Exam 11: Preparing a Worksheet for a Merchandise Company

Exam 1: Accounting Concepts and Procedures125 Questions

Exam 2: Debits and Credits: Analyzing and Recording Business Transactions125 Questions

Exam 3: Beginning the Accounting Cycle125 Questions

Exam 4: The Accounting Cycle Continued126 Questions

Exam 5: The Accounting Cycle Completed126 Questions

Exam 6: Banking Procedure and Control of Cash125 Questions

Exam 7: Calculating Pay and Payroll Taxes: the Beginning of the Payroll Process138 Questions

Exam 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:113 Questions

Exam 9: Sales and Cash Receipts125 Questions

Exam 10: Purchases and Cash Payments110 Questions

Exam 11: Preparing a Worksheet for a Merchandise Company123 Questions

Exam 12: Completion of the Accounting Cycle for a Merchandise Company125 Questions

Exam 13: Accounting for Bad Debts120 Questions

Exam 14: Notes Receivable and Notes Payable132 Questions

Exam 15: Accounting for Merchandise Inventory125 Questions

Exam 16: Accounting for Property, Plant, Equipment, and Intangible Assets147 Questions

Exam 17: Partnership130 Questions

Exam 18: Corporations: Organizations and Stock124 Questions

Exam 19: Corporations: Stock Values, Dividends, Treasury Stocks,122 Questions

Exam 20: Corporations and Bonds Payable138 Questions

Exam 21: Statement of Cash Flows125 Questions

Exam 22: Analyzing Financial Statements124 Questions

Exam 23: The Voucher System133 Questions

Exam 24: Departmental Accounting140 Questions

Exam 25: Manufacturing Accounting126 Questions

Select questions type

Sam received $8,000 in advance for renting part of his building. What is the entry to record the receipt?

(Multiple Choice)

4.8/5  (35)

(35)

Unearned Revenue is a liability account used to record rent fees received in advance.

(True/False)

4.7/5  (31)

(31)

The financial statement on which Rental Income would appear is the:

(Multiple Choice)

5.0/5  (37)

(37)

On November 1, Call Center received $4,800 for two years' rent in advance from Garrett Company. The November 30 adjusting entry that Call Center should make is to:

(Multiple Choice)

4.8/5  (40)

(40)

The adjustment for accrued wages was NOT done; this would cause:

(Multiple Choice)

4.7/5  (39)

(39)

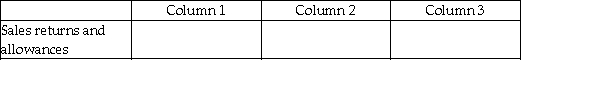

For each of the following, identify in Column 1 the balance the account will have in the adjusted trial balance columns (debit or credit), in Column 2 the financial statement column(s) in which the account balance will be found (income statement or balance sheet), and in Column 3 the effect the account will have on the determination of net income (increase, decrease, or none).

-

(Essay)

4.9/5  (48)

(48)

Beginning inventory was $3,600, purchases totaled $20,200 and and Cost of Goods Sold was $17,200. What is the ending inventory? Assume gross profit is $0.

(Multiple Choice)

4.7/5  (41)

(41)

During the preparation of the worksheet, the $5,000 balance of the Sam, Withdrawal account was extended as a debit to the income statement columns. This error will:

(Multiple Choice)

4.9/5  (35)

(35)

On the worksheet, accumulated depreciation appears in the income statement columns.

(True/False)

4.8/5  (41)

(41)

Under the periodic inventory method, the ending inventory is adjusted by debiting Income Summary and crediting Merchandise Inventory.

(True/False)

4.7/5  (38)

(38)

On the worksheet the beginning Merchandise Inventory account appears in:

(Multiple Choice)

4.9/5  (38)

(38)

Showing 41 - 60 of 123

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)