Exam 8: Analysis of a Tariff

Exam 1: International Economics Is Different60 Questions

Exam 2: The Basic Theory Using Demand and Supply60 Questions

Exam 3: Why Everybody Trades: Comparative Advantage59 Questions

Exam 4: Trade: Factor Availability and Factor Proportions Are Key48 Questions

Exam 5: Who Gains and Who Loses From Trade60 Questions

Exam 6: Scale Economies, Imperfect Competition, and Trade59 Questions

Exam 7: Growth and Trade Part II: Trade Policy60 Questions

Exam 8: Analysis of a Tariff60 Questions

Exam 9: Nontariff Barriers to Imports60 Questions

Exam 10: Arguments for and Against Protection60 Questions

Exam 11: Pushing Exports52 Questions

Exam 12: Trade Blocs and Trade Blocks60 Questions

Exam 13: Trade and the Environment60 Questions

Exam 14: Trade Policies for Developing Countries60 Questions

Exam 15: Multinationals and Migration: International Factor Movements60 Questions

Exam 16: Payments Among Nations60 Questions

Exam 17: The Foreign Exchange Market56 Questions

Exam 18: Forward Exchange and International Financial Investment60 Questions

Exam 19: What Determines Exchange Rates44 Questions

Exam 20: Government Policies Toward the Foreign Exchange Market56 Questions

Exam 21: International Lending and Financial Crises60 Questions

Exam 22: How Does the Open Macroeconomy Work59 Questions

Exam 23: Internal and External Balance With Fixed Exchange Rates59 Questions

Exam 24: Floating Exchange Rates and Internal Balance60 Questions

Exam 25: National and Global Choices: Floating Rates and the Alternatives60 Questions

Select questions type

Under free trade, a large country produces 1 million leather bags per year and imports another 2 million bags per year at the world price of $60 per bag. Assume that the country imposes a specific tariff of $5 per bag. As a result, the per-unit price of leather bags decreases to $58 in the international market and the import of leather bags drops to 1.6 million. The domestic production, on the other hand, increases to 1.1 million. Following the imposition of the tariff, the domestic consumers pay a price of _____ for each bag.

(Multiple Choice)

4.9/5  (36)

(36)

An ad valorem tariff is formulated as a money amount per unit of import that is due when the good reaches the importing country.

(True/False)

4.9/5  (37)

(37)

A small country is considering imposing a tariff on imported wine at the rate of $5 per bottle. Economists have estimated the following based on this tariff amount: World price of wine (free trade): \ 20 per bottle Domestic production (free trade): 500,000 bottles Domestic production (after tariff): 600,000 bottles Domestic consumption (free trade): 750,000 bottles Domestic consumption (after tariff): 650,000 bottles The imposition of the tariff on wine will cause the surplus of the domestic consumers to _____ by _____.

(Multiple Choice)

4.9/5  (32)

(32)

Firms in a given industry are affected by the tariff imposed on the product they sell, but not by the tariffs imposed on their purchased inputs.

(True/False)

4.8/5  (34)

(34)

