Exam 4: The Accounting Cycle Continued

Exam 1: Accounting Concepts and Procedures125 Questions

Exam 2: Debits and Credits: Analyzing and Recording Business Transactions125 Questions

Exam 3: Beginning the Accounting Cycle125 Questions

Exam 4: The Accounting Cycle Continued126 Questions

Exam 5: The Accounting Cycle Completed126 Questions

Exam 6: Banking Procedure and Control of Cash125 Questions

Exam 7: Calculating Pay and Payroll Taxes: the Beginning of the Payroll Process138 Questions

Exam 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:113 Questions

Exam 9: Sales and Cash Receipts125 Questions

Exam 10: Purchases and Cash Payments110 Questions

Exam 11: Preparing a Worksheet for a Merchandise Company123 Questions

Exam 12: Completion of the Accounting Cycle for a Merchandise Company125 Questions

Exam 13: Accounting for Bad Debts120 Questions

Exam 14: Notes Receivable and Notes Payable132 Questions

Exam 15: Accounting for Merchandise Inventory125 Questions

Exam 16: Accounting for Property, Plant, Equipment, and Intangible Assets147 Questions

Exam 17: Partnership130 Questions

Exam 18: Corporations: Organizations and Stock124 Questions

Exam 19: Corporations: Stock Values, Dividends, Treasury Stocks,122 Questions

Exam 20: Corporations and Bonds Payable138 Questions

Exam 21: Statement of Cash Flows125 Questions

Exam 22: Analyzing Financial Statements124 Questions

Exam 23: The Voucher System133 Questions

Exam 24: Departmental Accounting140 Questions

Exam 25: Manufacturing Accounting126 Questions

Select questions type

Which of the following accounts would appear on the Balance Sheet?

(Multiple Choice)

4.7/5  (46)

(46)

On the worksheet, the Balance Sheet debit column totaled $1,400 and the credit column totaled $2,000. What is the amount of Net Loss?

$ ________

(Short Answer)

4.8/5  (39)

(39)

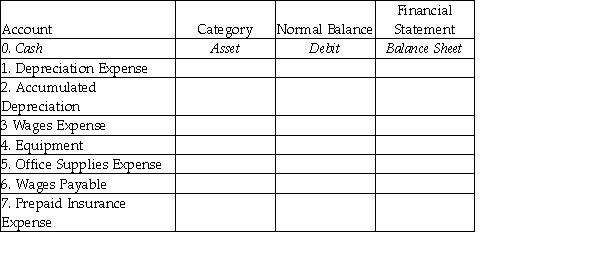

For each account listed, identify the category it belongs to, the normal balance (debit or credit), and the financial statement the account appears.

(Essay)

4.7/5  (33)

(33)

On November 30, the balance in the Supplies account was $500. During December additional supplies were purchased of $200. On December 31, there was $200 worth of Supplies on hand. What would be the adjustment for the month of December for Supplies?

$ ________

(Short Answer)

4.8/5  (34)

(34)

What are the differences between depreciation expense and accumulated depreciation?

(Essay)

5.0/5  (40)

(40)

Which of the following would cause a contra-asset to be credited and an expense debited?

(Multiple Choice)

4.8/5  (45)

(45)

The amount of supplies used during the period would be shown in the adjustment columns of the worksheet.

(True/False)

4.9/5  (45)

(45)

Equipment with a cost of $152,000 has an accumulated depreciation of $59,000. What is the historical cost of the equipment?

(Multiple Choice)

4.8/5  (44)

(44)

The estimated value of an item at the end of its useful life is:

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following transactions would result in an accrual?

(Multiple Choice)

4.9/5  (36)

(36)

Depreciation Expense is debited when recording the depreciation for the period.

(True/False)

4.9/5  (25)

(25)

Original cost of equipment is adjusted at the end of the accounting period.

(True/False)

4.8/5  (44)

(44)

The beginning capital balance used on the Statement of Owner's Equity is obtained from:

(Multiple Choice)

4.8/5  (32)

(32)

On a worksheet, the balance sheet debit column total is $1,000 and the credit column total is $2,200. Which of the following statements is correct?

(Multiple Choice)

4.9/5  (36)

(36)

After the adjustment for depreciation has been made, the original cost of the equipment:

(Multiple Choice)

4.9/5  (39)

(39)

To compute net income or net loss, the debit and credit columns of the income statement section of the worksheet are totaled, and the difference is placed on the smaller side.

(True/False)

4.7/5  (46)

(46)

The adjustment for depreciation was credited to Equipment and debited to Depreciation Expense. This would:

(Multiple Choice)

4.7/5  (35)

(35)

As accumulated depreciation is recorded, the net book value:

(Multiple Choice)

4.9/5  (34)

(34)

Showing 81 - 100 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)