Exam 1: Current Liabilities and Contingencies

Exam 1: Current Liabilities and Contingencies81 Questions

Exam 2: Non-Current Financial Liabilities97 Questions

Exam 3: Equities78 Questions

Exam 4: Complex Financial Instruments100 Questions

Exam 6: Pensions and Other Employee Future Benefits69 Questions

Exam 7: Accounting for Leases43 Questions

Exam 8: Accounting for Income Taxes78 Questions

Exam 9: Accounting Changes39 Questions

Exam 10: Statement of Cash Flows75 Questions

Select questions type

Explain some of the challenges that exist in determining the amount of a "liability" by identifying factors that influence the value of the indebtedness.

(Essay)

4.7/5  (34)

(34)

For a $100,000 trade payable with terms of 2/10, net 45, how much would be reported as "purchase discount lost" under the gross method if a payment was made after 60 days?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following is true about non-interest bearing notes?

(Multiple Choice)

4.8/5  (34)

(34)

Which statement is correct about provisions, contingent assets and contingent liabilities?

(Multiple Choice)

4.8/5  (32)

(32)

Which is a reason to use the net method to record purchase discounts?

(Multiple Choice)

4.8/5  (31)

(31)

Explain the meaning of the following terms: "financial guarantee" contract and "onerous" contract

(Essay)

4.7/5  (33)

(33)

For each independent situation:

1. Langford Airport Parking Ltd. awards customers 250 reward miles per stay, in a well-known airline mileage program. Langford pays the airline $0.06 for each mile. Langford, which is not an agent for the airline, estimates that the fair value of the miles is the same as the price paid-$0.06. Parking revenues on May 24, 2020 were $52,000. Langford awarded 40,000 airline points to its customers.

2. On October 15, 2020, Hamilton Windows and Sash properly recorded the issue of a $12,000, 7% note due April 15, 2021. Hamilton is preparing its financial statements for the year ended December 31, 2021. Hamilton does not make adjusting entries during the year.

Required:

For each of the situations described above, prepare the required journal entry for the underlined entity. If a journal entry is not required, explain why.

(Essay)

4.9/5  (44)

(44)

Consider the following independent situations. The underlined entity is the reporting entity.

1. The Supreme Court of Canada ordered a supplier to pay Towna Haring Inc. $500,000 for breach of contract.

2. Iwas Pharmaceuticals Inc. sued Game Day Agencies Ltd. for $8 million alleging patent infringement. While there may be some substance to Iwas's assertion, Game Day's legal counsel estimates that Iwas's likelihood of success is about 30%.

3. Environment Canada sued Foil Fan Isotopes Ltd. for $18 million seeking to recover the costs of cleaning up Foil Fan's accidental discharge of radioactive materials. Foil Fan acknowledges liability but is disputing the amount, claiming that the actual costs are in the range of$9 million to $12 million. Foil Fan's $18 million environmental insurance policy includes a $6 million deductible clause.

Required:

a. For each of the situations, indicate whether the appropriate accounting treatment is to:

A. Recognize an asset or liability.

B. Disclose the details of the contingency in the notes to the financial statements.

C. Neither provides for the item nor disclose the circumstances in the notes to the financial statements.

b. For each situation that requires the recognition of an asset or liability, record the journal entry.

(Essay)

4.8/5  (45)

(45)

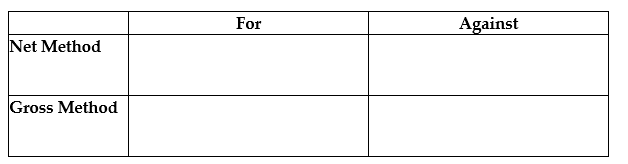

Contrast the gross method with the net method of recording purchase discounts by completing the following table:

(Essay)

4.9/5  (32)

(32)

For the following transaction, provide all of the required journal entries from inception to liquidation. Assume a December 31 year-end and that the company does not prepare interim statements. Round all amounts to nearest dollar. Face value of note payable \ 200,000 Date of issue for note May 1,2019 Due date for note May 1,2020 Interest rate in the note 5\% (interest due at maturity) Market rate of interest 5\% Consideration received Cash

(Essay)

4.9/5  (47)

(47)

Which statement is correct under the IFRS definition for a "liability"?

(Multiple Choice)

4.8/5  (37)

(37)

Consider the following independent situations. The underlined entity is the reporting entity.

1. Call Cattle Inc. sued Nutrient Feed Ltd. for $10 million alleging breach of contract. Nutrient's legal counsel estimates that Call's likelihood of success is about 80%. Based on its experience with cases of this nature, the law firm estimates that, if successful, the litigants will be awarded $8,800,000 to $9,000,000, with all payouts in this range being equally likely.

2. Deana Finnamore broke her leg when she tripped on an uneven floor surface in Groton Co.'s office. On the advice of legal counsel, Groton has offered Finnamore $140,000 to settle her $275,000 lawsuit. It is unknown whether Finnamore will accept the settlement offer. Groton's legal counsel estimates that Finnamore has a 90% probability of success, and that if successful, she will be awarded $230,000.

3. The courts ordered a competitor to pay $1,000,000 to Ferbert and Finn Corp. for patent infringement. The competitor's legal counsel indicated that the company will probably appeal the amount of the award.

Required:

a. For each of the situations, indicate whether the appropriate accounting treatment is to:

A. Recognize an asset or liability.

B. Disclose the details of the contingency in the notes to the financial statements.

C. Neither provide for the item nor disclose the circumstances in the notes to the financial statements.

b. For each situation that requires the recognition of an asset or liability, record the journal entry.

(Essay)

4.8/5  (34)

(34)

Showing 21 - 40 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)