Exam 4: Accrual Accounting Concepts

Exam 1: Introduction to Financial Statements174 Questions

Exam 2: A Further Look at Financial Statements191 Questions

Exam 3: The Accounting Information System221 Questions

Exam 4: Accrual Accounting Concepts258 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement211 Questions

Exam 6: Reporting and Analyzing Inventory189 Questions

Exam 7: Fraud, Internal Control, and Cash195 Questions

Exam 8: Reporting and Analyzing Receivables203 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets219 Questions

Exam 10: Reporting and Analyzing Liabilities246 Questions

Exam 11: Reporting and Analyzing Stockholders Equity216 Questions

Exam 12: Statement of Cash Flows177 Questions

Exam 13: Financial Analysis: The Big Picture203 Questions

Exam 14: Understanding Investments in Debt and Equity Securities209 Questions

Select questions type

The adjusting entry for unearned revenue results in an increase (a debit) to an asset account and an increase (a credit) to a revenue account.

Free

(True/False)

4.9/5  (39)

(39)

Correct Answer:

False

If a company fails to make an adjusting entry to record supplies expense, then:

Free

(Multiple Choice)

4.9/5  (41)

(41)

Correct Answer:

B

Baden Industries borrows $20,000 at 7% annual interest for six months on October 1, 2022.Which is the appropriate entry to accrue interest if Baden employs a December 31, 2022, fiscal year?

Free

(Multiple Choice)

4.9/5  (30)

(30)

Correct Answer:

A

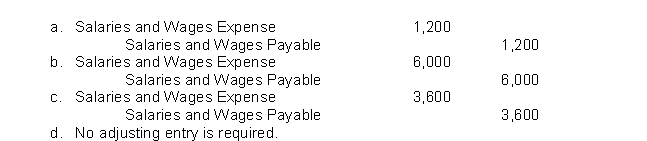

Snelling Tables paid employee wages on and through Friday, January 26, and the next payroll will be paid in February.There are three more working days in January (29-31).Employees work 5 days a week and the company pays $1,200 a day in wages.What will be the adjusting entry to accrue wages expense at the end of January?

(Short Answer)

4.9/5  (34)

(34)

Franklin Company schedules an appointment with High Country Septic Services on May 2.High Country services Franklin's septic system on May 9 and leaves an invoice at that time.Franklin pays the invoice on May 19.On what date does Franklin satisfy its performance obligation?

(Multiple Choice)

4.7/5  (37)

(37)

If a resource has been consumed but a bill has not been received at the end of the accounting period, then:

(Multiple Choice)

4.7/5  (41)

(41)

A company usually determines the amount of supplies used during a period by:

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following accounts is neither adjusted nor closed?

(Multiple Choice)

4.9/5  (39)

(39)

Which principle dictates that efforts (expenses) be recorded with accomplishments (revenues)?

(Multiple Choice)

4.7/5  (40)

(40)

Mary Richardo, CPA, has billed her clients for services performed.She subsequently receives payments from her clients.What entry will she make upon receipt of the payments?

(Multiple Choice)

4.9/5  (42)

(42)

One of the accounting concepts upon which adjustments for prepayments and accruals are based is:

(Multiple Choice)

4.9/5  (38)

(38)

Adjusting entries are recorded in the general journal but are not posted to the accounts in the general ledger.

(True/False)

4.9/5  (32)

(32)

Boyce Company purchased office supplies costing $7,000 and debited Supplies for the full amount.At the end of the accounting period, a physical count of office supplies revealed $1,800 still on hand.The appropriate adjusting journal entry to be made at the end of the period would be:

(Multiple Choice)

4.8/5  (30)

(30)

In the accounting cycle, closing entries are prepared before adjusting entries.

(True/False)

4.8/5  (44)

(44)

Which of the following items describe the two classifications of adjusting entries?

(Multiple Choice)

4.9/5  (39)

(39)

Using accrual accounting, expenses are recorded and reported only:

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)