Exam 22: Accounting Changes and Error Analysis

Exam 1: Financial Accounting and Accounting Standards86 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting123 Questions

Exam 3: The Accounting Information System110 Questions

Exam 4: Income Statement and Related Information59 Questions

Exam 5: Statement of Financial Position and Statement of Cash Flows111 Questions

Exam 6: Accounting and the Time Value of Money118 Questions

Exam 7: Cash and Receivables135 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach136 Questions

Exam 9: Inventories: Additional Valuation Issues120 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment137 Questions

Exam 11: Depreciation, Impairments, and Depletion123 Questions

Exam 12: Intangible Assets126 Questions

Exam 13: Current Liabilities, Provisions, and Contingencies129 Questions

Exam 14: Non-Current Liabilities108 Questions

Exam 15: Equity108 Questions

Exam 17: Investments74 Questions

Exam 18: Revenue83 Questions

Exam 19: Accounting for Income Taxes92 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits100 Questions

Exam 21: Accounting for Leases105 Questions

Exam 22: Accounting Changes and Error Analysis78 Questions

Exam 23: Statement of Cash Flows112 Questions

Exam 24: Presentation and Disclosure in Financial Reporting83 Questions

Select questions type

If an IASB standard creates a new policy, expresses preference for, or rejects a specific accounting policy, the change is considered clearly acceptable.

Free

(True/False)

4.8/5  (38)

(38)

Correct Answer:

True

A company changes from percentage-of-completion to cost-recovery, which is the method used for tax purposes.The entry to record this change should include a

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

Use the following information for questions.

Swift Company purchased a machine on January 1, 2009, for $300,000.At the date of acquisition, the machine had an estimated useful life of six years with no residual value.The machine is being depreciated on a straight-line basis.On January 1, 2012, Swift determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no residual value.An accounting change was made in 2012 to reflect this additional information.

-Assume that the direct effects of this change are limited to the effect on depreciation and the related tax provision, and that the income tax rate was 30% in 2009, 2010, 2011, and 2012.What should be reported in Swift's income statement for the year ended December 31, 2012, as the cumulative effect on prior years of changing the estimated useful life of the machine?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

A

Which of the following is not a retrospective-type accounting change?

(Multiple Choice)

4.9/5  (34)

(34)

On January 1, 2009, Piper Co., purchased a machine (its only depreciable asset) for $300,000.The machine has a five-year life, and no salvage value.Sum-of-the-years'-digits depreciation has been used for financial statement reporting and the elective straight-line method for income tax reporting.Effective January 1, 2012, for financial statement reporting, Piper decided to change to the straight-line method for depreciation of the machine.Assume that Piper can justify the change.

Piper's income before depreciation, before income taxes, and before the cumulative effect of the accounting change (if any), for the year ended December 31, 2012, is $250,000.The income tax rate for 2012, as well as for the years 2009-2011, is 30%.What amount should Piper report as net income for the year ended December 31, 2012?

(Multiple Choice)

4.7/5  (33)

(33)

Use the following information for questions.

In January 2012, Marcus Ltd.has installation costs of £9,000 on new machinery that were charged to Repair Expense.Other costs of this machinery of £30,000 were correctly recorded and have been depreciated using the straight-line method with an estimated life of 10 years and no residual value.At December 31,2012, Marcus decides that the machinery ha a remaining useful life of 15 years, starting with January 1,2012

-If the book have not been closed for 2012 and depreciation expense has not yet been recorded for 2012, the entry that marcus makes in 2012 to record depreciation on the machinery acquired in January, 2011, will include:

(Multiple Choice)

4.7/5  (36)

(36)

Use the following information for questions.

Swift Company purchased a machine on January 1, 2009, for $300,000.At the date of acquisition, the machine had an estimated useful life of six years with no residual value.The machine is being depreciated on a straight-line basis.On January 1, 2012, Swift determined, as a result of additional information, that the machine had an estimated useful life of eight years from the date of acquisition with no residual value.An accounting change was made in 2012 to reflect this additional information.

-What is the amount of depreciation expense on this machine that should be charged in Swift's income statement for the year ended December 31, 2012?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following would be a reason where IASB would permit companies to change accounting policy?

(Multiple Choice)

4.8/5  (42)

(42)

Why does IASB prohibit retrospective treatment of changes in accounting estimates?

(Multiple Choice)

4.8/5  (35)

(35)

Statement of financial position errors affect only the presentation of an asset or liability account.

(True/False)

4.8/5  (34)

(34)

Which of the following disclosures is required for a change from sum-of-the-years-digits to straight-line?

(Multiple Choice)

4.8/5  (36)

(36)

IASB requires companies to use which method for reporting changes in accounting policies?

(Multiple Choice)

5.0/5  (40)

(40)

Jacob, Inc., changed from the average cost to the FIFO cost flow assumption in 2012.the increase in the prior year`s income before taxes is €1,100,000.The tax rate is 35%.Jacob's 2012 journal entry to record the change in accounting policy will include.

(Multiple Choice)

4.9/5  (42)

(42)

Stone Company changed its method of pricing inventories from average cost to FIFO.What type of accounting change does this represent?

(Multiple Choice)

4.7/5  (44)

(44)

The accounting for change in estimates differs between U.S.GAAP and IFRS.

(True/False)

4.8/5  (38)

(38)

Which of the following is (are) the proper time period(s) to record the effects of a change in accounting estimate?

(Multiple Choice)

4.7/5  (32)

(32)

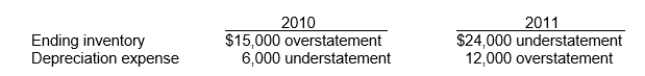

Use the following information for questions.

Armstrong Inc.is a calendar-year corporation.Its financial statements for the years ended 12\31\10 and 12\31\11 contained the following errors:

-Assume that no correcting entries were made at 12\31\10, or 12\31\11.Ignoring income taxes, by how much will retained earnings at 12\31\11 be overstated or understated?

-Assume that no correcting entries were made at 12\31\10, or 12\31\11.Ignoring income taxes, by how much will retained earnings at 12\31\11 be overstated or understated?

(Multiple Choice)

4.9/5  (28)

(28)

If a particular transaction is not specifically addressed by IFRS, where should an accountant turn to find a hierarchy of guidance to be consicered in the selection of an accounting policy?

(Multiple Choice)

4.8/5  (49)

(49)

Detmer Constuction Company decided at the beginning of 2012 to change from the cost-recovery method to the percentage-of-completion method for financial reporting purposes.The company will continue to use the cost-recovery method for tax purposes.For years prior to 2012, pretax income under the two methods was as follows: percentage-of-completion £144,000, and cost-recovery £114,000.The tax rate is 35%.Detmer has a profit-sharing plan, which pays all employees a bonus at year-end based on 1.5% of pretax income.What is the amount of the indirect effect of Detmer's change in accounting policy that will be reported in the 2012 income statement, assuming that the profit-sharing contract explicitly requires adjustment for changes in income numbers?

(Multiple Choice)

4.9/5  (42)

(42)

Counterbalancing errors are those that will be offset and that take longer than two periods to correct themselves.

(True/False)

4.9/5  (32)

(32)

Showing 1 - 20 of 78

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)