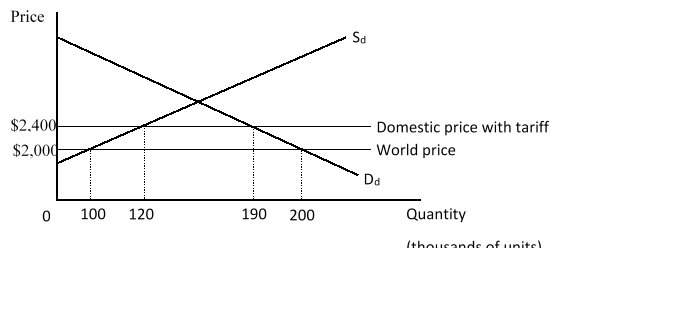

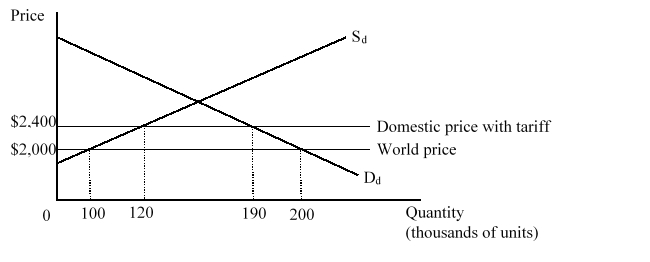

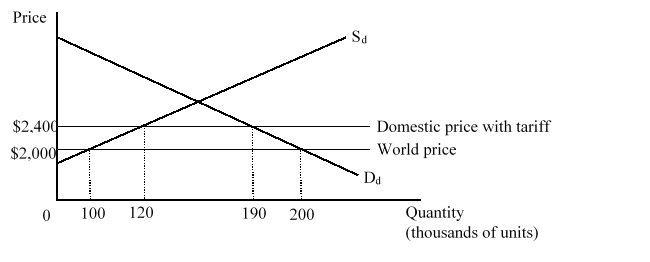

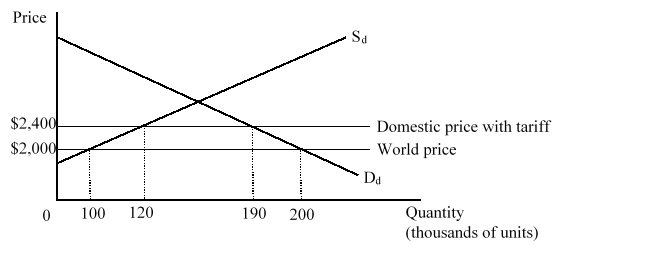

The figure given below shows the market for computers in the U.S. The domestic price line inclusive of the tariff lies above the international price line. Dd and Sd are the domestic demand and supply curves of computers respectively.  Under free-trade the U.S. imported _____ computers, but following the imposition of the tariff the U.S. began to import _____ computers.

Under free-trade the U.S. imported _____ computers, but following the imposition of the tariff the U.S. began to import _____ computers.

(Multiple Choice)

4.8/5  (38)

(38)

The table given below shows the pre-tariff and post-tariff prices, domestic production and consumption of copper in the United States. Suppose the U.S. government imposes a specific tariff of $0.20 per pound on copper imports by the country. Pre-tariff Post-tariff World price \ 0.50 per . \ 0.40 per . U.S. domestic price \ 0.50 per . \ 0.60 per . U.S. consumption 250 million . 210 million . U.S. production 100 million . 140 million .

a.Calculate the welfare loss to U.S.consumers of copper from the tariff.

b.Calculate the gain to U.S.producers of copper from the tariff.

c.Calculate the revenue collected by the U.S.government from taxing copper imports.

d.Calculate the net gain or loss to the U.S.economy as a whole from the tariff.

(Essay)

4.9/5  (40)

(40)

Which of the following refers to the extra cost of shifting to more expensive home production following the imposition of a tariff?

(Multiple Choice)

4.8/5  (42)

(42)

A tax imposed on the exports of a small country usually drives down the domestic price of the exportable good.

(True/False)

4.9/5  (42)

(42)

Under free trade, a large country produces 1 million leather bags per year and imports another 2 million bags per year at the world price of $60 per bag. Assume that the country imposes a specific tariff of $5 per bag. As a result, the per-unit price of leather bags decreases to $58 in the international market and the import of leather bags drops to 1.6 million. The domestic production, on the other hand, increases to 1.1 million. As a result of the tariff being imposed:

(Multiple Choice)

4.8/5  (33)

(33)

Compare and contrast the effects of a tariff on prices and national well-being imposed in a small country with the effects of a tariff imposed in a large country. Illustrate your answer with the help of suitable diagrams.

(Essay)

4.9/5  (32)

(32)

The figure given below shows the market for computers in the U.S. The domestic price line inclusive of the tariff lies above the international price line. Dd and Sd are the domestic demand and supply curves of computers respectively.  The imposition of a tariff on computers caused economic well-being in the U.S. to _____ by _____.

The imposition of a tariff on computers caused economic well-being in the U.S. to _____ by _____.

