Exam 5: Inventories and Cost of Goods Sold

Exam 1: Accounting As a Form of Communication163 Questions

Exam 2: Financial Statements and the Annual Report157 Questions

Exam 3: Processing Accounting Information133 Questions

Exam 4: Income Measurement and Accrual Accounting161 Questions

Exam 5: Inventories and Cost of Goods Sold179 Questions

Exam 6: Cash and Internal Control158 Questions

Exam 7: Receivables and Investments152 Questions

Exam 8: Operating Assets: Property, Plant, and Equipment, and Intangibles145 Questions

Exam 9: Current Liabilities, Contingencies, and the Time Value of Money140 Questions

Exam 10: Long-Term Liabilities155 Questions

Exam 11: Stockholders Equity149 Questions

Exam 12: The Statement of Cash Flows158 Questions

Exam 13: Financial Statement Analysis168 Questions

Exam 14: International Financial Reporting Standards40 Questions

Select questions type

The buyer must include goods purchased FOB shipping point in its inventory account if the goods are still in transit.

(True/False)

4.7/5  (38)

(38)

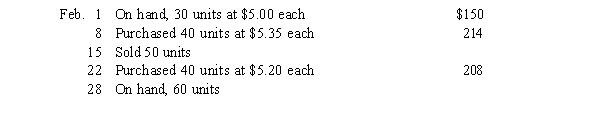

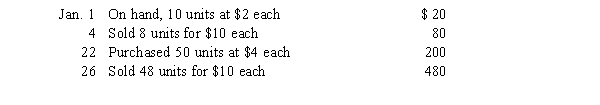

Readers.com uses a perpetual inventory system.  If Readers.com uses the moving average method, how much is ending inventory on February 28?

If Readers.com uses the moving average method, how much is ending inventory on February 28?

(Multiple Choice)

4.9/5  (42)

(42)

Which method assigns the same cost to all units whether sold or left in ending inventory?

(Multiple Choice)

4.8/5  (40)

(40)

Zebra Company overstated its December 31, 2014 inventory by $5,200.Which statement is true concerning

Zebra's financial statement amounts for 2014?

(Multiple Choice)

4.8/5  (32)

(32)

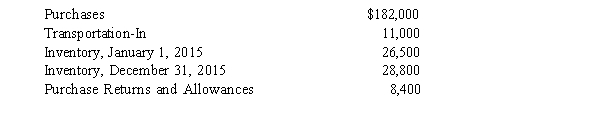

The following is from Goldman Inc.'s 2015 income statement.  How much will Goldman report as its cost of goods sold in its 2015 income statement?

How much will Goldman report as its cost of goods sold in its 2015 income statement?

(Multiple Choice)

4.9/5  (28)

(28)

Which of these is not an acceptable inventory costing method under IFRS?

(Multiple Choice)

4.9/5  (40)

(40)

Which one of the following accounts most likely would appear on the income statement of a merchandise company, but not on the income statement of a service company?

(Multiple Choice)

4.9/5  (39)

(39)

Which method assigns the cost of the most recent items purchased to cost of goods sold?

(Multiple Choice)

4.8/5  (32)

(32)

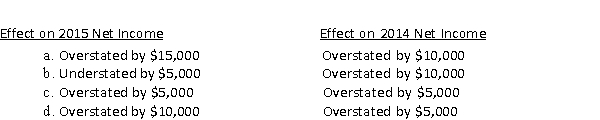

If a company overstates its ending inventory balance for 2015 by $10,000, and overstates its ending inventory balance for 2014 by $5,000 what are the effects on its net income for 2015 and 2014?

(Short Answer)

4.9/5  (33)

(33)

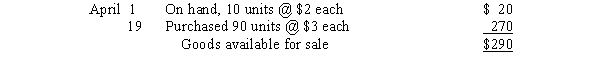

Quan uses a periodic inventory system.At the end of April, Quan had 20 units on hand.  If Quan uses the LIFO inventory method, how much is inventory on the balance sheet as of April 30?

If Quan uses the LIFO inventory method, how much is inventory on the balance sheet as of April 30?

(Multiple Choice)

5.0/5  (37)

(37)

The excess of the value of a company's inventory stated at FIFO over the value stated at LIFO is called an)

_________________________.

(Short Answer)

4.7/5  (41)

(41)

Blenham, Inc.sells merchandise on credit.If a customer pays its balance due after the discount period has passed, what is the effect of the payment on Blenham's accounting equation?

(Multiple Choice)

4.9/5  (42)

(42)

Purchase discounts decrease the total cost of merchandise acquired.

(True/False)

4.8/5  (39)

(39)

Adam Inc.uses a perpetual inventory system.  If Adam uses the FIFO method, how much is ending inventory on January 31?

If Adam uses the FIFO method, how much is ending inventory on January 31?

(Multiple Choice)

4.9/5  (37)

(37)

When a company using LIFO experiences a partial or complete liquidation of its older, lower-priced inventory, its gross margin will be higher, lower, or unchanged) for the period.

(Short Answer)

4.7/5  (31)

(31)

The inventory turnover ratio is a measure of how many times during a period a company sells off its inventory.

(True/False)

4.7/5  (42)

(42)

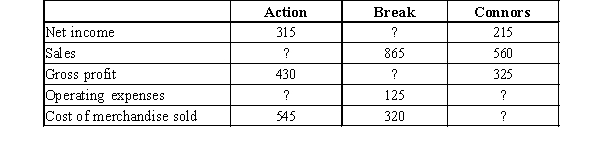

Complete the following data taken from the condensed income statements for merchandising companies: Action, Break, & Connors.

(Essay)

4.8/5  (37)

(37)

Showing 21 - 40 of 179

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)