Exam 2: The Recording Process

Exam 1: Accounting in Action240 Questions

Exam 2: The Recording Process207 Questions

Exam 3: Adjusting the Accounts261 Questions

Exam 4: Completing the Accounting Cycle239 Questions

Exam 5: Accounting for Merchandising Operations246 Questions

Exam 6: Inventories232 Questions

Exam 7: Accounting Information Systems150 Questions

Exam 8: Fraud, Internal Control, and Cash230 Questions

Exam 9: Accounting for Receivables239 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets305 Questions

Exam 11: Current Liabilities and Payroll Accounting218 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions204 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting191 Questions

Exam 15: Long-Term Liabilities209 Questions

Exam 16: Investments188 Questions

Exam 17: Statement of Cash Flows215 Questions

Exam 18: Financial Statement Analysis224 Questions

Exam 19: Managerial Accounting206 Questions

Exam 20: Job Order Costing204 Questions

Exam 21: Process Costing195 Questions

Exam 22: Cost-Volume-Profit215 Questions

Exam 23: Budgetary Planning214 Questions

Exam 24: Budgetary Control and Responsibility Accounting213 Questions

Exam 25: Standard Costs and Balanced Scorecard244 Questions

Exam 26: Incremental Analysis and Capital Budgeting217 Questions

Exam 27: Time Value of Money72 Questions

Select questions type

During 2016 its first year of operations Aida's Bakery had revenues of $65000 and expenses of $35000. The business had owner's drawings of $22000. What is the amount of owner's equity at December 31 2016?

(Multiple Choice)

4.7/5  (38)

(38)

Camper Van Company purchased equipment for $2300 cash. As a result of this event

(Multiple Choice)

4.9/5  (49)

(49)

Which one of the following could represent the expanded basic accounting equation?

(Multiple Choice)

4.9/5  (33)

(33)

The entire group of accounts maintained by a company is called the

(Multiple Choice)

4.7/5  (42)

(42)

Which account below is not a subdivision of owner's equity?

(Multiple Choice)

4.9/5  (34)

(34)

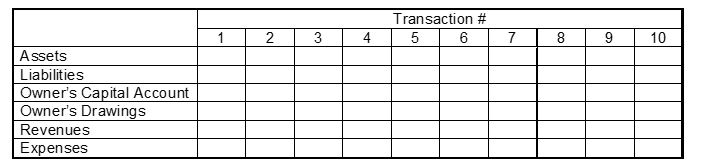

For each transaction given enter in the tabulation given below a "D" for debit and a "C" for credit to reflect the increases and decreases of the assets liabilities and owner's equity accounts. In some cases there may be a "D" and a "C" in the same box.

Transactions:

1. Owner invests cash in the business.

2. Pays insurance in advance for six months.

3. Pays secretary's salary.

4. Purchases office supplies on account.

5. Pays electricity bill.

6. Borrows money from local bank.

7. Makes payment on account.

8. Receives cash due from customers.

9. Provides services on account.

10. Owner withdraws assets from the business.

(Essay)

4.8/5  (36)

(36)

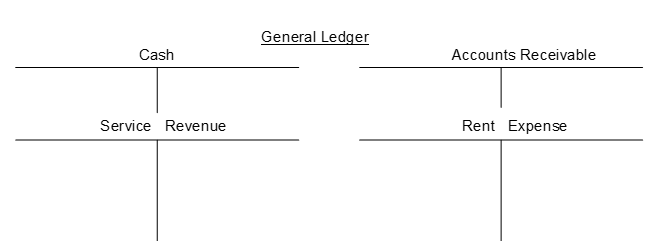

The transactions of the Litehouse Realty are recorded in the general journal below. You are to post the journal entries to T-accounts.

(Essay)

4.9/5  (43)

(43)

Prepare journal entries for each of the following transactions.

1. Performed services for customers on account $8400.

2. Purchased $20000 of equipment on account.

3. Received $3800 from customers in transaction 1.

4. The owner J. Dean withdrew $2900 cash for personal use.

(Essay)

4.8/5  (39)

(39)

The basic steps in the recording process are: _______________ each transaction enter the transaction in a ________________ and transfer the _______________ information to appropriate accounts in the ________________.

(Short Answer)

4.8/5  (39)

(39)

______________ _______________ and _______________ have debit normal account balances whereas _______________ ________________ and ________________ have credit normal account balances.

(Short Answer)

4.9/5  (35)

(35)

The double-entry system requires that each transaction must be recorded

(Multiple Choice)

4.7/5  (32)

(32)

For the basic accounting equation to stay in balance each transaction recorded must

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following correctly identifies normal balances of accounts? A)

Assets Debit Liabilities Credit Owner's Capital Credit Revenues Debit Expenses Credit

B)

Assets Debit Liabilities Credit Owner's Capital Credit Revenues Credit Expenses Credit

C)

Assets Credit Liabilities Debit Owner's Capital Debit Revenues Credit Expenses Debit

D)

Assets Debit Liabilities Credit Owner's Capital Credit Revenues Credit Expenses Debit

(Short Answer)

4.8/5  (36)

(36)

Beethoven Company provided consulting services and billed the client $3600. As a result of this event

(Multiple Choice)

4.9/5  (35)

(35)

Under the double-entry system revenues must always equal expenses.

(True/False)

4.8/5  (39)

(39)

The name given to entering transaction data in the journal is

(Multiple Choice)

4.9/5  (41)

(41)

Showing 41 - 60 of 207

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)