(Multiple Choice)

4.9/5  (43)

(43)

Calculate the effective rate of protection for the domestic MP3 player industry following the imposition of a 20 percent tariff on the imports of MP3 players. The cost of material inputs used in production of MP3 players in the country is $100 per unit and there is free trade in these material inputs. The world price of MP3 players is $175 per unit. Assume that the country is a small country.

(Multiple Choice)

4.8/5  (36)

(36)

"The higher the tariff, the more domestic production is increased. Thus, a prohibitive tariff is socially optimal." Explain the validity of this statement.

(Essay)

4.8/5  (39)

(39)

If a small country imposes a tariff on imported motorcycles, the world price of motorcycles will _____ and the domestic price of motorcycles will _____.

(Multiple Choice)

4.9/5  (33)

(33)

The figure given below shows the market for computers in the U.S. The domestic price line inclusive of the tariff lies above the international price line. Dd and Sd are the domestic demand and supply curves of computers respectively.  The consumption effect of the tariff on computers is worth

The consumption effect of the tariff on computers is worth

(Multiple Choice)

4.8/5  (38)

(38)

The consumption effect of a tariff indicates the welfare loss to a country resulting from the domestic consumers shifting from cheaper imports to more expensive local goods.

(True/False)

4.7/5  (38)

(38)

The figure given below shows the market for computers in the U.S. The domestic price line inclusive of the tariff lies above the international price line. Dd and Sd are the domestic demand and supply curves of computers respectively.  Calculate the tariff revenue of the U.S. government.

Calculate the tariff revenue of the U.S. government.

(Multiple Choice)

4.7/5  (47)

(47)

The figure given below shows the market for computers in the U.S. The domestic price line inclusive of the tariff lies above the international price line. Dd and Sd are the domestic demand and supply curves of computers respectively.  The production effect of the tariff on computers is worth

The production effect of the tariff on computers is worth

(Multiple Choice)

4.9/5  (36)

(36)

A small country is considering imposing a tariff on imported wine at the rate of $5 per bottle. Economists have estimated the following based on this tariff amount: World price of wine (free trade): \ 20 per bottle Domestic production (free trade): 500,000 bottles Domestic production (after tariff): 600,000 bottles Domestic consumption (free trade): 750,000 bottles Domestic consumption (after tariff): 650,000 bottles Before the tariff is imposed, the country imports _____ bottles of wine, but following the imposition of the tariff, the country will import _____ bottles of wine.

(Multiple Choice)

4.8/5  (35)

(35)

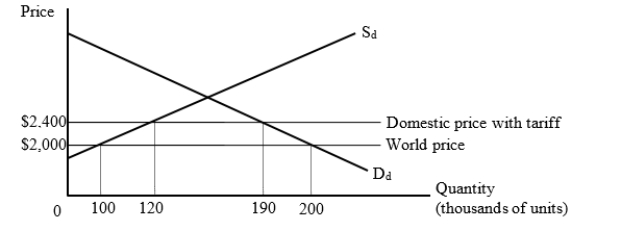

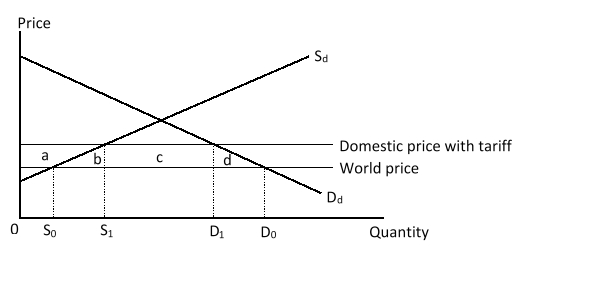

The figure given below shows the market for shoes in the U.S. The domestic price line with tariff lies above the international price line. Dd and Sd are the domestic demand and supply curves of shoes respectively.  The imposition of a tariff on shoes caused economic welfare in the U.S. to _____ by an amount measured by the area _____.

The imposition of a tariff on shoes caused economic welfare in the U.S. to _____ by an amount measured by the area _____.

(Multiple Choice)

4.9/5  (37)

(37)

Showing 21 - 40 of 60

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)