Capital87 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows107 Questions

Exam 11: Cash Flow Estimation and Risk Analysis78 Questions

Exam 12: Corporate Valuation and Financial Planning45 Questions

Exam 13: Corporate Governance51 Questions

Exam 15: Capital Structure Decisions97 Questions

Exam 16: Supply Chains and Working Capital Management131 Questions

Exam 17: Multinational Financial Management49 Questions

Exam 18: Public and Private Financing: Initial Offerings, Seasoned Offerings, and Investment Banks13 Questions

Exam 19: Lease Financing22 Questions

Exam 20: Hybrid Financing: Preferred Stock, Warrants, and Convertibles30 Questions

Exam 21: Dynamic Capital Structures and Corporate Valuation35 Questions

Exam 22: Mergers and Corporate Control42 Questions

Exam 23: Enterprise Risk Management14 Questions

Exam 24: Bankruptcy, Reorganization, and Liquidation12 Questions

Exam 25: Portfolio Theory and Asset Pricing Models31 Questions

Exam 26: Real Options19 Questions

Exam 27: Providing and Obtaining Credit38 Questions

Exam 28: Advanced Issues in Cash Management and Inventory Control29 Questions

Exam 29: Pension Plan Management10 Questions

Exam 30: Financial Management in Not-For-Profit Businesses10 Questions

Select questions type

Assume that you own an annuity that will pay you $15,000 per year for 12 years, with the first payment being made today.You need money today to open a new restaurant, and your uncle offers to give you $120,000 for the annuity.If you sell it, what rate of return would your uncle earn on his investment?

(Multiple Choice)

4.9/5  (38)

(38)

If the discount (or interest) rate is positive, the future value of an expected series of payments will always exceed the present value of the same series.

(True/False)

4.8/5  (34)

(34)

If the discount (or interest) rate is positive, the present value of an expected series of payments will always exceed the future value of the same series.

(True/False)

4.9/5  (47)

(47)

When a loan is amortized, a relatively high percentage of the payment goes to reduce the outstanding principal in the early years, and the principal repayment's percentage declines in the loan's later years.

(True/False)

4.8/5  (28)

(28)

Which of the following statements regarding a 15-year (180-month) $225,000, fixed-rate mortgage is CORRECT? (Ignore taxes and transactions costs.)

(Multiple Choice)

4.8/5  (29)

(29)

Starting to invest early for retirement reduces the benefits of compound interest.

(True/False)

4.9/5  (28)

(28)

Geraldine was injured in a car accident, and the insurance company has offered her the choice of $25,000 per year for 15 years, with the first payment being made today, or a lump sum.If a fair return is 7.5%, how large must the lump sum be to leave her as well off financially as with the annuity?

(Multiple Choice)

4.8/5  (37)

(37)

The present value of a future sum increases as either the discount rate or the number of periods per year increases, other things held constant.

(True/False)

4.7/5  (31)

(31)

What annual payment must you receive in order to earn a 6.5% rate of return on a perpetuity that has a cost of $1,250?

(Multiple Choice)

4.8/5  (36)

(36)

If we are given a periodic interest rate, say a monthly rate, we can find the nominal annual rate by dividing the periodic rate by the number of periods per year.

(True/False)

4.9/5  (30)

(30)

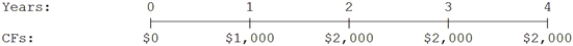

You sold your motorcycle and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 6.0%?

(Multiple Choice)

4.9/5  (31)

(31)

Your bank offers a 10-year certificate of deposit (CD) that pays 6.5% interest, compounded annually.If you invest $2,000 in the CD, how much will you have when it matures?

(Multiple Choice)

4.8/5  (38)

(38)

The going rate of interest on a 5-year treasury bond is 4.25%.You have one that will pay $2,500 five years from now.How much is the bond worth today?

(Multiple Choice)

4.7/5  (37)

(37)

You would like to travel in South America 5 years from now, and you can save $3,100 per year, beginning one year from today.You plan to deposit the funds in a mutual fund that you think will return 8.5% per year.Under these conditions, how much would you have just after you make the 5th deposit, 5 years from now?

(Multiple Choice)

4.9/5  (38)

(38)

A U.S.Treasury bond will pay a lump sum of $1,000 exactly 3 years from today.The nominal interest rate is 6%, semiannual compounding.Which of the following statements is CORRECT?

(Multiple Choice)

4.8/5  (40)

(40)

You have $5,000 invested in a bank that pays 3.8% annually.How long will it take for your funds to triple?

(Multiple Choice)

4.8/5  (34)

(34)

As a result of compounding, the effective annual rate on a bank deposit (or a loan) is always equal to or less than the nominal rate on the deposit (or loan).

(True/False)

4.7/5  (41)

(41)

An uncle of yours who is about to retire wants to sell some of his stock and buy an annuity that will provide him with income of $50,000 per year for 30 years, beginning a year from today.The going rate on such annuities is 7.25%.How much would it cost him to buy such an annuity today?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 121 - 140 of 163

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)