Exam 14: Notes Receivable and Notes Payable

Exam 1: Accounting Concepts and Procedures125 Questions

Exam 2: Debits and Credits: Analyzing and Recording Business Transactions125 Questions

Exam 3: Beginning the Accounting Cycle125 Questions

Exam 4: The Accounting Cycle Continued126 Questions

Exam 5: The Accounting Cycle Completed126 Questions

Exam 6: Banking Procedure and Control of Cash125 Questions

Exam 7: Calculating Pay and Payroll Taxes: the Beginning of the Payroll Process138 Questions

Exam 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:113 Questions

Exam 9: Sales and Cash Receipts125 Questions

Exam 10: Purchases and Cash Payments110 Questions

Exam 11: Preparing a Worksheet for a Merchandise Company123 Questions

Exam 12: Completion of the Accounting Cycle for a Merchandise Company125 Questions

Exam 13: Accounting for Bad Debts120 Questions

Exam 14: Notes Receivable and Notes Payable132 Questions

Exam 15: Accounting for Merchandise Inventory125 Questions

Exam 16: Accounting for Property, Plant, Equipment, and Intangible Assets147 Questions

Exam 17: Partnership130 Questions

Exam 18: Corporations: Organizations and Stock124 Questions

Exam 19: Corporations: Stock Values, Dividends, Treasury Stocks,122 Questions

Exam 20: Corporations and Bonds Payable138 Questions

Exam 21: Statement of Cash Flows125 Questions

Exam 22: Analyzing Financial Statements124 Questions

Exam 23: The Voucher System133 Questions

Exam 24: Departmental Accounting140 Questions

Exam 25: Manufacturing Accounting126 Questions

Select questions type

Melon Industries issues a $20,000, 10%, 135-day note to Apple Communications. Interest on the note is _________ and the maturity value is __________. (Use a 360-day year. Do not round any intermediate calculations. Round your final answers to the nearest dollar.)

(Multiple Choice)

4.9/5  (37)

(37)

Indicate the account(s) to be debited and credited to record the following transactions.

-Paying the principal plus accrued interest.

Debit ________ & ________ Credit ________

A)Cash

B) Notes receivable

C)Accounts receivable

D) Interest receivable

E)Notes payable

F) Accounts payable

G)Interest payable

H) Discount on notes payable

I) Interest expense

J) Interest income

K) Sales

(Short Answer)

4.9/5  (41)

(41)

Barrel Enterprises was unable to collect a $1,900 note receivable plus $80 interest on the maturity date, but hoped to collect the amount in the future. Barrel Enterprises should record this event on the maturity date as:

(Multiple Choice)

4.8/5  (39)

(39)

Jane borrowed $1,000 from West Bank and signed a promissory note. West Bank is:

(Multiple Choice)

4.8/5  (34)

(34)

A $5,600, 8% note dated May 20 for 78 days was discounted on June 23 at 14%. The amount of the discount (using a 360-day year) is: (Do not round any intermediate calculations. Round your final answer to the nearest cent.)

(Multiple Choice)

4.8/5  (30)

(30)

The proceeds received from discounting a note could be more than the face value.

(True/False)

4.9/5  (38)

(38)

What is the debtor's entry to record a note paid, with interest accrued in the previous year (assume there is no reversing entry)?

(Multiple Choice)

4.7/5  (49)

(49)

An adjustment that must be made for the accrued interest on a note receivable would include a:

(Multiple Choice)

4.9/5  (37)

(37)

The formula for calculating interest on a note is: principal × rate × time.

(True/False)

4.7/5  (41)

(41)

The discount period is the amount of time the bank holds a note that was discounted until the maturity date.

(True/False)

4.9/5  (38)

(38)

The principal amount on a $1,800, 4%, 60-day promissory note is: (Do not round any intermediate calculations. Round your final answer to the nearest cent.)

(Multiple Choice)

5.0/5  (41)

(41)

Ross, immediately after receiving a note from a customer, discounted it at the bank and received the proceeds. Ross's entry on his books would include a:

(Multiple Choice)

5.0/5  (42)

(42)

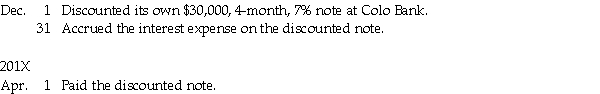

Prepare general journal entries for Huckabee Corporation for the following transactions:

201X

(Essay)

4.9/5  (38)

(38)

For notes payable issued in one period and due in the next period, accrued interest payable must be recorded at the beginning of the next period.

(True/False)

4.7/5  (29)

(29)

Prepare journal entries for the following transactions for Design Imports.

a) Purchased $7,800 of merchandise (perpetual inventory method) from Serial Material Company on account.

b) Gave Serial Material Company a 120-day, 5% note in settlement of the account payable.

c) Design Imports defaulted on its note on the maturity date.

d) Design Imports paid the previously defaulted note plus $115 additional interest.

(Essay)

4.8/5  (43)

(43)

Indicate the account(s) to be debited and credited to record the following transactions.

-A promissory note received in granting a time extension to a charge customer.

Debit ________ Credit ________

(Multiple Choice)

4.7/5  (37)

(37)

Prepare journal entries for the following transactions for Mission Company:

June 1 Purchased equipment from Carry, Inc. for $9,400, giving a 3-month, 10% note

Sept. 1 Paid amount due on note

(Essay)

4.9/5  (36)

(36)

When a commercial bank discounts a note on the date of issue, the interest is deducted when the note matures.

(True/False)

4.8/5  (36)

(36)

Showing 61 - 80 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)